Exam 17: Activity-Based Costing and Analysis

Exam 1: Accounting in Business285 Questions

Exam 2: Accounting for Business Transactions251 Questions

Exam 3: Adjusting Accounts for Financial Statements403 Questions

Exam 4: Accounting for Merchandising Operations252 Questions

Exam 5: Inventories and Cost of Sales238 Questions

Exam 6: Cash,fraud,and Internal Controls228 Questions

Exam 7: Accounting for Receivables219 Questions

Exam 8: Accounting for Long-Term Assets258 Questions

Exam 9: Accounting for Current Liabilities219 Questions

Exam 10: Accounting for Long-Term Liabilities231 Questions

Exam 11: Corporate Reporting and Analysis247 Questions

Exam 12: Reporting Cash Flows247 Questions

Exam 13: Analysis of Financial Statements245 Questions

Exam 14: Managerial Accounting Concepts and Principles252 Questions

Exam 15: Job Order Costing and Analysis215 Questions

Exam 16: Process Costing and Analysis225 Questions

Exam 17: Activity-Based Costing and Analysis223 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis247 Questions

Exam 19: Variable Costing and Analysis202 Questions

Exam 20: Master Budgets and Performance Planning224 Questions

Exam 21: Flexible Budgets and Standard Costs223 Questions

Exam 22: Performance Measurement and Responsibility Accounting210 Questions

Exam 23: Relevant Costing for Managerial Decisions149 Questions

Exam 24: Capital Budgeting and Investment Analysis161 Questions

Exam 25: Time Value of Money84 Questions

Exam 26: Investments217 Questions

Exam 27: Lean Principles and Accounting30 Questions

Select questions type

A cost pool is a collection of costs that are related to the same or similar activity.

(True/False)

4.9/5  (39)

(39)

ABC is significantly less costly to implement and maintain than more traditional overhead costing systems.

(True/False)

4.9/5  (43)

(43)

West Company estimates that overhead costs for the next year will be $5,240,000 for indirect labor and $550,000 for factory utilities.The company uses machine hours as its overhead allocation base.If 150,000 machine hours are planned for this next year,what is the company's plantwide overhead rate?

(Multiple Choice)

4.9/5  (40)

(40)

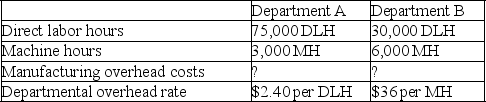

A company's total expected overhead costs and related overhead data are shown below.

a.Compute estimated manufacturing overhead costs for Department A.

b.Compute estimated manufacturing overhead costs for Department B.

a.Compute estimated manufacturing overhead costs for Department A.

b.Compute estimated manufacturing overhead costs for Department B.

(Essay)

4.9/5  (33)

(33)

A company estimates that overhead costs for the next year will be $3,600,000 for indirect labor,$200,000 for factory utilities,and $21,500 for depreciation on factory machinery.The company uses machine hours as its overhead allocation base.If 764,300 machine hours are planned for this next year,what is the company's plantwide overhead rate?

(Essay)

4.9/5  (37)

(37)

The use of a plantwide overhead rate is not acceptable for external reporting under GAAP.

(True/False)

4.8/5  (49)

(49)

How much overhead cost will be assigned to the ice cream sandwich product line using activity-based costing (ABC)?

(Multiple Choice)

4.9/5  (33)

(33)

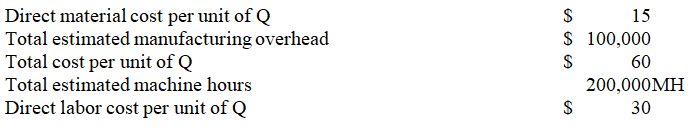

Gray Company uses a plantwide overhead rate with machine hours as the allocation base.Use the following information to solve for the amount of machine hours estimated per unit of product Q.

(Multiple Choice)

4.9/5  (38)

(38)

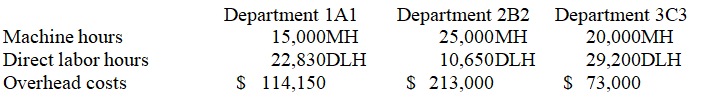

A company produces surgical equipment that goes through three departments,1A1,2B2,and 3C3,before they are complete.Expected costs and activities for the three departments are shown below.All departments have departmental overhead rates based on direct labor hours.Therefore,the overhead rate for each department is $5 per direct labor hour.

(True/False)

4.8/5  (32)

(32)

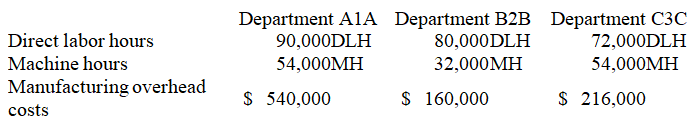

Aurora Corporation produces outdoor security lighting products.All products go through three processes before completion.Use the expected overhead costs and related data shown below to compute departmental overhead rates based on machine hours in Department A1A; based on direct labor hours in Department B2B; and machine hours in Department C3C.

(Multiple Choice)

4.9/5  (30)

(30)

The departmental overhead rate method allows each department to have its own overhead rate and its own allocation base.

(True/False)

5.0/5  (30)

(30)

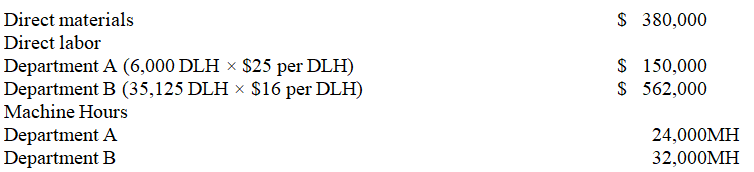

Wall Nuts, Inc. produces paneling that requires two processes, A and B, to complete. Oak is the best-selling of all the many types of paneling produced. Information related to the 40,000 units of oak paneling produced annually is shown in the following table:

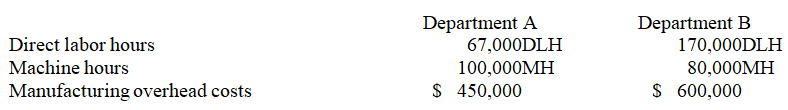

Wall Nuts' total expected overhead costs and related overhead data are shown below.

Wall Nuts' total expected overhead costs and related overhead data are shown below.

-Use the above data for Wall Nuts,Inc.to compute the total manufacturing cost per unit of oak paneling assuming the company uses departmental overhead rates based on machine hours in Department A and machine hours in Department B.

-Use the above data for Wall Nuts,Inc.to compute the total manufacturing cost per unit of oak paneling assuming the company uses departmental overhead rates based on machine hours in Department A and machine hours in Department B.

(Multiple Choice)

4.9/5  (39)

(39)

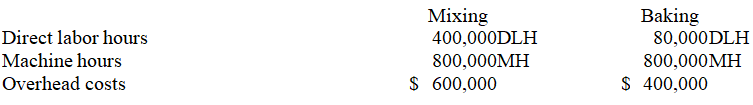

Aztec Industries produces bread which goes through two operations, mixing and baking, before it is ready to be packaged. Next year's expected costs and activities are shown below.

-Compute Aztec's departmental overhead rate for the mixing department based on direct labor hours.

-Compute Aztec's departmental overhead rate for the mixing department based on direct labor hours.

(Multiple Choice)

4.8/5  (42)

(42)

How much overhead cost will be assigned to each product line using activity-based costing (ABC)?

(Multiple Choice)

4.9/5  (30)

(30)

The plantwide overhead rate is total plantwide allocation base divided by total budgeted plantwide overhead cost.

(True/False)

4.9/5  (30)

(30)

Why is overhead allocation under ABC usually more accurate than either the plantwide overhead allocation method or the departmental overhead allocation method?

(Essay)

4.8/5  (36)

(36)

If the direct labor time estimates are met,Malone will allocate $12.59 of overhead cost to each unit of Little X.

(True/False)

4.7/5  (36)

(36)

Showing 161 - 180 of 223

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)