Exam 9: Relevant Information and Decision Making: Production Decisions

Exam 1: Management Accounting and Management Decisions90 Questions

Exam 2: Cost Behaviour and Cost-Volume Relationships96 Questions

Exam 3: Measurement of Cost Behaviour97 Questions

Exam 4: Cost Management Systems134 Questions

Exam 5: Cost Allocation and Activity-Based Costing Systems128 Questions

Exam 6: Job-Costing Systems88 Questions

Exam 7: Process-Costing Systems82 Questions

Exam 8: Relevant Information and Decision Making: Marketing Decisions100 Questions

Exam 9: Relevant Information and Decision Making: Production Decisions111 Questions

Exam 10: Capital Budgeting Decisions116 Questions

Exam 11: The Master Budget112 Questions

Exam 12: Flexible Budgets and Variance Analysis106 Questions

Exam 13: Management Control Systems, the Balanced Scorecard, and Responsibility Accounting94 Questions

Exam 14: Management Control in Decentralized Organizations103 Questions

Select questions type

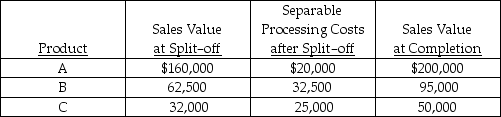

Mann Corporation has a joint process, which produces three products, A, B and C. Each product may be sold at split-off or processed further and then sold. Joint processing costs for a year amount to $125,000. Other relevant data are as follows:

-Once product A is produced, processing it further will cause profits to

-Once product A is produced, processing it further will cause profits to

(Multiple Choice)

4.9/5  (37)

(37)

A relevant costing analysis that focuses on whether a product should be processed beyond the split-off point.

(Short Answer)

4.8/5  (36)

(36)

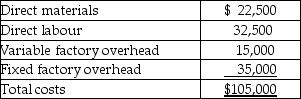

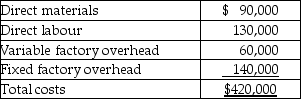

Pett Company produces a part that is used in the manufacture of one of its products. The costs associated with the production of 5,000 units of this part are as follows:

Of the fixed factory overhead costs, $15,000 is avoidable.

-Assume that Pett can buy 5,000 units of the part from another producer for $21 each. The current facilities could be used to make 5,000 units of a product that has a contribution margin of $5 per unit. Fixed factory overhead costs to produce this new product would be exactly the same as for the currently produced part. Pett should

Of the fixed factory overhead costs, $15,000 is avoidable.

-Assume that Pett can buy 5,000 units of the part from another producer for $21 each. The current facilities could be used to make 5,000 units of a product that has a contribution margin of $5 per unit. Fixed factory overhead costs to produce this new product would be exactly the same as for the currently produced part. Pett should

(Multiple Choice)

4.7/5  (48)

(48)

A cost that has already been incurred and is irrelevant to the decision-making process.

(Short Answer)

4.8/5  (42)

(42)

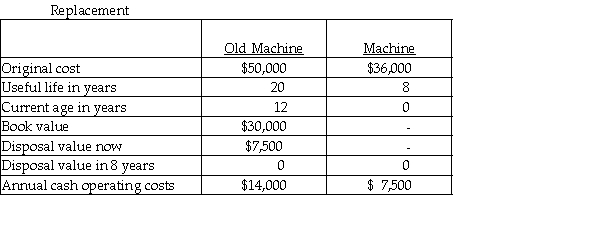

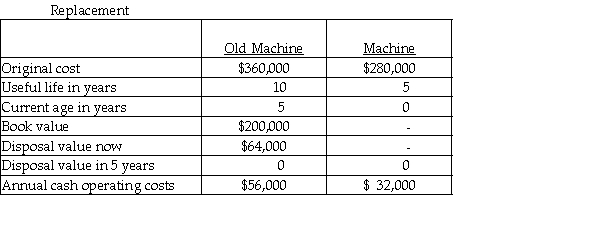

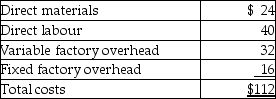

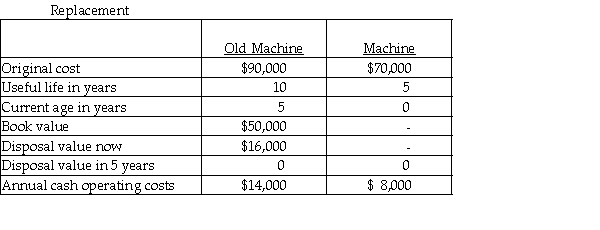

The Enger Company is contemplating replacing some old equipment. The pertinent information is as follows:  -The total relevant costs to consider if the old equipment is replaced are

-The total relevant costs to consider if the old equipment is replaced are

(Multiple Choice)

5.0/5  (39)

(39)

Make-or-buy decisions can apply to services as well as to products.

(True/False)

4.7/5  (41)

(41)

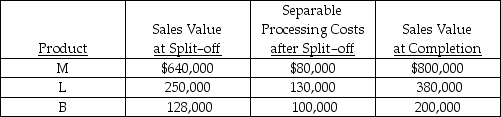

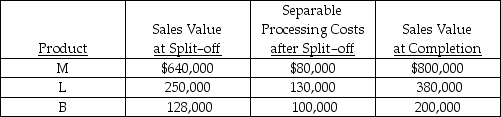

Avey Corporation has a joint process which produces three products, M, L and B. Each product may be sold at split-off or processed further and then sold. Joint processing costs for a year amount to $500,000. Other relevant data are as follows:

-To maximize profits, which products should Avey process further?

-To maximize profits, which products should Avey process further?

(Multiple Choice)

4.9/5  (46)

(46)

Avey Corporation has a joint process which produces three products, M, L and B. Each product may be sold at split-off or processed further and then sold. Joint processing costs for a year amount to $500,000. Other relevant data are as follows:

-Once product M is produced, processing it further will cause profits to

-Once product M is produced, processing it further will cause profits to

(Multiple Choice)

4.9/5  (35)

(35)

A relevant costing analysis that focuses on keeping or dropping a segment of a business.

(Short Answer)

5.0/5  (29)

(29)

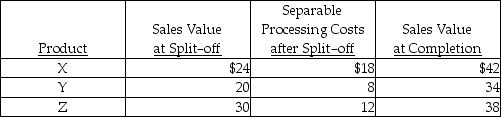

Hamilton, Inc. produces three products using a joint process which provides for $350,000 in joint costs. The products X, Y and Z can be sold at split-off or processed further and then sold. The production level for each product is 5,000 units. The following unit information is also available:

-To maximize profits, which products should Hamilton process further?

-To maximize profits, which products should Hamilton process further?

(Multiple Choice)

4.9/5  (35)

(35)

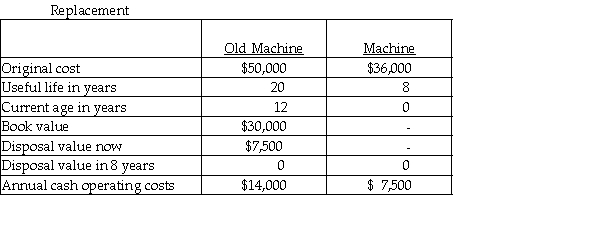

Buckner Company is considering replacing a machine that is presently used in the production of its product. The following data are available:  -Which of the data provided in the table is irrelevant?

-Which of the data provided in the table is irrelevant?

(Multiple Choice)

4.8/5  (34)

(34)

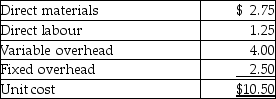

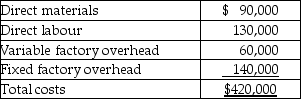

Peters Company produces a product with the following unit cost.

Fixed selling costs are $600,000 per year and variable selling costs are $1.50 per unit sold.

Production capacity is 500,000 units per year. However, the company expects to produce only 300,000 units next year. The product normally sells for $15 each. A customer has offered to buy 150,000 units for $10 each. The units would be sold in an area outside the market area currently served.

-The incremental cost per unit associated with the special order is

Fixed selling costs are $600,000 per year and variable selling costs are $1.50 per unit sold.

Production capacity is 500,000 units per year. However, the company expects to produce only 300,000 units next year. The product normally sells for $15 each. A customer has offered to buy 150,000 units for $10 each. The units would be sold in an area outside the market area currently served.

-The incremental cost per unit associated with the special order is

(Multiple Choice)

4.9/5  (36)

(36)

The split-off point is the juncture in manufacturing where the joint products become individually identifiable.

(True/False)

4.9/5  (39)

(39)

Barker Company produces a part that is used in the manufacture of one of its products. The costs associated with the production of 5,000 units of this part are as follows:

Of the fixed factory overhead costs, $60,000 is avoidable.

-Blass Company has offered to sell 5,000 units of the same part to Barker for $72 per unit. Assuming there is no other use for the facilities, Barker should

Of the fixed factory overhead costs, $60,000 is avoidable.

-Blass Company has offered to sell 5,000 units of the same part to Barker for $72 per unit. Assuming there is no other use for the facilities, Barker should

(Multiple Choice)

4.8/5  (39)

(39)

Barker Company produces a part that is used in the manufacture of one of its products. The costs associated with the production of 5,000 units of this part are as follows:

Of the fixed factory overhead costs, $60,000 is avoidable.

-Assuming no other use of their facilities, the highest price that Barker should be willing to pay for 5,000 units of the part is

Of the fixed factory overhead costs, $60,000 is avoidable.

-Assuming no other use of their facilities, the highest price that Barker should be willing to pay for 5,000 units of the part is

(Multiple Choice)

4.8/5  (36)

(36)

Bovee Company manufactures a part for its production cycle. The costs per unit for 10,000 units of this part are as follows:

The fixed factory overhead costs are unavoidable.

-Assume that Bovee can buy 10,000 units of the part from another producer for $120 each. The facilities currently used to make the part could be rented out to another manufacturer for $160,000 a year. Bovee should

The fixed factory overhead costs are unavoidable.

-Assume that Bovee can buy 10,000 units of the part from another producer for $120 each. The facilities currently used to make the part could be rented out to another manufacturer for $160,000 a year. Bovee should

(Multiple Choice)

4.9/5  (39)

(39)

A current or future action can always influence the long-run impact of a past outlay.

(True/False)

4.9/5  (39)

(39)

The Enger Company is contemplating replacing some old equipment. The pertinent information is as follows:  -The difference in cost between keeping the old equipment and replacing the old equipment, ignoring income taxes, is

-The difference in cost between keeping the old equipment and replacing the old equipment, ignoring income taxes, is

(Multiple Choice)

5.0/5  (45)

(45)

Overland Company is considering replacing a machine that is presently used in the production of its product. The following data are available:  -The difference in cost between keeping the old machine and replacing the old machine, ignoring income taxes, is

-The difference in cost between keeping the old machine and replacing the old machine, ignoring income taxes, is

(Multiple Choice)

4.8/5  (31)

(31)

Showing 61 - 80 of 111

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)