Exam 4: Consolidated Techniques and Procedures

Exam 1: Business Combinations36 Questions

Exam 2: Stock Investments - Investor Accounting and Reporting41 Questions

Exam 3: An Introduction to Consolidated Financial Statements39 Questions

Exam 4: Consolidated Techniques and Procedures38 Questions

Exam 5: Intercompany Profit Transactions Inventories40 Questions

Exam 6: Intercompany Profit Transactions Plant Assets39 Questions

Exam 7: Intercompany Profit Transactions Bonds40 Questions

Exam 8: Consolidations - Changes in Ownership Interests37 Questions

Exam 9: Indirect and Mutual Holdings37 Questions

Exam 11: Consolidation Theories, Push-Down Accounting, and Corporate Joint Ventures41 Questions

Exam 12: Derivatives and Foreign Currency: Concepts and Common Transactions40 Questions

Exam 13: Accounting for Derivatives and Hedging Activities40 Questions

Exam 14: Foreign Currency Financial Statements39 Questions

Exam 15: Segment and Interim Financial Reporting40 Questions

Exam 16: Partnerships - Formation, Operations, and Changes in Ownership Interests40 Questions

Exam 17: Partnership Liquidation40 Questions

Exam 18: Corporate Liquidations and Reorganizations40 Questions

Exam 19: An Introduction to Accounting for State and Local Governmental Units38 Questions

Exam 20: Accounting for State and Local Governmental Units - Governmental Funds37 Questions

Exam 21: Accounting for State and Local Governmental Units - Proprietary and Fiduciary Funds39 Questions

Exam 22: Accounting for Not-For-Profit Organizations39 Questions

Exam 23: Estates and Trusts38 Questions

Select questions type

Which of the following will be debited to the Investment account when the equity method is used?

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following statements is not true with respect to the statement of cash flows for a consolidated entity?

(Multiple Choice)

4.8/5  (46)

(46)

Use the following information to answer question(s) below.

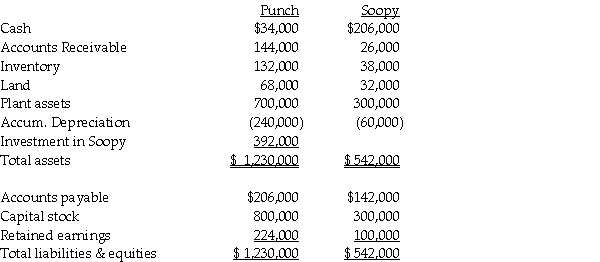

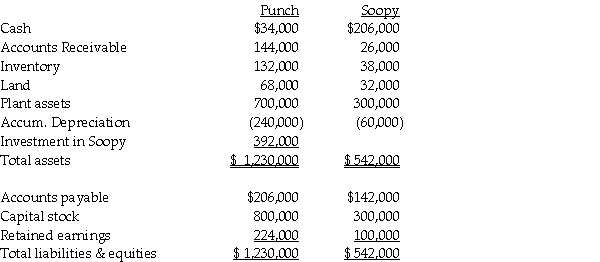

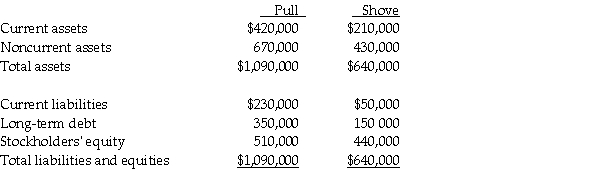

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date(after the acquisition) are given below:

At the date of the acquisition, the book values of Soopy's net assets were equal to the fair value except for Soopy's inventory, which had a fair value of $60,000.

Determine below what the consolidated balance would be for each of the requested accounts.

-What is the amount of total assets?

At the date of the acquisition, the book values of Soopy's net assets were equal to the fair value except for Soopy's inventory, which had a fair value of $60,000.

Determine below what the consolidated balance would be for each of the requested accounts.

-What is the amount of total assets?

(Multiple Choice)

5.0/5  (32)

(32)

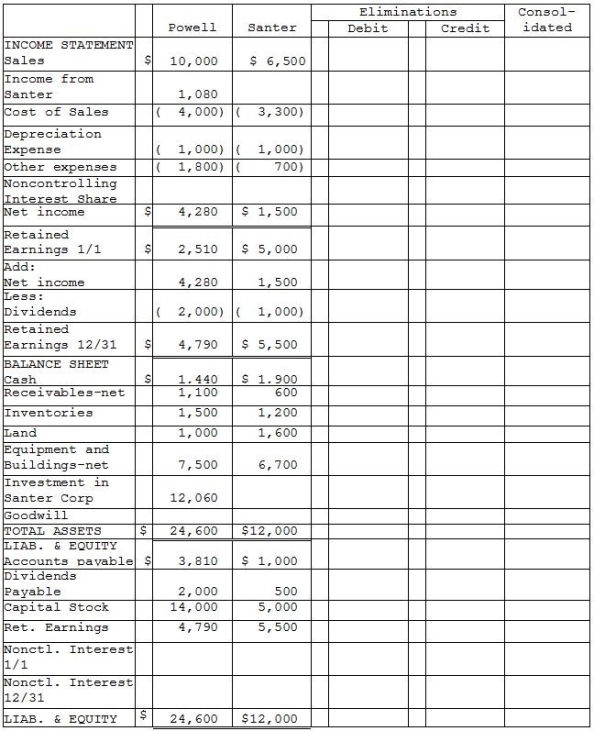

Powell Corporation acquired 90% of the voting stock of Santer Corporation on January 1, 2014 for $11,700 when Santer had Capital Stock of $5,000 and Retained Earnings of $4,000. The amounts reported on the financial statements approximated fair value, with the exception of inventories, which were understated on the books by $500 and were sold in 2014, land which was undervalued by $1,000, and equipment with a remaining useful life of 5 years under the straight-line method which was undervalued by $1,500. Any remainder was assigned to goodwill.

Financial statements for Powell and Santer Corporations at the end of the fiscal year ended December 31, 2015 appear in the first two columns of the partially completed consolidation working papers. Powell has accounted for its investment in Santer using the equity method of accounting. Powell Corporation owed Santer Corporation $100 on open account at the end of the year. Dividends receivable in the amount of $450 payable from Santer to Powell is included in Powell's net receivables.

Required:

Complete the consolidation working papers for Powell Corporation and Subsidiary for the year ended December 31, 2015.

(Essay)

4.8/5  (42)

(42)

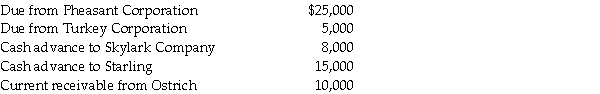

Bird Corporation has several subsidiaries that are included in its consolidated financial statements and several other investments in corporations that are not consolidated. In its year-end trial balance, the following intercompany balances appear. Ostrich Corporation is the unconsolidated company; the rest are consolidated.  What amount should Bird report as intercompany receivables on its consolidated balance sheet?

What amount should Bird report as intercompany receivables on its consolidated balance sheet?

(Multiple Choice)

4.8/5  (46)

(46)

Use the following information to answer question(s) below.

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date(after the acquisition) are given below:

At the date of the acquisition, the book values of Soopy's net assets were equal to the fair value except for Soopy's inventory, which had a fair value of $60,000.

Determine below what the consolidated balance would be for each of the requested accounts.

-What is the reported amount for the noncontrolling interest?

At the date of the acquisition, the book values of Soopy's net assets were equal to the fair value except for Soopy's inventory, which had a fair value of $60,000.

Determine below what the consolidated balance would be for each of the requested accounts.

-What is the reported amount for the noncontrolling interest?

(Multiple Choice)

4.9/5  (33)

(33)

Use the following information to answer question(s) below.

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date(after the acquisition) are given below:

At the date of the acquisition, the book values of Soopy's net assets were equal to the fair value except for Soopy's inventory, which had a fair value of $60,000.

Determine below what the consolidated balance would be for each of the requested accounts.

-What amount of Goodwill will be reported?

At the date of the acquisition, the book values of Soopy's net assets were equal to the fair value except for Soopy's inventory, which had a fair value of $60,000.

Determine below what the consolidated balance would be for each of the requested accounts.

-What amount of Goodwill will be reported?

(Multiple Choice)

4.8/5  (39)

(39)

On January 2, 2014, PBL Enterprises purchased 90% of Santos Incorporated outstanding common stock for $1,687,500 cash. Santos' net assets had a book value of $1,300,000 at the time. A building with a 15-year remaining life and a book value of $100,000 had a fair value of $175,000. Any other excess amount was attributed to goodwill. PBL reported net income for the first year of $350,000 (without regard for its ownership in Santos), while Santos had $175,000 in earnings.

Required:

1. Calculate the amount of goodwill related to this acquisition as reported on the consolidated balance sheet at January 2, 2014.

2. Calculate the amount of consolidated net income for the year ended December 31, 2014.

3. What is the amount that will be assigned to the building on the consolidated balance sheet at the date of acquisition?

(Essay)

4.8/5  (30)

(30)

Use the following information to answer question(s) below.

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date(after the acquisition) are given below:

At the date of the acquisition, the book values of Soopy's net assets were equal to the fair value except for Soopy's inventory, which had a fair value of $60,000.

Determine below what the consolidated balance would be for each of the requested accounts.

-What amount of total liabilities will be reported?

At the date of the acquisition, the book values of Soopy's net assets were equal to the fair value except for Soopy's inventory, which had a fair value of $60,000.

Determine below what the consolidated balance would be for each of the requested accounts.

-What amount of total liabilities will be reported?

(Multiple Choice)

4.9/5  (31)

(31)

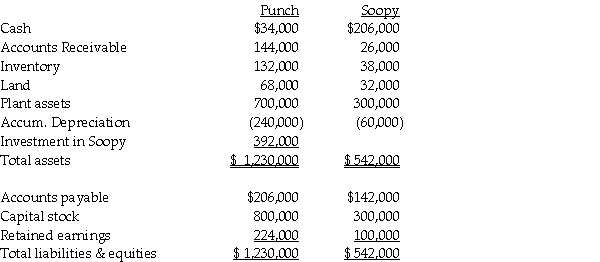

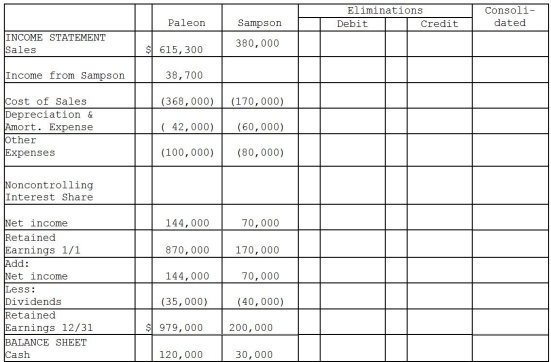

On January 2, 2014, Paleon Packaging purchased 90% of the outstanding common stock of Sampson Shipping and Supplies for $513,000. Sampson's book values represented the fair values of all recorded assets and liabilities at that date, however Sampson had rights to a patent that was not recorded on their books, with an approximate fair value of $270,000, and a 10-year remaining useful life. Sampson's shareholders' equity reported on that date consisted of $100,000 in capital stock and $150,000 in retained earnings. Any remaining fair value/book value differential is assumed to be goodwill. The December 31, 2015 financial statements for each of the companies are provided in the worksheet below.

Required: Complete the consolidation worksheet provided below to determine consolidated balances to be reported at December 31, 2015.

(Essay)

4.7/5  (36)

(36)

Which one of the following will increase consolidated retained earnings?

(Multiple Choice)

4.9/5  (37)

(37)

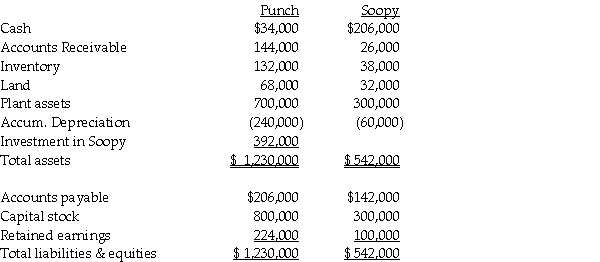

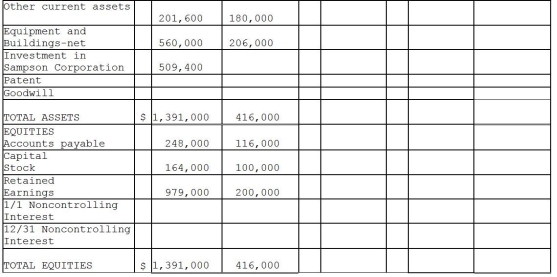

Pull Incorporated and Shove Company reported summarized balance sheets as shown below, on December 31, 2014.

On January 1, 2015, Pull purchased 70% of the outstanding capital stock of Shove for $392,000, of which $92,000 was paid in cash, and $300,000 was borrowed from their bank. The debt is to be repaid in 10 annual installments beginning on December 31, 2015, with each payment consisting of $30,000 principal, plus accrued interest.

The excess fair value of Shove Company over the underlying book value is allocated to inventory (60 percent) and to goodwill (40 percent).

Required: Calculate the balance in each of the following accounts, on the consolidated balance sheet, immediately following the acquisition.

a. Current assets

b. Noncurrent assets

c. Current liabilities

d. Long-term debt

e. Stockholders' equity

On January 1, 2015, Pull purchased 70% of the outstanding capital stock of Shove for $392,000, of which $92,000 was paid in cash, and $300,000 was borrowed from their bank. The debt is to be repaid in 10 annual installments beginning on December 31, 2015, with each payment consisting of $30,000 principal, plus accrued interest.

The excess fair value of Shove Company over the underlying book value is allocated to inventory (60 percent) and to goodwill (40 percent).

Required: Calculate the balance in each of the following accounts, on the consolidated balance sheet, immediately following the acquisition.

a. Current assets

b. Noncurrent assets

c. Current liabilities

d. Long-term debt

e. Stockholders' equity

(Essay)

4.8/5  (33)

(33)

When performing a consolidation, if the balance sheet does not balance,

(Multiple Choice)

4.7/5  (37)

(37)

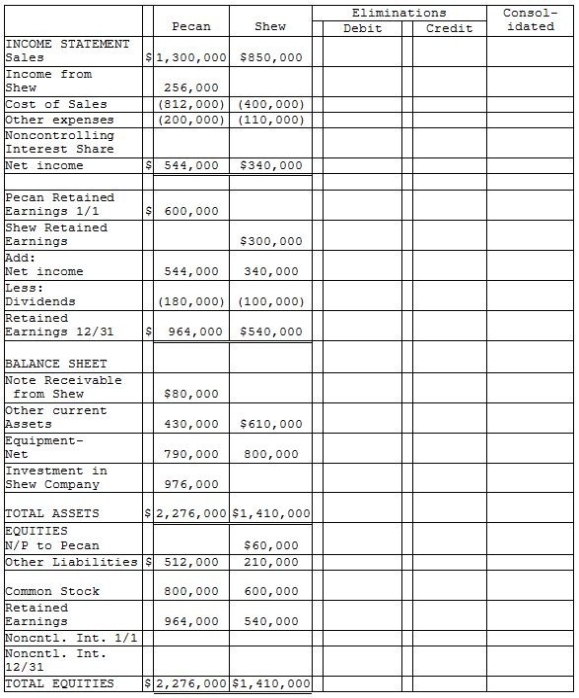

Pecan Incorporated acquired 80% of the voting stock of Shew Manufacturing for $800,000 on January 2, 2014 when Shew had outstanding common stock of $600,000 and Retained Earnings of $300,000. The book value and fair value of Shew's assets and liabilities were equal except for equipment. The entire fair value/book value differential is allocated to equipment and is fully depreciated on a straight-line basis over a 5-year period.

During 2014, Shew borrowed $80,000 on a short-term non-interest-bearing note from Pecan, and on December 31, 2014, Shew mailed a check for $20,000 to Pecan in partial payment of the note. Pecan deposited the check on January 4, 2015, and recorded the entry to reduce the note balance at that time.

Required:

Complete the consolidation working papers for the year ended December 31, 2014.

(Essay)

4.9/5  (37)

(37)

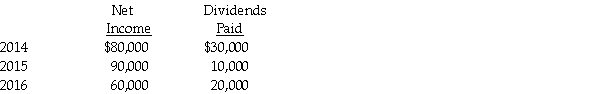

On January 1, 2014, Paisley Incorporated paid $300,000 for 60% of Smarnia Company's outstanding capital stock. Smarnia reported common stock on that date of $250,000 and retained earnings of $100,000. Plant assets, which had a five-year remaining life, were undervalued in Smarnia's financial records by $10,000. Smarnia also had a patent that was not on the books, but had a market value of $60,000. The patent has a remaining useful life of 10 years. Any remaining fair value/book value differential is allocated to goodwill. Smarnia's net income and dividends paid the first three years that Paisley owned them are shown below.

Requirement 1: Calculate the noncontrolling interest share in Smarnia's income for each of the three years.

Requirement 2: Calculate the noncontrolling interest that should be reported on the consolidated balance sheet at the end of each of the three years.

Requirement 3: Assuming that Paisley uses the equity method to record their investment in Smarnia, calculate the ending balance in the Investment in Smarnia account for each of the three years.

Requirement 1: Calculate the noncontrolling interest share in Smarnia's income for each of the three years.

Requirement 2: Calculate the noncontrolling interest that should be reported on the consolidated balance sheet at the end of each of the three years.

Requirement 3: Assuming that Paisley uses the equity method to record their investment in Smarnia, calculate the ending balance in the Investment in Smarnia account for each of the three years.

(Essay)

4.8/5  (35)

(35)

On consolidated working papers, a subsidiary's net income is

(Multiple Choice)

4.8/5  (26)

(26)

In contrast with single entity organizations, consolidated financial statements include which of the following in the calculation of cash flows from operating activities under the indirect method?

(Multiple Choice)

4.8/5  (37)

(37)

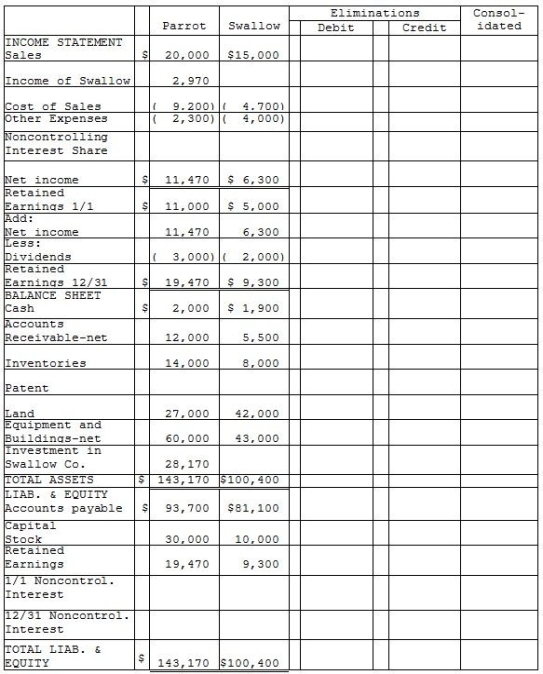

Parrot Corporation acquired 90% of Swallow Co. on January 1, 2014 for $27,000 cash when Swallow's stockholders' equity consisted of $10,000 of Capital Stock and $5,000 of Retained Earnings. The difference between the fair value and book value of Swallow's net assets was allocated solely to a patent amortized over 5 years. The separate company statements for Parrot and Swallow appear in the first two columns of the partially completed consolidation working papers.

Required:

Complete the consolidation working papers for Parrot and Swallow for the year 2014.

(Essay)

4.8/5  (34)

(34)

Showing 21 - 38 of 38

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)