Exam 5: Cost Allocation and Activity-Based Costing Systems

Exam 1: Management Accounting and Management Decisions90 Questions

Exam 2: Cost Behaviour and Cost-Volume Relationships96 Questions

Exam 3: Measurement of Cost Behaviour97 Questions

Exam 4: Cost Management Systems134 Questions

Exam 5: Cost Allocation and Activity-Based Costing Systems128 Questions

Exam 6: Job-Costing Systems88 Questions

Exam 7: Process-Costing Systems82 Questions

Exam 8: Relevant Information and Decision Making: Marketing Decisions100 Questions

Exam 9: Relevant Information and Decision Making: Production Decisions111 Questions

Exam 10: Capital Budgeting Decisions116 Questions

Exam 11: The Master Budget112 Questions

Exam 12: Flexible Budgets and Variance Analysis106 Questions

Exam 13: Management Control Systems, the Balanced Scorecard, and Responsibility Accounting94 Questions

Exam 14: Management Control in Decentralized Organizations103 Questions

Select questions type

A system in which an organization purchases materials and parts and produces components just when they are needed in the production process.

(Short Answer)

4.8/5  (33)

(33)

If the step-down method is used and the costs of the service department with the greatest total cost are allocated first, Department B costs allocated to Department D would be

(Multiple Choice)

4.8/5  (34)

(34)

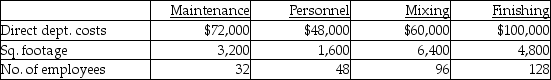

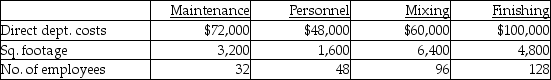

County Company has two service departments, Maintenance and Personnel, as well as two production departments, Mixing and Finishing. Maintenance costs are allocated based on square footage, while personnel costs are allocated based on number of employees. The following information has been gathered for the current year:

-If the direct method is used to allocate costs, the total cost of the Finishing Department after allocation would be

-If the direct method is used to allocate costs, the total cost of the Finishing Department after allocation would be

(Multiple Choice)

4.9/5  (35)

(35)

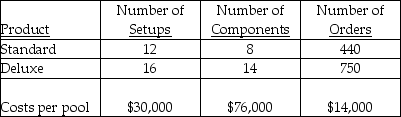

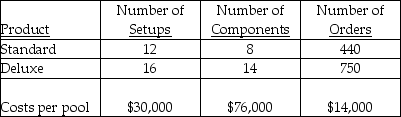

Stanley Corp. manufactures two models of its roasting pans, a standard and a deluxe model. Three activities have been identified as cost drivers and the related costs pooled together to arrive at the following information:

-If activity-based costing is used, then the total cost of the components used in the deluxe model would be

-If activity-based costing is used, then the total cost of the components used in the deluxe model would be

(Multiple Choice)

4.9/5  (31)

(31)

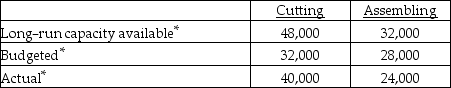

Stumbo Company has two production departments, Cutting and Assembling, served by one maintenance department. Budgeted fixed costs for the maintenance department for 20X3 were $60,000, and the variable cost per labour hour was $2.00. Other relevant data for 20X3 are as follows:

Actual maintenance department costs for 20X3 were $64,000 fixed and $120,000 variable.

*in labour hours

-The amount of variable maintenance costs allocated to the Cutting Department should be

Actual maintenance department costs for 20X3 were $64,000 fixed and $120,000 variable.

*in labour hours

-The amount of variable maintenance costs allocated to the Cutting Department should be

(Multiple Choice)

5.0/5  (34)

(34)

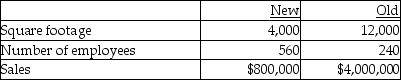

Stohr Company has two departments, New and Old. Central costs are allocated to the two departments in various ways. Relevant information is presented below:

-If total advertising expense is $120,000 and it is allocated on the basis of sales, the amount allocated to the Old Department should be

-If total advertising expense is $120,000 and it is allocated on the basis of sales, the amount allocated to the Old Department should be

(Multiple Choice)

4.7/5  (34)

(34)

Stanley Corp. manufactures two models of its roasting pans, a standard and a deluxe model. Three activities have been identified as cost drivers and the related costs pooled together to arrive at the following information:

-If activity-based costing is used, then the total amount of overhead allocated to the deluxe model would be

-If activity-based costing is used, then the total amount of overhead allocated to the deluxe model would be

(Multiple Choice)

4.9/5  (38)

(38)

County Company has two service departments, Maintenance and Personnel, as well as two production departments, Mixing and Finishing. Maintenance costs are allocated based on square footage, while personnel costs are allocated based on number of employees. The following information has been gathered for the current year:

-If the step-down method is used to allocate costs, and the Personnel Department renders the greatest service, then the total cost of the Finishing Department after allocation would be

-If the step-down method is used to allocate costs, and the Personnel Department renders the greatest service, then the total cost of the Finishing Department after allocation would be

(Multiple Choice)

4.9/5  (40)

(40)

Showing 121 - 128 of 128

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)