Exam 19: Deferred Compensation

Exam 1: An Introduction to Taxation and Understanding Federal Tax Law194 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General155 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses124 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses178 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Alternative Minimum Tax134 Questions

Exam 13: Tax Credits and Payment Procedures120 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations148 Questions

Exam 15: Property Transactions: Nontaxable Exchanges138 Questions

Exam 16: Property Transactions: Capital Gains and Losses78 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods110 Questions

Exam 19: Deferred Compensation101 Questions

Exam 20: Corporations and Partnerships198 Questions

Select questions type

After 2011, income averaging is allowed for Federal income tax purposes.

(True/False)

4.8/5  (36)

(36)

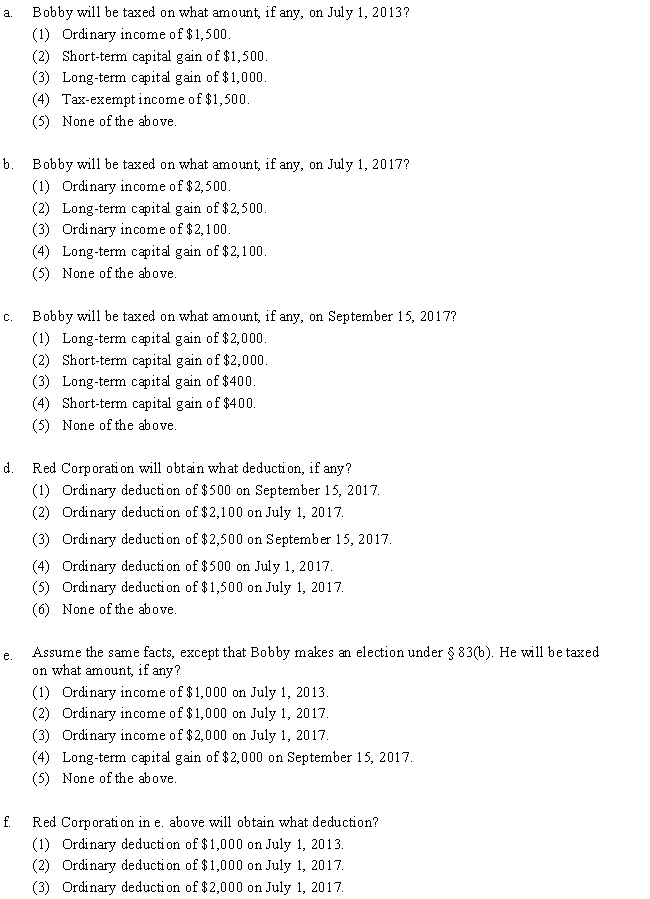

On July 1, 2013, Red Corporation sold 100 of its common shares (worth $15 per share) to its employee Bobby for $5 per share. The sale was subject to Bobby's agreement to resell the shares to the corporation for $5 per share if his employment is terminated within the following four years. The shares were valued at $26 per share on July 1, 2017. He sold the shares for $30 per share on September 15, 2017. No special election under § 83(b) was made. Identify the correct answer.

(Essay)

4.9/5  (38)

(38)

Chee is a key employee of an H.R 10 (Keogh) defined contribution plan (a profit sharing plan) created by a partnership. Answer each of the following independent questions.

a.During 2017, $7,400 is contributed to the H.R. 10 plan for Chee. What amount is deductible if Chee's earned income is $45,000 (after the deduction for one-half of self employment tax)?

b.In 2017, $8,020 is contributed to the H.R. 10 (Keogh) plan on Chee's behalf. If Chee's earned income is $36,000 (after the deduction for one-half of self employment tax), what deduction, if any is allowed?

c.The partnership had a bad year in 2017, and only $820 was contributed to the H.R. 10 plan on Chee's behalf. Chee earned only $700 during 2017. Calculate Chee's allowable deduction.

(Essay)

4.8/5  (45)

(45)

A participant, who is age 38, in a cash or deferred arrangement plan [§ 401(k)] may contribute up to what amount in 2017?

(Multiple Choice)

4.7/5  (43)

(43)

The special § 83(b) election (i.e., where income is taxed in the year of the grant) with respect to a restricted stock plan may be advantageous in which of the following situations in 2017?

(Multiple Choice)

4.8/5  (43)

(43)

The minimum annual distributions must be made over the life of the participant or the life of the participant and a designated individual beneficiary.

(True/False)

4.9/5  (45)

(45)

If a married taxpayer is an active participant in another qualified retirement plan, the traditional IRA deduction phaseout begins at $99,000 of AGI for a joint return in 2017.

(True/False)

4.8/5  (44)

(44)

Pony, Inc., issues restricted stock to employees in July 2017, with a two-year vesting period and an SRF. An employee must remain a full-time employee of Pony for two years after the restricted stock is issued. The stock is trading at $10 per share when the stock is issued. An employee, Sam, decides to make the § 83(b) election with his 1,000 shares. At the end of 2017, the stock is selling for $13 per share. What amount, if any, can Pony take as a compensation deduction?

(Multiple Choice)

4.9/5  (35)

(35)

A defined contribution plan is exempt from funding requirements.

(True/False)

4.9/5  (34)

(34)

Zackie has five years of service completed as of February 5, 2017, which is his employment anniversary date. If his defined benefit plan [not a § 401(m) arrangement] uses the graded vesting rule, determine Zackie's nonforfeitable percentage.

(Multiple Choice)

5.0/5  (33)

(33)

A cash balance plan is a hybrid form of pension plan that is similar in many aspects to a defined contribution plan.

(True/False)

4.9/5  (51)

(51)

Brown, Inc., uses the three-to-seven year graded vesting approach for its defined benefit retirement plan. Peter has five years of service completed as of February 5, 2017, his employment anniversary date. Determine Peter's nonforfeitable percentage.

(Multiple Choice)

4.8/5  (41)

(41)

Joyce, age 40, and Sam, age 42, who have been married for seven years, are both active participants in qualified retirement plans. Their total AGI for 2017 is $120,000. Each is employed and earns a salary of $65,000. What are their combined deductible contributions to traditional IRAs?

(Multiple Choice)

4.8/5  (33)

(33)

Forfeitures may be allocated to the accounts of the remaining participants in defined contribution plans.

(True/False)

4.8/5  (40)

(40)

In order to postpone income tax obligations as long as possible, retirement assets should be taken from which assets (or accounts) first?

(Multiple Choice)

5.0/5  (38)

(38)

Scott, age 68, has accumulated $850,000 in a defined contribution plan, $100,000 of which represents his own after-tax contributions. If the full amount is distributed in 2017, his early distribution penalty is:

(Multiple Choice)

4.8/5  (41)

(41)

Qualified plans have higher startup and administrative costs than nonqualified plans.

(True/False)

4.8/5  (38)

(38)

Which would not be considered an advantage of a nonqualified stock option plan over an incentive stock option (ISO) plan?

(Multiple Choice)

4.8/5  (34)

(34)

In 2017, Jindal Corporation paid compensation of $42,300 to the participants in a profit sharing plan and then contributed $12,800 to the plan. Jindal's deductible amount and any contribution carryover are as follows:

(Multiple Choice)

4.8/5  (38)

(38)

Showing 41 - 60 of 101

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)