Exam 18: Activity-Based Costing and Other Cost Management Tools

Exam 12: Corporations: Paid-In Capital and the Balance Sheet167 Questions

Exam 13: Corporations: Effects on Retained Earnings and the Income Statement164 Questions

Exam 14: The Statement of Cash Flows157 Questions

Exam 15: Financial Statement Analysis161 Questions

Exam 16: Introduction to Management Accounting161 Questions

Exam 17: Job Order and Process Costing168 Questions

Exam 18: Activity-Based Costing and Other Cost Management Tools160 Questions

Exam 19: Cost-Volume-Profit Analysis163 Questions

Exam 20: Short-Term Business Decisions164 Questions

Exam 21: Capital Investment Decisions and the Time Value of Money152 Questions

Exam 22: The Master Budget and Responsibility Accounting155 Questions

Exam 23: Flexible Budgets and Standard Costs165 Questions

Exam 24: Performance Evaluation and the Balanced Scorecard166 Questions

Select questions type

Nemesis Company manufactures water skis. Nemesis pursues a target pricing strategy. Please review the data below:

Current market price \ 180 per pair Current manufacturing cost \ 110 per pair Current non-manufacturing cost \ 25 per pair Desired profit 30\% of price

-

Which of the following represents the target cost?

(Multiple Choice)

4.8/5  (40)

(40)

Pitt Jones Company had the following activities, allocated costs, and allocation bases:

Activities Allocated Costs Allocation Base Account inquiry (hours) \ 60,000 2,000 hours Account billing (lines) \ 30,000 20,000 lines Account verification (accounts) \ 15,000 20,000 accounts Correspondence (letters) \ 10,000 1,000 letters

The above activities are carried out at two of their regional offices.

Northeast Office Midwest Office Account inquiry (hours) 100 hours 200 hours Account billing (lines) 10,000 lines 7,000 lines Account verification (accounts) 1,000 accounts 600 accounts Correspondence (letters) 50 letters 100 letters

-

What is the cost per unit for the account inquiry activity?

(Multiple Choice)

4.9/5  (47)

(47)

In a just-in-time costing system, the entry to record the standard cost of finished goods completed would include which of the following?

(Multiple Choice)

4.9/5  (45)

(45)

Costs incurred after the company sells poor-quality goods to the customer are considered external failure costs.

(True/False)

4.8/5  (39)

(39)

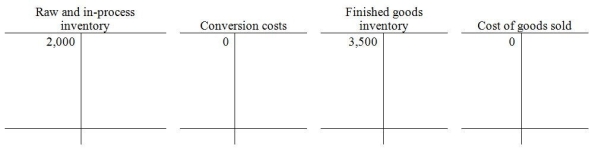

Archetype Fabrication makes pre-stressed concrete forms for the building industry. They use just-in-time production and accounting methodology. At the beginning of January, selected account balances are shown in the T-accounts below.  During January, the following 5 transactions take place:

1) Purchase $40,000 of materials on account.

2) Pay out $25,000 of direct labor costs.

3) Incur $9,000 of manufacturing overhead costs.

4) Complete 12 units. Each unit includes $1,500 of materials, $300 of direct labor, and $150 of manufacturing overhead costs.

5) Sell 10 of the 12 completed units at a price of $2,200.

-

Use the T-accounts shown above to record the transactions, and then answer the following question:

After transaction number 5, what was the balance in the Conversion costs account?

During January, the following 5 transactions take place:

1) Purchase $40,000 of materials on account.

2) Pay out $25,000 of direct labor costs.

3) Incur $9,000 of manufacturing overhead costs.

4) Complete 12 units. Each unit includes $1,500 of materials, $300 of direct labor, and $150 of manufacturing overhead costs.

5) Sell 10 of the 12 completed units at a price of $2,200.

-

Use the T-accounts shown above to record the transactions, and then answer the following question:

After transaction number 5, what was the balance in the Conversion costs account?

(Multiple Choice)

4.9/5  (35)

(35)

Activity-based costing systems and traditional costing systems will produce the same results for product cost and profitability, although they use different methods of calculation.

(True/False)

4.9/5  (31)

(31)

Formosa Steel Products makes steel building materials for export, and uses an activity-based costing system to account for the indirect manufacturing costs of its various products. Indirect costs for the whole factory are broken down into three activities-casting, materials handling, and milling. The cost driver for casting is machine hours; the cost driver for material handling is kilograms, and the cost driver for milling is direct labor hours. Activity costs and volumes for the year were estimated as follows:

Activity Cost Volume Casting \ 2,000,000 800,000.00 Machine hours Material Handling \ 400,000 500,000.00 Kilograms Milling \ 1,120,000 140,000.00 Direct labor hours

One product is steel reinforcement rods, sold by the metric ton. Engineering reports show that one metric ton of steel reinforcement rods requires $100 of direct materials cost plus $50 of direct labor cost. Producing one metric ton of steel rods also requires 24 machine hours for casting, weighs 1,000 kilograms, and requires 15 direct labor hours.

(Multiple Choice)

4.8/5  (29)

(29)

Kenney Company uses activity-based costing to account for its manufacturing process. Kenney Company produces tires and each tire has $.50 of direct materials, includes 20 parts and requires 2 hours of machine time. There is no direct labor. Additional information follows:

Activity Allocation Base Cost Allocation Rate Materials handling Number of parts \ .16 Machining Machine hours \ 14.40 Assembling Number of parts \ .70 Packaging Number of finished units \ 5.40

-

What is the cost of materials handling per tire?

(Multiple Choice)

4.8/5  (36)

(36)

Pollenti Company has just merged with another industrial firm whose business had been failing. Pollenti immediately conducted a thorough study of the new company's work processes, and produced a report including the data shown below:

• A new inspection process is recommended to minimize defective raw materials. It would cost $12,000 to implement.

• Shoddy business practices are resulting in excessive warranty costs $15,000 more than normal due mainly to material failure.

• Reengineering of the assembly line will increase productivity. It would cost $18,000 to implement.

• Inefficient workplace design is costing $5,000 in unnecessary rework costs.

• Estimated amount of lost profits due to dissatisfied customers who turn to the competition is $80,000.

-

Based on the above, what is the amount of appraisal costs, if any, included here?

(Multiple Choice)

4.9/5  (31)

(31)

Johnson Production Company uses just-in-time production and accounting methods. On June 1, Johnson paid $6,000 for factory repair and maintenance costs in cash. Please provide the journal entry.

(Essay)

4.9/5  (39)

(39)

Johnson Production Company uses just-in-time production and accounting methods. On June 1, Johnson purchased $4,000 of raw materials on account. Which of the following journal entries correctly records this transaction?

(Multiple Choice)

4.9/5  (35)

(35)

Full-product cost includes both manufacturing and non-manufacturing costs.

(True/False)

4.8/5  (31)

(31)

Which of the following categories includes costs incurred when poor quality goods or services are detected before delivery to customers?

(Multiple Choice)

4.8/5  (32)

(32)

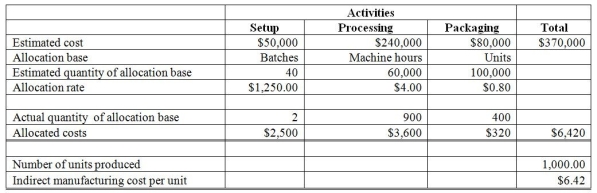

Clark Manufacturing makes blank CDs; it is a very competitive market and the company follows a target pricing strategy. Currently the market price for a unit of product (one unit equals a package of 100 CDs) is $18.00. Clark's production costs are shown below:

Direct materials $5.00 per unit

Direct labor $2.90 per unit

Indirect production costs $6.42 per unit

Non-manufacturing costs $3.20 per unit

Clark uses activity-based costing for its indirect production costs and provides the following information about this particular product:  -

The company's objective is to earn 5% profit on the sales price of the product. Clark carried out a value engineering study and decided that they could make the processing activity more efficient and save costs. In order to achieve their profit objective for this product, they need to reduce the indirect cost per unit from $6.42 down to what amount?

-

The company's objective is to earn 5% profit on the sales price of the product. Clark carried out a value engineering study and decided that they could make the processing activity more efficient and save costs. In order to achieve their profit objective for this product, they need to reduce the indirect cost per unit from $6.42 down to what amount?

(Multiple Choice)

4.7/5  (32)

(32)

Which of the following would most likely be treated as an activity in an activity-based costing system?

(Multiple Choice)

4.9/5  (37)

(37)

Pitt Jones Company had the following activities, allocated costs, and allocation bases:

Artivitias Allocated Casts Allocation Bare Accaunt inquiry (hours) \ 60,000 2,000 hours Account billing (lines) \ 30,000 20,000 lines Afcaunt verification (accounts) \ 15,000 20,000 accounts Correspandence (letters) \ 10,000 1,000 letters

The above activities are carried out at two of their regional offices:

Northeast Office Midwest Office Account inquiry (hours) 100 hours 200 hours Account billing (lines) 10,000 lines 7,000 lines Account verification (accounts) 1,000 accounts 600 accounts Correspondence (letters) 50 letters 100 letters

-

How much of the account verification costs will be assigned to the Northeast Office?

(Multiple Choice)

4.9/5  (40)

(40)

Johnson Production Company uses just-in-time production and accounting methods. On June 1, Johnson completed 400 units of product and moved the products to finished goods. Each unit included $8.00 of direct materials cost and $2.00 of conversion costs. Please provide the journal entry.

(Essay)

4.8/5  (41)

(41)

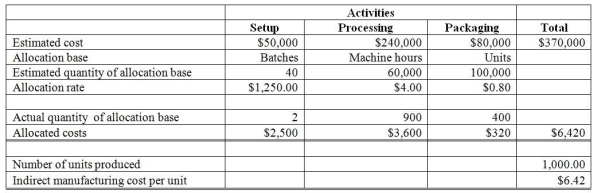

Clark Manufacturing makes blank CDs; it is a very competitive market and the company follows a target pricing strategy. Currently the market price for a unit of product (one unit equals a package of 100 CDs) is $18.00. Clark's production costs are shown below:

Direct materials $5.00 per unit

Direct labor $2.90 per unit

Indirect production costs $6.42 per unit

Non-manufacturing costs $3.20 per unit

Clark uses activity-based costing for its indirect production costs and provides the following information about this particular product:  -

The company's objective is to earn 5% profit on the sales price of the product. Clark carried out a value engineering study and decided that they could make the processing activity more efficient and save costs. If they reduce the total processing activity cost by $20,000, what will their profit percentage be? (Please round to the nearest tenth of a percent.)

-

The company's objective is to earn 5% profit on the sales price of the product. Clark carried out a value engineering study and decided that they could make the processing activity more efficient and save costs. If they reduce the total processing activity cost by $20,000, what will their profit percentage be? (Please round to the nearest tenth of a percent.)

(Multiple Choice)

4.7/5  (35)

(35)

Two main benefits of activity-based costing are more accurate product cost information and more detailed information on costs of activities and the drivers of these costs.

(True/False)

4.7/5  (37)

(37)

The cost of inspection at various stages of production is an example of what type of cost?

(Multiple Choice)

4.7/5  (39)

(39)

Showing 121 - 140 of 160

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)