Exam 17: Activity-Based Costing and Analysis

Exam 1: Accounting in Business285 Questions

Exam 2: Accounting for Business Transactions251 Questions

Exam 3: Adjusting Accounts for Financial Statements403 Questions

Exam 4: Accounting for Merchandising Operations252 Questions

Exam 5: Inventories and Cost of Sales238 Questions

Exam 6: Cash,fraud,and Internal Controls228 Questions

Exam 7: Accounting for Receivables219 Questions

Exam 8: Accounting for Long-Term Assets258 Questions

Exam 9: Accounting for Current Liabilities219 Questions

Exam 10: Accounting for Long-Term Liabilities231 Questions

Exam 11: Corporate Reporting and Analysis247 Questions

Exam 12: Reporting Cash Flows247 Questions

Exam 13: Analysis of Financial Statements245 Questions

Exam 14: Managerial Accounting Concepts and Principles252 Questions

Exam 15: Job Order Costing and Analysis215 Questions

Exam 16: Process Costing and Analysis225 Questions

Exam 17: Activity-Based Costing and Analysis223 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis247 Questions

Exam 19: Variable Costing and Analysis202 Questions

Exam 20: Master Budgets and Performance Planning224 Questions

Exam 21: Flexible Budgets and Standard Costs223 Questions

Exam 22: Performance Measurement and Responsibility Accounting210 Questions

Exam 23: Relevant Costing for Managerial Decisions149 Questions

Exam 24: Capital Budgeting and Investment Analysis161 Questions

Exam 25: Time Value of Money84 Questions

Exam 26: Investments217 Questions

Exam 27: Lean Principles and Accounting30 Questions

Select questions type

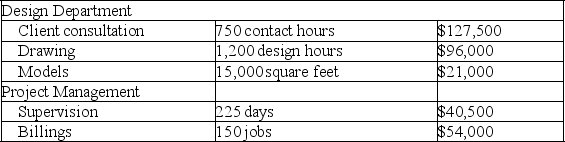

Inside Out,Company designs custom showroom spaces in interior design marts across the country.The following data pertain to a recent reporting period.

Required

a.Use ABC to compute overhead rates for each activity.

b.Assign costs to a 3,000 square-foot job that requires 70 contact hours,20 design hours,and 14 days to complete.

Required

a.Use ABC to compute overhead rates for each activity.

b.Assign costs to a 3,000 square-foot job that requires 70 contact hours,20 design hours,and 14 days to complete.

(Essay)

4.8/5  (39)

(39)

The ________ overhead rate is calculated by dividing total budgeted overhead cost by a chosen allocation base,such as direct labor hours.

(Short Answer)

4.8/5  (36)

(36)

Two big benefits of ABC costing are a)more accurate product cost information and b)more detailed information on costs and the drivers of those costs.

(True/False)

4.8/5  (42)

(42)

The following data relates to Mangini Company's estimated amounts for next year.  What is the company's plantwide overhead rate if machine hours are the allocation base?

What is the company's plantwide overhead rate if machine hours are the allocation base?

(Multiple Choice)

4.7/5  (36)

(36)

A method of assigning overhead costs to a product using a single overhead rate is:

(Multiple Choice)

4.8/5  (44)

(44)

ABC allocates overhead costs to products based on activities rather than direct labor or machine hours.

(True/False)

4.7/5  (29)

(29)

Which of the following statements is true with regard to activity-based costing rates?

(Multiple Choice)

4.8/5  (34)

(34)

The cost to heat a manufacturing facility can be directly linked to the number of units produced.

(True/False)

4.9/5  (33)

(33)

A single cost pool is used when allocating overhead using the activity-based costing method.

(True/False)

4.8/5  (43)

(43)

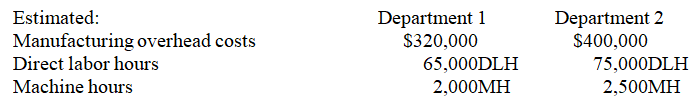

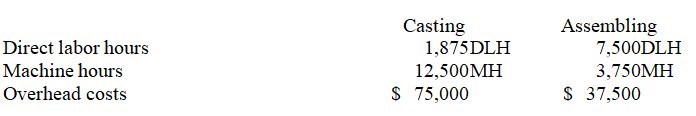

A company produces heating elements that go through two operations,casting and assembling,before they are complete.Expected costs and activities for the two departments are shown below.Given this information,the departmental overhead rate for the assembling department based on direct labor hours is $5 per direct labor hour.

(True/False)

4.7/5  (42)

(42)

Compared to the departmental overhead rate method,the plantwide overhead rate method usually results in more accurate overhead allocations.

(True/False)

4.8/5  (34)

(34)

Some companies allocate their overhead cost using a plantwide overhead rate largely because of its simplicity.

(True/False)

4.9/5  (34)

(34)

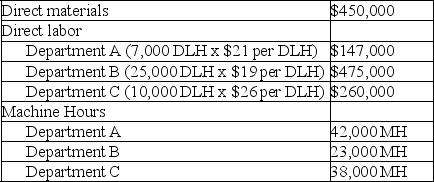

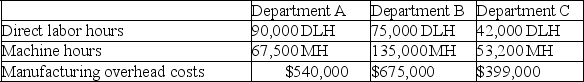

Freeze Frame,Inc.produces cameras that require three processes,A,B,and C,to complete.Digital camera model #789 is the best-selling of all the many types of cameras produced.Information related to the 550,000 units of digital camera model #789 produced annually is shown below.

Freeze Frame's total expected overhead costs and related overhead data are shown below:

Freeze Frame's total expected overhead costs and related overhead data are shown below:

-a.Compute a departmental overhead rate for department A based on machine hours.

b.How much overhead is associated with model 789 from department A?

c.Compute a departmental overhead rate for department B based on direct labor hours.

d.How much overhead is associated with model 789 from department B?

e.Compute a departmental overhead rate for department C based on machine hours.

f.How much overhead is associated with model 789 from department C?

g What is the per unit cost of the 550,000 units of model 789?

-a.Compute a departmental overhead rate for department A based on machine hours.

b.How much overhead is associated with model 789 from department A?

c.Compute a departmental overhead rate for department B based on direct labor hours.

d.How much overhead is associated with model 789 from department B?

e.Compute a departmental overhead rate for department C based on machine hours.

f.How much overhead is associated with model 789 from department C?

g What is the per unit cost of the 550,000 units of model 789?

(Essay)

4.7/5  (42)

(42)

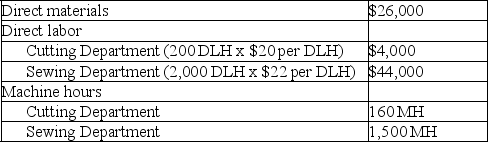

Lemon Yellow Company produces children's clothing that requires two processes,cutting and sewing,to complete.The company is concerned about one product,a hooded jacket,which hasn't been selling as well as it had in past years.Information related to the 20,000 jackets produced annually is shown in the following table:

Lemon Yellow's total expected overhead costs and related overhead data are shown below.The company uses departmental overhead rates based on direct labor hours in the Cutting Department and machine hours in the Sewing Department.

Lemon Yellow's total expected overhead costs and related overhead data are shown below.The company uses departmental overhead rates based on direct labor hours in the Cutting Department and machine hours in the Sewing Department.

Assume this jacket currently sells for $10.How much profit does the company make per jacket?

Assume this jacket currently sells for $10.How much profit does the company make per jacket?

(Essay)

4.8/5  (38)

(38)

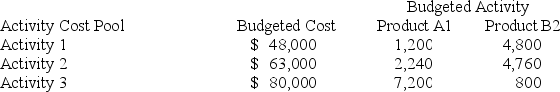

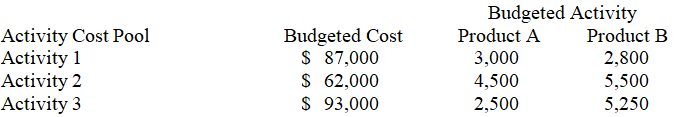

A company has two products: A1 and B2.It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools:  Annual production and sales level of Product A1 is 8,480 units,and the annual production and sales level of Product B2 is 22,310 units.

-What is the approximate overhead cost per unit of Product B2 under activity-based costing?

Annual production and sales level of Product A1 is 8,480 units,and the annual production and sales level of Product B2 is 22,310 units.

-What is the approximate overhead cost per unit of Product B2 under activity-based costing?

(Multiple Choice)

4.8/5  (39)

(39)

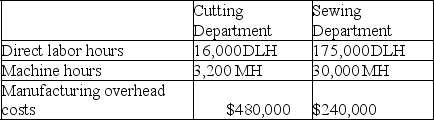

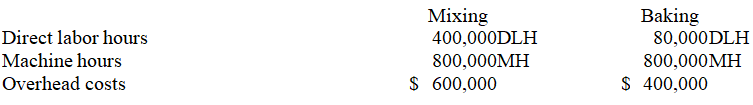

Aztec Industries produces bread which goes through two operations, mixing and baking, before it is ready to be packaged. Next year's expected costs and activities are shown below.

-Compute Aztec's departmental overhead rate for the baking department based on machine hours.

-Compute Aztec's departmental overhead rate for the baking department based on machine hours.

(Multiple Choice)

4.8/5  (28)

(28)

The ________ stage of ABC is to compute an activity rate for each cost pool and then use this rate to allocate overhead costs to products.

(Short Answer)

4.8/5  (32)

(32)

A company has two products: A and B.It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools:  Annual production and sales level of Product A is 34,300 units,and the annual production and sales level of Product B is 69,550 units.

-What is the approximate overhead cost per unit of Product B under activity-based costing?

Annual production and sales level of Product A is 34,300 units,and the annual production and sales level of Product B is 69,550 units.

-What is the approximate overhead cost per unit of Product B under activity-based costing?

(Multiple Choice)

5.0/5  (31)

(31)

Showing 141 - 160 of 223

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)