Exam 12: Leverage and Capital Structure

Exam 1: The Role of Managerial Finance133 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis209 Questions

Exam 4: Cash Flow and Financial Planning185 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return190 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows and Risk Refinements195 Questions

Exam 12: Leverage and Capital Structure217 Questions

Exam 13: Payout Policy130 Questions

Exam 14: Working Capital and Current Assets Management340 Questions

Exam 15: Current Liabilities Management171 Questions

Select questions type

The contribution margin is defined as the percent of each sales dollar that remains after satisfying fixed operating costs.

(True/False)

4.8/5  (40)

(40)

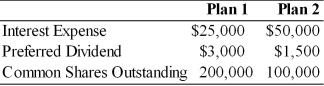

Table 12.1  -Assuming a 40 percent tax rate, what is the financial breakeven point for each plan? (See Table 12.1)

-Assuming a 40 percent tax rate, what is the financial breakeven point for each plan? (See Table 12.1)

(Essay)

4.8/5  (37)

(37)

Pecking order is a hierarchy of financing beginning with retained earnings followed by debt financing and finally external equity financing.

(True/False)

5.0/5  (33)

(33)

________ costs are a function of time, not sales, and are typically contractual.

(Multiple Choice)

4.8/5  (25)

(25)

A decrease in fixed financial costs will result in ________ in financial risk.

(Multiple Choice)

4.9/5  (35)

(35)

The inexpensive nature of long-term debt in a firm's capital structure is due to the fact that

(Multiple Choice)

4.9/5  (37)

(37)

As debt is substituted for equity in the capital structure and the debt ratio increases, the behavior of the overall cost of capital is partially explained by

(Multiple Choice)

4.8/5  (30)

(30)

The dollar breakeven sales level can be solved for by dividing fixed costs by the dollar contribution margin.

(True/False)

4.9/5  (31)

(31)

A firm has fixed operating costs of $175,000, total sales revenue of $3,000,000 and total variable costs of $2,250,000. The firm's degree of operating leverage is ________.

(Multiple Choice)

4.9/5  (31)

(31)

A corporation has $10,000,000 of 10 percent preferred stock outstanding and a 40 percent tax rate. The amount of earnings before interest and taxes (EBIT) required to pay the preferred dividends is

(Multiple Choice)

4.9/5  (35)

(35)

As debt is substituted for equity in the capital structure and the debt ratio increases, all of the following statements about the component costs of capital are true EXCEPT

(Multiple Choice)

4.9/5  (32)

(32)

Tangshan Mining Company must choose its optimal capital structure. Currently, the firm has a 40 percent debt ratio and the firm expects to generate a dividend next year of $4.89 per share and dividends are grow at a constant rate of 5 percent for the foreseeable future. Stockholders currently require a 10.89 percent return on their investment. Tangshan Mining is considering changing its capital structure if it would benefit shareholders. The firm estimates that if it increases the debt ratio to 50 percent, it will increase its expected dividend to $5.24 per share. Because of the additional leverage, dividend growth is expected to increase to 6 percent and this growth will be sustained indefinitely. However, because of the added risk, the required return demanded by stockholders will increase to 11.34 percent.

(a) What is the value per share for Tangshan Mining under the current capital structure?

(b) What is the value per share for Tangshan Mining under the proposed capital structure?

(c) Should Tangshan Mining make the capital structure change? Explain.

(Essay)

4.9/5  (32)

(32)

The reason why maximizing share value and maximizing EPS do not give the same optimal capital structure is because

(Multiple Choice)

4.9/5  (29)

(29)

The basic sources of capital for a firm include all of the following EXCEPT

(Multiple Choice)

4.9/5  (37)

(37)

With the existence of fixed operating costs, a decrease in sales will result in ________ in EBIT.

(Multiple Choice)

4.9/5  (30)

(30)

A corporation has $5,000,000 of 10 percent bonds and $3,000,000 of 12 percent preferred stock outstanding. The firm's financial breakeven (assuming a 40 percent tax rate) is

(Multiple Choice)

4.8/5  (37)

(37)

The closer the base sales level used is to the operating breakeven point, the smaller the operating leverage.

(True/False)

4.8/5  (39)

(39)

Holding all other factors constant, a firm that is subject to a greater level of business risk should employ less total leverage than an otherwise equivalent firm that is subject to a lesser level of business risk.

(True/False)

4.9/5  (38)

(38)

Tony's Beach T-Shirts has fixed annual operating costs of $75,000. Tony retails his T-shirts for $14.99 each and the variable cost per T-shirt is $4.99. Based on this information, the breakeven sales level in dollars is

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following is NOT a reason why debt capital is considered to be the least risky source of capital?

(Multiple Choice)

4.7/5  (25)

(25)

Showing 181 - 200 of 217

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)