Exam 18: Employee Expenses and Deferred Compensation

Exam 1: Tax Research115 Questions

Exam 2 an Introduction to Taxation104 Questions

Exam 3: Corporate Formations and Capital Structure123 Questions

Exam 4: I: Determination of Tax138 Questions

Exam 5: The Corporate Income Tax126 Questions

Exam 6: Gross Income: Inclusions132 Questions

Exam 7: Corporate Nonliquidating Distributions113 Questions

Exam 8: Gross Income: Exclusions107 Questions

Exam 9: Other Corporate Tax Levies104 Questions

Exam 10: Property Transactions: Capital Gains and Losses133 Questions

Exam 1: Corporate Liquidating Distributions102 Questions

Exam 12: Deductions and Losses130 Questions

Exam 13: Corporate Acquisitions and Reorganizations104 Questions

Exam 14: Itemized Deductions114 Questions

Exam 15: Consolidated Tax Returns99 Questions

Exam 16: Losses and Bad Debts114 Questions

Exam 17: Partnership Formation and Operation115 Questions

Exam 18: Employee Expenses and Deferred Compensation135 Questions

Exam 19: Special Partnership Issues107 Questions

Exam 20: Depreciation cost Recovery amortization and Depletion93 Questions

Exam 21: S Corporations103 Questions

Exam 22: Accounting Periods and Methods107 Questions

Exam 23: The Gift Tax105 Questions

Exam 24: Property Transactions: Nontaxable Exchanges115 Questions

Exam 25: The Estate Tax107 Questions

Exam 26: Property Transactions: Section 1231 and Recapture100 Questions

Exam 27: Income Taxation of Trusts and Estates105 Questions

Exam 28: Special Tax Computation Methods, tax Credits, and Payment of Tax117 Questions

Exam 29: Administrative Procedures104 Questions

Select questions type

Matt is a sales representative for a local company. He entertains customers as part of his job. During the current year he spends $3,000 on business entertainment. The company provides him an expense allowance of $2,000 under a nonaccountable plan. How will Matt treat the $2,000 partial reimbursement and the $3,000 entertainment expense?

Free

(Multiple Choice)

4.9/5  (30)

(30)

Correct Answer:

D

Commuting to and from a job location is a deductible expense.

Free

(True/False)

4.9/5  (50)

(50)

Correct Answer:

False

Transportation expenses incurred to travel from one job to another are deductible if a taxpayer has more than one job.

Free

(True/False)

4.8/5  (38)

(38)

Correct Answer:

True

Josiah is a human resources manager of a large software company.He is considering asking for a leave of absence to pursue an MBA degree.Josiah will pay for his MBA tuition of $45,000 a year without any employer assistance.Josiah will incur a large debt if he pursues an MBA.Upon completing his MBA,he would want to consider various job opportunities.Discuss the tax issues affecting Josiah's decision?

(Essay)

4.8/5  (33)

(33)

Which statement is correct regarding SIMPLE retirement plans?

(Multiple Choice)

4.8/5  (51)

(51)

Martin Corporation granted a nonqualified stock option to employee Caroline on January 1,2011. The option price was $150,and the FMV of the Martin stock was also $150 on the grant date.The option allowed Caroline to purchase 1,000 shares of Martin stock. The option itself does not have a readily ascertainable FMV. Caroline exercised the option on August 1,2014 when the stock's FMV was $250.If Caroline sells the stock on September 5,2015 for $300 per share,she must recognize

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following statements is incorrect regarding unfunded deferred compensation plans?

(Multiple Choice)

4.8/5  (42)

(42)

If an employee incurs business-related entertainment expenses that are fully reimbursed,it is the employer who is subject to the 50% limitation.

(True/False)

4.9/5  (33)

(33)

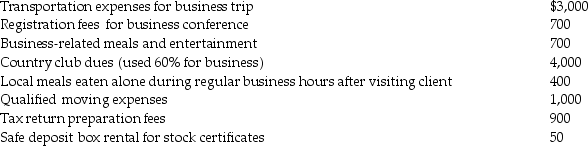

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:

In addition,Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition,Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

(Essay)

5.0/5  (35)

(35)

When a public school system requires advanced education for a teacher to continue employment,the teacher's expenses are a deductible education expense.

(True/False)

4.7/5  (43)

(43)

The maximum tax deductible contribution to a traditional IRA in 2014 is $5,500 ($6,500 for a taxpayer age 50 or over).

(True/False)

4.9/5  (43)

(43)

Allison,who is single,incurred $4,000 for unreimbursed employee expenses,$10,000 for mortgage interest and real estate taxes on her home,and $500 for investment counseling fees.Allison's AGI is $80,000.Allison's allowable deductions from AGI are (after limitations have been applied)

(Multiple Choice)

4.8/5  (35)

(35)

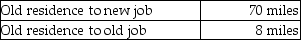

Donald takes a new job and moves to a new residence.The distances are as follows:  By how many miles does the move exceed the minimum distance requirement for the moving expense deduction?

By how many miles does the move exceed the minimum distance requirement for the moving expense deduction?

(Multiple Choice)

4.9/5  (32)

(32)

Characteristics of profit-sharing plans include all of the following with the exception of:

(Multiple Choice)

4.9/5  (35)

(35)

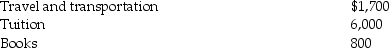

Ellie,a CPA,incurred the following deductible education expenses to maintain or improve her skills:

Ellie's AGI for the year is $60,000.

a.If Ellie is self-employed,what are the amount of and the nature of the deduction for these expenses?

b.If,instead,Ellie is an employee who is not reimbursed by his employer,what are the amount of and the nature of the deduction for these expenses (after limitations)?

Ellie's AGI for the year is $60,000.

a.If Ellie is self-employed,what are the amount of and the nature of the deduction for these expenses?

b.If,instead,Ellie is an employee who is not reimbursed by his employer,what are the amount of and the nature of the deduction for these expenses (after limitations)?

(Essay)

4.8/5  (34)

(34)

A contributor may make a deductible contribution to a Coverdell Education Savings Account for a qualified designated beneficiary of up to $2,000.

(True/False)

4.9/5  (37)

(37)

Wilson Corporation granted an incentive stock option to Reva on January 1,two years ago.The option price was $300,and the FMV of the Wilson stock was also $300 on the grant date.The option allowed Reva to purchase 150 shares of Wilson stock.Reva exercised the option on August 1,this year,when the stock's FMV was $400.Unless otherwise stated,assume Reva is a qualifying employee.The results of the above transactions to Reva will be

(Multiple Choice)

4.8/5  (37)

(37)

Chuck,who is self-employed,is scheduled to fly from Minneapolis to London on a business trip.His flight schedule included a connection through New York City.When Chuck arrived in New York City,he learned that his flight to London had been cancelled due to a volcanic eruption in Iceland.All air travel to Europe was delayed for five days because of significant amounts of ash in the air,causing Chuck to incur costs for hotel and meals in New York City.Since Chuck had never been to New York City before,he spent the time sightseeing.What tax issues are present?

(Essay)

4.9/5  (36)

(36)

H (age 50)and W (age 48)are married but only W is employed.She is not covered by a retirement plan at work.She earns $75,000 during the year and they have combined AGI of $78,000 before any IRA contribution.In 2014,the maximum amount together they may contribute to tax deductible IRAs is

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following conditions would generally not favor the rollover of an untaxed retirement fund (e.g.traditional IRA or 401(k)plan)to a Roth account?

(Multiple Choice)

4.8/5  (32)

(32)

Showing 1 - 20 of 135

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)