Exam 15: Cost Allocation: Joint Products and Byproducts

Exam 1: The Accountants Vital Role in Decision Making141 Questions

Exam 2: An Introduction to Cost Terms and Purposes165 Questions

Exam 3: Cost-Volume-Profit Analysis139 Questions

Exam 4: Job Costing138 Questions

Exam 5: Activity-Based Costing and Management133 Questions

Exam 6: Master Budget and Responsibility Accounting150 Questions

Exam 7: Flexible Budgets, Variances, and Management Control: I146 Questions

Exam 8: Flexible Budgets, Variances, and Management Control: II137 Questions

Exam 9: Income Effects of Denominator Level on Inventory Valuation154 Questions

Exam 10: Quantitative Analyses of Cost Functions114 Questions

Exam 11: Decision Making and Relevant Information146 Questions

Exam 12: Pricing Decisions, Product Profitability Decisions, and Cost Management135 Questions

Exam 13: Strategy, Balanced Scorecard, and Profitability Analysis140 Questions

Exam 14: Period Cost Allocation153 Questions

Exam 15: Cost Allocation: Joint Products and Byproducts149 Questions

Exam 16: Revenue and Customer Profitability Analysis137 Questions

Exam 17: Process Costing128 Questions

Exam 18: Spoilage, Rework, and Scrap121 Questions

Exam 19: Cost Management: Quality, Time, and the Theory of Constraints158 Questions

Exam 20: Inventory Cost Management Strategies136 Questions

Exam 21: Capital Budgeting: Methods of Investment Analysis128 Questions

Exam 22: Capital Budgeting: a Closer Look120 Questions

Exam 23: Transfer Pricing and Multinational Management Control Systems141 Questions

Exam 24: Multinational Performance Measurement and Compensation139 Questions

Select questions type

Use the information below to answer the following question(s).

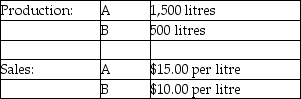

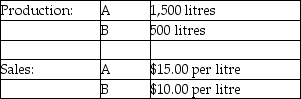

Beverage Drink Company processes direct materials up to the split off point, where two products, A and B, are obtained. The following information was collected for the month of July:

Direct materials processed: 2,500 litres (with 20 percent shrinkage)

Cost of purchasing 2,500 litres of direct materials and processing it up to the split off point to yield a total of 2,000 litres of good products was $4,500. There were no inventory balances of A and B.

Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150. Product Z5 is sold for $25.00 per litre. There was no beginning inventory and ending inventory was 125 litres.

Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275. Product W3 is sold for $30.00 per litre. There was no beginning inventory and ending inventory was 25 litres.

-What is Product Z5's estimated net realizable value?

Cost of purchasing 2,500 litres of direct materials and processing it up to the split off point to yield a total of 2,000 litres of good products was $4,500. There were no inventory balances of A and B.

Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150. Product Z5 is sold for $25.00 per litre. There was no beginning inventory and ending inventory was 125 litres.

Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275. Product W3 is sold for $30.00 per litre. There was no beginning inventory and ending inventory was 25 litres.

-What is Product Z5's estimated net realizable value?

(Multiple Choice)

4.8/5  (32)

(32)

Answer the following question(s) using the information below:

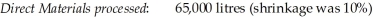

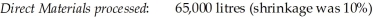

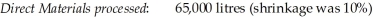

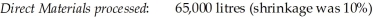

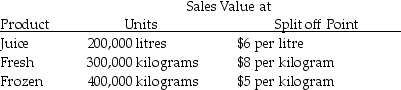

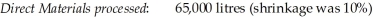

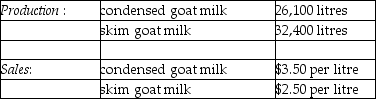

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre. Xyla can be sold for $18 per litre.

Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50. The product can be sold for $9 per litre.

There are no beginning and ending inventory balances.

-What is the reason that accountants do not like to carry inventory at net realizable value?

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre. Xyla can be sold for $18 per litre.

Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50. The product can be sold for $9 per litre.

There are no beginning and ending inventory balances.

-What is the reason that accountants do not like to carry inventory at net realizable value?

(Multiple Choice)

4.9/5  (35)

(35)

Use the information below to answer the following question(s).

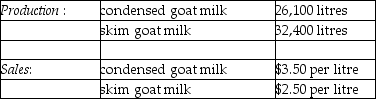

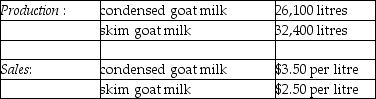

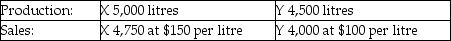

Chem Manufacturing Company processes direct materials up to the split off point, where two products (X and Y) are obtained and sold. The following information was collected for the month of November.

Direct materials processed:

10,000 litres (10,000 litres yield 9,500 litres of good product and 500 litres of shrinkage)

The cost of purchasing 10,000 litres of direct materials and processing it up to the split off point to yield a total of 9,500 litres of good products was $975,000.

The beginning inventories totalled 50 litres for X and 25 litres for Y. Ending inventory amounts reflected 300 litres of product X and 525 litres of product Y. October costs were per unit were the same as November.

-What is product X's approximate gross margin percentage using the physical volume method?

The cost of purchasing 10,000 litres of direct materials and processing it up to the split off point to yield a total of 9,500 litres of good products was $975,000.

The beginning inventories totalled 50 litres for X and 25 litres for Y. Ending inventory amounts reflected 300 litres of product X and 525 litres of product Y. October costs were per unit were the same as November.

-What is product X's approximate gross margin percentage using the physical volume method?

(Multiple Choice)

4.8/5  (37)

(37)

Answer the following question(s) using the information below:

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre. Xyla can be sold for $18 per litre.

Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50. The product can be sold for $9 per litre.

There are no beginning and ending inventory balances.

-Using the sales value at split off method, the percentage weightings for joint cost allocations for Jarlon and Kharton respectively are:

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre. Xyla can be sold for $18 per litre.

Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50. The product can be sold for $9 per litre.

There are no beginning and ending inventory balances.

-Using the sales value at split off method, the percentage weightings for joint cost allocations for Jarlon and Kharton respectively are:

(Multiple Choice)

4.8/5  (44)

(44)

Use the information below to answer the following question(s).

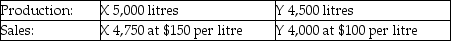

Troy Company processes 15,000 litres of direct materials to produce two products, Product X and Product Y. Product X, a byproduct, sells for $4 per litre, and Product Y, the main product, sells for $50 per litre. The following information is for August:

The manufacturing costs totalled $15,000.

-Which of the following entries is the initial entry to recognize a byproduct in the General ledger, based on the accounting method of recognizing byproducts at the time of production?

The manufacturing costs totalled $15,000.

-Which of the following entries is the initial entry to recognize a byproduct in the General ledger, based on the accounting method of recognizing byproducts at the time of production?

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following is False concerning manufacturing of joint products and joint costing?

(Multiple Choice)

4.9/5  (36)

(36)

The production method of accounting for byproducts recognizes byproducts in the financial statements at the time when production is completed.

(True/False)

4.8/5  (39)

(39)

Use the information below to answer the following question(s).

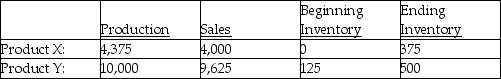

Raynor Manufacturing purchases trees from Tree Nursery and processes them up to the split off point, where two products (paper and pencil casings) are obtained. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of October.

Trees processed:

50 trees (yield is 30,000 sheets of paper and 30,000 pencil casings and no scrap)

Cost of purchasing 50 trees and processing them up to the split off point to yield 30,000 sheets of paper and 30,000 pencil casings is $1,500.

Raynor Manufacturing's accounting department reported no beginning inventories; however, ending inventory amounts reflected 1,000 sheets of paper in stock.

-What is the approximate cost assigned to the pencil casings if joint costs are allocated using the sales value at split off method?

Cost of purchasing 50 trees and processing them up to the split off point to yield 30,000 sheets of paper and 30,000 pencil casings is $1,500.

Raynor Manufacturing's accounting department reported no beginning inventories; however, ending inventory amounts reflected 1,000 sheets of paper in stock.

-What is the approximate cost assigned to the pencil casings if joint costs are allocated using the sales value at split off method?

(Multiple Choice)

4.9/5  (35)

(35)

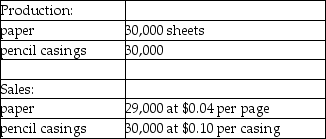

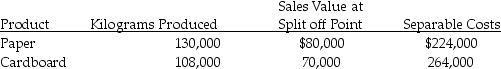

Green Paper Company processes wood pulp into two products. During January the joint costs of processing were $144,000. Production and sales value information for the month were as follows:

Paper sells for $2.75 a kilogram and cardboard sells for $3.50 a kilogram.

There were no beginning inventories for April but ending inventories totalled 10,000 kilograms for paper and 12,000 kilograms for cardboard.

Required:

Prepare a product line income statement assuming that joint costs are allocated on the constant gross margin percentage method.

Paper sells for $2.75 a kilogram and cardboard sells for $3.50 a kilogram.

There were no beginning inventories for April but ending inventories totalled 10,000 kilograms for paper and 12,000 kilograms for cardboard.

Required:

Prepare a product line income statement assuming that joint costs are allocated on the constant gross margin percentage method.

(Essay)

4.8/5  (37)

(37)

The costs of production that yield multiple products simultaneously are known as joint costs.

(True/False)

5.0/5  (39)

(39)

It is easier to cost inventory if the joint products are sold before the split off point without further processing.

(True/False)

5.0/5  (37)

(37)

Assigning joint costs when only a portion of a business's products are sold to a single customer is an example of which of the following?

(Multiple Choice)

4.8/5  (41)

(41)

Use the information below to answer the following question(s).

Chem Manufacturing Company processes direct materials up to the split off point, where two products (X and Y) are obtained and sold. The following information was collected for the month of November.

Direct materials processed:

10,000 litres (10,000 litres yield 9,500 litres of good product and 500 litres of shrinkage)

The cost of purchasing 10,000 litres of direct materials and processing it up to the split off point to yield a total of 9,500 litres of good products was $975,000.

The beginning inventories totalled 50 litres for X and 25 litres for Y. Ending inventory amounts reflected 300 litres of product X and 525 litres of product Y. October costs were per unit were the same as November.

-What is product Y's approximate joint production cost if the sales value at split off point method is used?

The cost of purchasing 10,000 litres of direct materials and processing it up to the split off point to yield a total of 9,500 litres of good products was $975,000.

The beginning inventories totalled 50 litres for X and 25 litres for Y. Ending inventory amounts reflected 300 litres of product X and 525 litres of product Y. October costs were per unit were the same as November.

-What is product Y's approximate joint production cost if the sales value at split off point method is used?

(Multiple Choice)

5.0/5  (46)

(46)

Answer the following question(s) using the information below:

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre. Xyla can be sold for $18 per litre.

Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50. The product can be sold for $9 per litre.

There are no beginning and ending inventory balances.

-When a product is the result of a joint process, the decision to process the product past the splitoff point further should be influenced by the

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre. Xyla can be sold for $18 per litre.

Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50. The product can be sold for $9 per litre.

There are no beginning and ending inventory balances.

-When a product is the result of a joint process, the decision to process the product past the splitoff point further should be influenced by the

(Multiple Choice)

4.9/5  (39)

(39)

Answer the following question(s) using the information below:

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre. Xyla can be sold for $18 per litre.

Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50. The product can be sold for $9 per litre.

There are no beginning and ending inventory balances.

-Using the sales value at split off method, the joint costs allocated to Jarlon would be:

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre. Xyla can be sold for $18 per litre.

Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50. The product can be sold for $9 per litre.

There are no beginning and ending inventory balances.

-Using the sales value at split off method, the joint costs allocated to Jarlon would be:

(Multiple Choice)

4.8/5  (39)

(39)

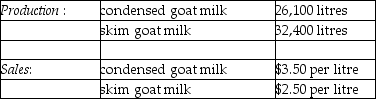

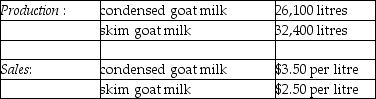

Peachland Fruit Ltd. harvests blueberries. After harvest, the company sells some berries fresh, freezes others and processes some into juice. During the summer the joint costs of processing the berry products were $620,000. Any separable costs for each product are negligible and are not traced. There was no beginning or ending inventories for the summer. Production and sales value information for the summer were as follows:

Required:

Determine the amount allocated to each product if the sales value at split off method is used and compute the cost per case for each product.

Required:

Determine the amount allocated to each product if the sales value at split off method is used and compute the cost per case for each product.

(Essay)

4.9/5  (31)

(31)

Answer the following question(s) using the information below:

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre. Xyla can be sold for $18 per litre.

Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50. The product can be sold for $9 per litre.

There are no beginning and ending inventory balances.

-How much (if any) extra income would Morton earn if it produced and sold all of the Xyla from the condensed goat milk? Allocate joint processing costs based upon relative sales value on the splitoff. (Extra income means income in excess of what Morton would have earned from selling condensed goat milk.)

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre. Xyla can be sold for $18 per litre.

Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50. The product can be sold for $9 per litre.

There are no beginning and ending inventory balances.

-How much (if any) extra income would Morton earn if it produced and sold all of the Xyla from the condensed goat milk? Allocate joint processing costs based upon relative sales value on the splitoff. (Extra income means income in excess of what Morton would have earned from selling condensed goat milk.)

(Multiple Choice)

4.9/5  (34)

(34)

Net realizable value generally means expected sales value plus expected separable costs.

(True/False)

4.8/5  (35)

(35)

Use the information below to answer the following question(s).

Beverage Drink Company processes direct materials up to the split off point, where two products, A and B, are obtained. The following information was collected for the month of July:

Direct materials processed: 2,500 litres (with 20 percent shrinkage)

Cost of purchasing 2,500 litres of direct materials and processing it up to the split off point to yield a total of 2,000 litres of good products was $4,500. There were no inventory balances of A and B.

Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150. Product Z5 is sold for $25.00 per litre. There was no beginning inventory and ending inventory was 125 litres.

Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275. Product W3 is sold for $30.00 per litre. There was no beginning inventory and ending inventory was 25 litres.

-What are the expected final sales values of production if Product Z5 and Product W3 are produced?

Cost of purchasing 2,500 litres of direct materials and processing it up to the split off point to yield a total of 2,000 litres of good products was $4,500. There were no inventory balances of A and B.

Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150. Product Z5 is sold for $25.00 per litre. There was no beginning inventory and ending inventory was 125 litres.

Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275. Product W3 is sold for $30.00 per litre. There was no beginning inventory and ending inventory was 25 litres.

-What are the expected final sales values of production if Product Z5 and Product W3 are produced?

(Multiple Choice)

4.7/5  (34)

(34)

If managers make processing or selling decisions using incremental revenue / incremental cost approach, which of the following statements is true?

(Multiple Choice)

4.9/5  (35)

(35)

Showing 21 - 40 of 149

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)