Exam 10: Capital Budgeting Techniques

Exam 1: The Role of Managerial Finance133 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis209 Questions

Exam 4: Cash Flow and Financial Planning183 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return190 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows117 Questions

Exam 12: Risk and Refinements in Capital Budgeting106 Questions

Exam 13: Leverage and Capital Structure217 Questions

Exam 14: Payout Policy130 Questions

Exam 15: Working Capital and Current Assets Management340 Questions

Exam 16: Current Liabilities Management171 Questions

Exam 17: Hybrid and Derivative Securities185 Questions

Exam 18: Mergers, Lbos, Divestitures, and Business Failure191 Questions

Exam 19: International Managerial Finance108 Questions

Select questions type

Should Tangshan Mining company accept a new project if its maximum payback is 3.25 years and its initial after tax cost is $5,000,000 and it is expected to provide after-tax operating cash inflows of $1,800,000 in year 1, $1,900,000 in year 2, $700,000 in year 3 and $1,800,000 in year 4?

(Multiple Choice)

4.7/5  (36)

(36)

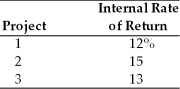

A firm with a cost of capital of 13 percent is evaluating three capital projects. The internal rates of return are as follows:  The firm should

The firm should

(Multiple Choice)

4.7/5  (37)

(37)

Payback is considered an unsophisticated capital budgeting because it

(Multiple Choice)

4.8/5  (32)

(32)

If its IRR is greater than 0 percent, a project should be accepted.

(True/False)

4.8/5  (39)

(39)

The evaluation of capital expenditure proposals to determine whether they meet the firm's minimum acceptance criteria is called

(Multiple Choice)

4.7/5  (45)

(45)

A sophisticated capital budgeting technique that can be computed by subtracting a project's initial investment from the present value of its cash inflows discounted at a rate equal to the firm's cost of capital is called net present value.

(True/False)

4.8/5  (33)

(33)

The payback period of a project that costs $1,000 initially and promises after-tax cash inflows of $3,000 each year for the next three years is 3.33 years.

(True/False)

4.9/5  (35)

(35)

________ is the process of evaluating and selecting long-term investments consistent with the firm's goal of owner wealth maximization.

(Multiple Choice)

4.8/5  (36)

(36)

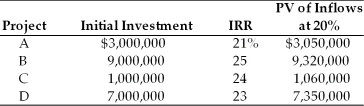

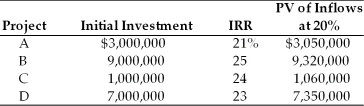

Table 10.5

Galaxy Satellite Co. is attempting to select the best group of independent projects competing for the firm's fixed capital budget of $10,000,000. Any unused portion of this budget will earn less than its 20 percent cost of capital. A summary of key data about the proposed projects follows.  -Consider the following projects, X and Y where the firm can only choose one. Project X costs $600 and has cash flows of $400 in each of the next 2 years. Project Y also costs $600, and generates cash flows of $500 and $275 for the next 2 years, respectively. Sketch a net present value profile for each of these projects. Which project should the firm choose if the cost of capital is 10 percent? What if the cost of capital is 25 percent? Show all work.

-Consider the following projects, X and Y where the firm can only choose one. Project X costs $600 and has cash flows of $400 in each of the next 2 years. Project Y also costs $600, and generates cash flows of $500 and $275 for the next 2 years, respectively. Sketch a net present value profile for each of these projects. Which project should the firm choose if the cost of capital is 10 percent? What if the cost of capital is 25 percent? Show all work.

(Essay)

5.0/5  (32)

(32)

Table 10.5

Galaxy Satellite Co. is attempting to select the best group of independent projects competing for the firm's fixed capital budget of $10,000,000. Any unused portion of this budget will earn less than its 20 percent cost of capital. A summary of key data about the proposed projects follows.  -Use the IRR approach to select the best group of projects. (See Table 10.5)

-Use the IRR approach to select the best group of projects. (See Table 10.5)

(Essay)

4.8/5  (30)

(30)

If a firm has unlimited funds to invest, all the mutually exclusive projects that meet its minimum investment criteria can be implemented.

(True/False)

4.8/5  (33)

(33)

Since the cost of capital tends to be a reasonable estimate of the rate at which the firm could actually reinvest intermediate cash inflows, the use of NPV is in theory preferable to IRR.

(True/False)

5.0/5  (38)

(38)

Mutually exclusive projects are those whose cash flows are unrelated to one another; the acceptance of one does not eliminate any others from further consideration.

(True/False)

4.8/5  (39)

(39)

Capital budgeting is the process of evaluating and selecting short-term investments consistent with the firm's goal of owner wealth maximization.

(True/False)

4.8/5  (34)

(34)

A non-conventional cash flow pattern associated with capital investment projects consists of an initial

(Multiple Choice)

4.9/5  (35)

(35)

The most common motive for adding fixed assets to the firm is

(Multiple Choice)

4.8/5  (38)

(38)

On a purely theoretical basis, NPV is a better approach to capital budgeting than IRR because NPV implicitly assumes that any intermediate cash inflows generated by an investment are reinvested at the firm's cost of capital.

(True/False)

4.9/5  (29)

(29)

Showing 141 - 160 of 167

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)