Exam 9: Reporting Foreign Operations

Exam 1: Setting the Stage40 Questions

Exam 2: Intercorporate Equity Investments: an Introduction42 Questions

Exam 3: Business Combinations40 Questions

Exam 4: Wholly-Owned Subsidiaries: Reporting Subsequent to Acquisition37 Questions

Exam 5: Consolidation of Non-Wholly Owned Subsidiaries36 Questions

Exam 6: Subsequent-Year Consolidations: General Approach36 Questions

Exam 7: Segmented and Interim Reporting41 Questions

Exam 8: Foreign Currency Transactions and Hedges49 Questions

Exam 9: Reporting Foreign Operations43 Questions

Exam 10: Financial Reporting for Not-For-Profit Organizations46 Questions

Exam 11: Public Sector Financial Reporting41 Questions

Exam 12: Income Tax Allocation4 Questions

Exam 13: Income Tax Allocation Subsequent to Acquisition4 Questions

Exam 14: Good will Impairment Test6 Questions

Exam 15: Step Purchases6 Questions

Exam 16: Decreases in Ownership Interest4 Questions

Exam 18: Intercompany Bond Holdings6 Questions

Exam 19: Fund Accounting5 Questions

Select questions type

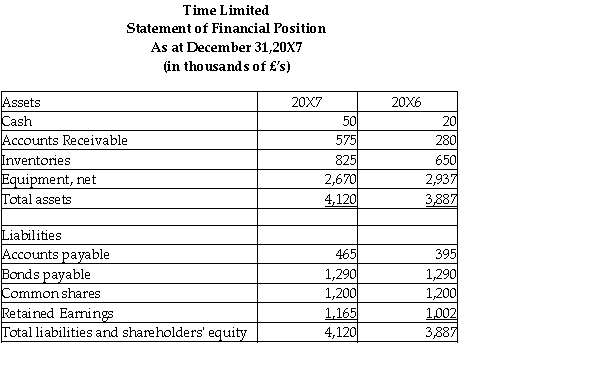

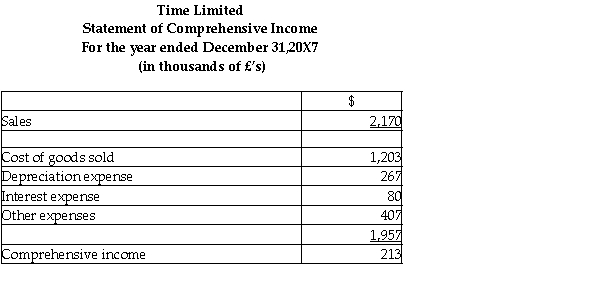

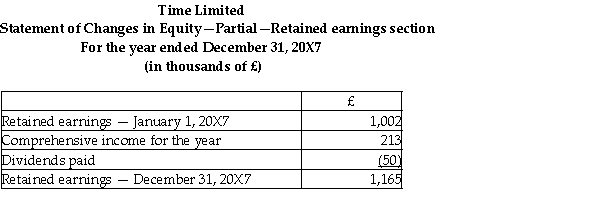

On January 1,20X7,Clock Inc.of Vancouver,British Columbia,purchased 75% of the outstanding shares of Time Limited,in London England.Time Limited's statements of financial position,statements of comprehensive income and changes in equity - retained earnings section for the year ended December 31,20X7 are below.

Additional information:

1.Time was incorporated on January 1,20X3 when it acquired all its equipment for £4,005,000 and issued its 10 year bonds payable.

2.Time's purchases and sales occurred evenly over the year.Inventories on hand at December 31,20X6 and December 20X7 were purchased evenly over the last quarter of 20X6 and 20X7,respectively.Inventories as at December 31,20X7 were £650,000.

3.Dividends were paid on March 31,20X7.

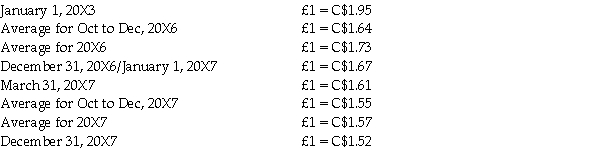

4.Foreign exchanges rates are as follows:

Additional information:

1.Time was incorporated on January 1,20X3 when it acquired all its equipment for £4,005,000 and issued its 10 year bonds payable.

2.Time's purchases and sales occurred evenly over the year.Inventories on hand at December 31,20X6 and December 20X7 were purchased evenly over the last quarter of 20X6 and 20X7,respectively.Inventories as at December 31,20X7 were £650,000.

3.Dividends were paid on March 31,20X7.

4.Foreign exchanges rates are as follows:  Required:

Translate Time's statement of comprehensive income for the year ended December 31,20X7 into Canadian dollars assuming its functional currency is Canadian dollars.Calculate the translation gain or loss arising in 20X7.

Required:

Translate Time's statement of comprehensive income for the year ended December 31,20X7 into Canadian dollars assuming its functional currency is Canadian dollars.Calculate the translation gain or loss arising in 20X7.

(Essay)

4.9/5  (33)

(33)

Which of the following factors is a secondary indicator used to choose a functional currency?

(Multiple Choice)

4.8/5  (50)

(50)

DNA was incorporated on January 2,20X0 and commenced active operations immediately.Common shares were issued on the date of incorporation and no new common shares have been issued since then.On December 31,20X3,INT purchased 70% of the outstanding common shares of DNA for 800,000 Swiss francs (CHF).

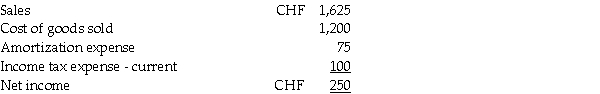

DNA's main operations are located in Switzerland.For the year ending December 31,20X6,the income statement (in 000s)for DNA was as follows:  The comparative and condensed statements of financial position (in 000s)for DNA were as follows:

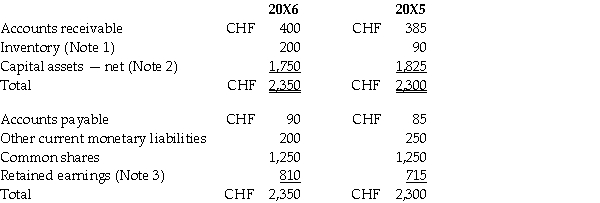

The comparative and condensed statements of financial position (in 000s)for DNA were as follows:  OTHER INFORMATION:

• Purchases and sales of merchandise inventory occurred evenly throughout the year.

• The ending inventory was purchased evenly throughout the last month of the year.

• DNA had purchased the capital assets on hand at the end of 20X6 on March 17,20X1.There were no purchases or sales of capital assets from 20X3 to 20X6.

• Dividends were paid on June 30,20X6.

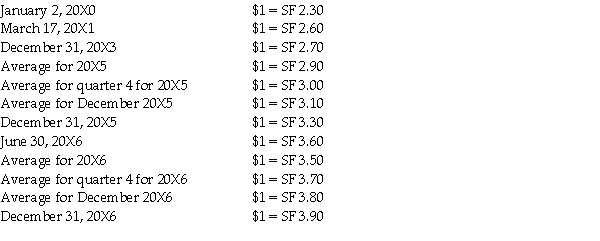

Assume that foreign exchange rates were as follows:

OTHER INFORMATION:

• Purchases and sales of merchandise inventory occurred evenly throughout the year.

• The ending inventory was purchased evenly throughout the last month of the year.

• DNA had purchased the capital assets on hand at the end of 20X6 on March 17,20X1.There were no purchases or sales of capital assets from 20X3 to 20X6.

• Dividends were paid on June 30,20X6.

Assume that foreign exchange rates were as follows:  DNA's financial statements need to be translated into Canadian dollars for consolidation with INT's financial statements.

Required:

Calculate the exchange gain/loss on current monetary items for 20X6 under the temporal method.

DNA's financial statements need to be translated into Canadian dollars for consolidation with INT's financial statements.

Required:

Calculate the exchange gain/loss on current monetary items for 20X6 under the temporal method.

(Essay)

4.8/5  (41)

(41)

Showing 41 - 43 of 43

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)