Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law159 Questions

Exam 2: Working With the Tax Law85 Questions

Exam 3: Computing the Tax150 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General153 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses97 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion116 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses166 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses103 Questions

Exam 12: Tax Credits and Payments109 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 1200 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 292 Questions

Exam 14: Property Transactions: Capital Gains and Losses, 1231, Recapture Provisions144 Questions

Exam 15: Alternative Minimum Tax125 Questions

Exam 16: Accounting Periods and Methods87 Questions

Exam 17: Corporations: Introduction and Operating Rules109 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation145 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganizations70 Questions

Exam 21: Partnerships159 Questions

Exam 22: S: Corporations159 Questions

Exam 23: Exempt Entities151 Questions

Exam 24: Multistate Corporate Taxation145 Questions

Exam 25: Taxation of International Transactions148 Questions

Exam 26: Tax Practice and Ethics147 Questions

Exam 28: Income Taxation of Trusts and Estates145 Questions

Select questions type

A major disadvantage of a flat tax type of income tax is its complexity.

Free

(True/False)

4.7/5  (34)

(34)

Correct Answer:

False

Under Clint's will, all of his property passes to either the Lutheran Church or to his wife.No Federal estate tax will be due on Clint's death in 2012.

Free

(True/False)

4.9/5  (42)

(42)

Correct Answer:

True

A safe and easy way for a taxpayer to avoid local and state sales taxes is to have the purchase sent to an address in another state that levies no such taxes.

Free

(True/False)

4.8/5  (27)

(27)

Correct Answer:

False

If property tax rates are not changed, the amount of ad valorem taxes imposed on realty will remain the same.

(True/False)

4.9/5  (29)

(29)

Which, if any, of the following is a typical characteristic of an ad valorem tax on personalty?

(Multiple Choice)

4.8/5  (44)

(44)

The Federal estate and gift taxes are examples of progressive taxes.

(True/False)

4.9/5  (40)

(40)

A parent employs his twin daughters, age 18, in his sole proprietorship.The daughters are not subject to FICA coverage.

(True/False)

4.8/5  (33)

(33)

The ad valorem tax on personal use personalty is more often avoided by taxpayers than the ad valorem tax on business use personalty.

(True/False)

4.9/5  (31)

(31)

When Congress enacts a tax cut that is phased in over a period of years, revenue neutrality is achieved.

(True/False)

4.8/5  (40)

(40)

Compare civil fraud with criminal fraud with regard to the following:

(Essay)

4.8/5  (39)

(39)

The annual exclusion, currently $13,000, is available for gift but not estate tax purposes.

(True/False)

4.8/5  (34)

(34)

Your client, Connie, won $12,000 in a football office pool. She sees no reason to include it in her income for several reasons. First, the amount won will not be reported to the IRS. Second, as an average income employee, she is unlikely to be audited by the IRS. Third, she feels that she has probably lost this much in other past office pools. How do you respond?

(Essay)

4.9/5  (33)

(33)

A state income tax can be imposed on nonresident taxpayers who earn income within the state or on an itinerant basis.

(True/False)

4.8/5  (34)

(34)

The tax law contains various provisions that encourage home ownership.

(Essay)

4.9/5  (40)

(40)

Taxes levied by both states and the Federal government include:

(Multiple Choice)

4.7/5  (42)

(42)

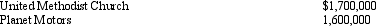

Due to the population change, the Goose Creek School District has decided to close one of its high schools.Since it has no further need of the property, the school is listed for sale.The two bids it receives are as follows:

The United Methodist Church would use the property to establish a sectarian middle school.Planet, a well-known car dealership, would revamp the property and operate it as a branch location.

If you were a member of the School District board, what factors would you consider in evaluating the two bids?

The United Methodist Church would use the property to establish a sectarian middle school.Planet, a well-known car dealership, would revamp the property and operate it as a branch location.

If you were a member of the School District board, what factors would you consider in evaluating the two bids?

(Essay)

4.9/5  (38)

(38)

Which, if any, of the following provisions cannot be justified as mitigating the effect of the annual accounting period concept?

(Multiple Choice)

4.7/5  (34)

(34)

Allowing a domestic production activities deduction for certain manufacturing income can be justified:

(Multiple Choice)

4.9/5  (36)

(36)

With regard to state income taxes, explain what is meant by the "jock tax"?

(Essay)

4.8/5  (40)

(40)

Showing 1 - 20 of 159

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)