Exam 12: Alternative Minimum Tax

Exam 1: An Introduction to Taxation and Understanding Federal Tax Law194 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General155 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses124 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses178 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Alternative Minimum Tax134 Questions

Exam 13: Tax Credits and Payment Procedures120 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations148 Questions

Exam 15: Property Transactions: Nontaxable Exchanges138 Questions

Exam 16: Property Transactions: Capital Gains and Losses78 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods110 Questions

Exam 19: Deferred Compensation101 Questions

Exam 20: Corporations and Partnerships198 Questions

Select questions type

Which of the following would not cause an individual taxpayer's AMTI to increase in the current year?

(Multiple Choice)

4.8/5  (35)

(35)

The AMT exemption for a C corporation is $50,000, reduced by 50% of the amount by which AMTI exceeds $150,000.

(True/False)

4.9/5  (34)

(34)

How can the positive AMT adjustment for research and experimental expenditures be avoided?

(Essay)

4.8/5  (42)

(42)

In the current tax year David, a 32-year-old single taxpayer, reported itemized deductions of $24,500, comprised of the following amounts.

$6,000 of medical expenses (in excess of 10% of AGI)

4,500 of property taxes on his home

2,500 of investment expenses (not limited by investment income)

3,000 of charitable contributions

8,500 of home mortgage interest

Which of David's itemized deductions could create an AMT preference?

(Multiple Choice)

4.8/5  (35)

(35)

Tad and Audria, who are married filing a joint return, have AMTI of $256,000 for 2017. Calculate their AMT exemption.

(Essay)

4.8/5  (38)

(38)

Frederick sells equipment whose adjusted basis for regular income tax purposes is $345,000 and for AMT purposes is $380,000. The sales proceeds are $850,000. Determine the effect on:

a.Taxable income.

b.AMTI.

(Essay)

4.8/5  (33)

(33)

If the taxpayer elects to capitalize and to amortize intangible drilling costs over a 3-year period for regular income tax purposes, there is no adjustment or preference for AMT purposes.

(True/False)

4.8/5  (43)

(43)

In 2017, Brenda has calculated her regular tax liability to be $32,500 and her tentative minimum tax (TMT) to be $36,300. Additionally, Brenda holds an alternative minimum tax credit of $6,200 from 2013.

What is Brenda's total 2017 Federal income tax liability?

(Multiple Choice)

4.9/5  (44)

(44)

In 2017, Blake incurs $270,000 of mining exploration expenditures, and deducts the entire amount for regular income tax purposes. Which of the following statements is correct?

(Multiple Choice)

4.8/5  (35)

(35)

Use the following selected data to calculate Devon's taxable income prior to any personal exemption taken. Devon itemizes deductions.

(Essay)

4.8/5  (34)

(34)

The phaseout of the AMT exemption amount for a taxpayer filing as a head of household both begins and ends at a higher income level than it does for a single taxpayer.

(True/False)

4.8/5  (45)

(45)

In the current tax year, Ben exercised an incentive stock option (ISO), acquiring stock with a fair market value of $190,000 for $170,000. As a result, his AMT basis for the stock is $170,000, his regular income tax basis for the stock is $170,000, and his AMT adjustment is $0 ($170,000 - $170,000).

(True/False)

4.8/5  (37)

(37)

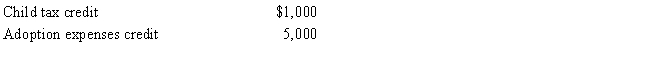

Prior to the effect of the tax credits, Justin's regular income tax liability is $200,000. and his tentative minimum tax is $195,000. Justin reports the following credits.

Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

(Multiple Choice)

4.7/5  (45)

(45)

All of a C corporation's AMT is available for carryover as a minimum tax credit, regardless of whether the adjustments and preferences originate from timing differences or AMT preferences.

(True/False)

4.9/5  (36)

(36)

Keosha acquires used 10-year personal property to use in her business in 2017 and uses MACRS depreciation for regular income tax purposes. As a result, Keosha will incur a positive AMT adjustment in 2017, because AMT depreciation is slower.

(True/False)

4.8/5  (36)

(36)

Beige, Inc., records AMTI of $200,000. Calculate the amount of the AMT exemption if:

a.Beige is a small corporation for AMT purposes.

b.Beige is not a small corporation for AMT purposes.

(Essay)

4.8/5  (42)

(42)

In 2017, Brenda has calculated her regular tax liability to be $32,500 and her tentative minimum tax (TMT) to be $36,300. Additionally, Brenda has an adoption expense credit (personal, nonrefundable credit) of $6,200.

What is Brenda's total 2017 Federal income tax liability?

(Multiple Choice)

4.8/5  (31)

(31)

Which of the following regular taxable income amounts does not potentially create an adjustment or preference in both the individual and the corporate AMT calculations?

(Multiple Choice)

4.9/5  (34)

(34)

Showing 61 - 80 of 134

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)