Exam 9: Deductions: Employee and Self-Employed-Related Expenses

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law159 Questions

Exam 2: Working With the Tax Law85 Questions

Exam 3: Computing the Tax150 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General153 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses97 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion116 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses166 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses103 Questions

Exam 12: Tax Credits and Payments109 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 1200 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 292 Questions

Exam 14: Property Transactions: Capital Gains and Losses, 1231, Recapture Provisions144 Questions

Exam 15: Alternative Minimum Tax125 Questions

Exam 16: Accounting Periods and Methods87 Questions

Exam 17: Corporations: Introduction and Operating Rules109 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation145 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganizations70 Questions

Exam 21: Partnerships159 Questions

Exam 22: S: Corporations159 Questions

Exam 23: Exempt Entities151 Questions

Exam 24: Multistate Corporate Taxation145 Questions

Exam 25: Taxation of International Transactions148 Questions

Exam 26: Tax Practice and Ethics147 Questions

Exam 28: Income Taxation of Trusts and Estates145 Questions

Select questions type

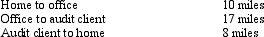

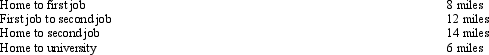

Bill is employed as an auditor by a CPA firm.On most days, he commutes by auto from his home to the office.During one month, however, he has an extensive audit assignment closer to home.For this engagement, Bill drives directly from home to the client's premises and back. Mileage information is summarized below:

If Bill spends 21 days on the audit, what is his deductible mileage?

If Bill spends 21 days on the audit, what is his deductible mileage?

Free

(Short Answer)

4.8/5  (39)

(39)

Correct Answer:

336 miles [16 miles (each day) ´ 21 days].

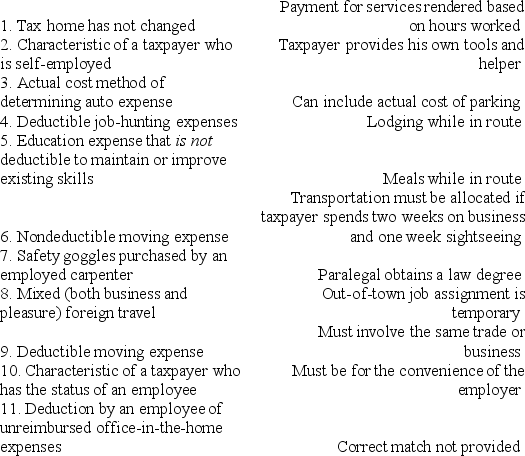

Match the statements that relate to each other.(Note: Choice L may be used more than once.)

Free

(Essay)

4.9/5  (37)

(37)

Correct Answer:

Tom owns and operates a lawn maintenance company. He does not concern himself with employment taxes because he considers all the persons who work for him to be independent contractors. He bases this assumption of the fact that several of his friends who operate similar businesses follow the same approach. Comment on Tom's situation.

Free

(Essay)

4.8/5  (41)

(41)

Correct Answer:

Tom is living dangerously. Although the similar treatment by others is helpful, under current criteria (see Footnote 64 in Chapter 9 of the text), other considerations come into play. For example, does Tom have any reasonable basis for not treating his workers as employees (i.e., judicial precedent, published ruling, technical advice, prior acceptance by the IRS on audit)? Probably most significant is whether Tom files a Form 1099-MISC for each worker. If not, his status looks bleak as he has acted inconsistently with the position he is taking.

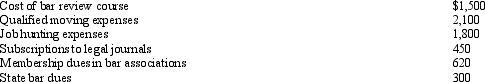

In the current year, Bo accepted employment with a Kansas City law firm after graduating from law school.Her expenses for the year are listed below:

Since Bo worked just part of the year, her salary was only $32,100.In terms of deductions from AGI, how much does Bo have?

Since Bo worked just part of the year, her salary was only $32,100.In terms of deductions from AGI, how much does Bo have?

(Essay)

4.8/5  (32)

(32)

Joyce, age 39, and Sam, age 40, who have been married for seven years, are both active participants in qualified retirement plans.Their total AGI for 2012 is $120,000.Each is employed and earns a salary of $65,000.What are their combined deductible contributions to traditional IRAs?

(Multiple Choice)

4.7/5  (36)

(36)

Dave is the regional manager for a national chain of auto-parts stores and is based in Salt Lake City.When the company opens new stores in Boise, Dave is given the task of supervising their initial operation.For three months, he works weekdays in Boise and returns home on weekends.He spends $410 returning to Salt Lake City but would have spent $350 had he stayed in Boise for the weekend.As to the weekend trips, how much, if any, qualifies as a deduction?

(Multiple Choice)

4.9/5  (43)

(43)

Which, if any, of the following expenses are not subject to the 2%-of-AGI floor?

(Multiple Choice)

4.8/5  (34)

(34)

Once set for a year, when might the IRS change the rate for the automatic mileage method?

(Essay)

5.0/5  (37)

(37)

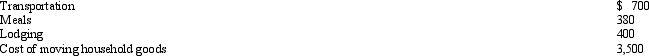

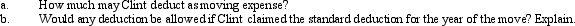

After graduating from college, Clint obtained employment in Omaha.In moving from his parents' home in Baltimore to Omaha, Clint incurred the following expenses:

(Essay)

4.9/5  (30)

(30)

During the year, Peggy went from Nashville to Quito (Ecuador) on business.She spent four days on business, two days on travel, and four days on vacation.Disregarding the vacation costs, Peggy's unreimbursed expenses are:  Peggy's deductible expenses are:

Peggy's deductible expenses are:

(Multiple Choice)

4.7/5  (36)

(36)

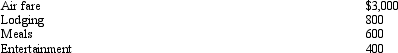

Taylor performs services for Jonathan on a regular basis.There exists considerable doubt as to whether Taylor is an employee or an independent contractor.

(Essay)

4.8/5  (38)

(38)

When is a taxpayer's work assignment in a new locale temporary? Permanent? What difference does it make?

(Essay)

4.8/5  (46)

(46)

If an individual is ineligible to make a deductible contribution to a traditional IRA, nondeductible contributions of any amount can be made to a traditional IRA.

(True/False)

4.9/5  (33)

(33)

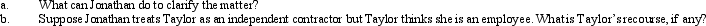

Ava holds two jobs and attends graduate school on weekends.The education improves her skills, but does not qualify her for a new trade of business.Before going to the second job, she returns home for dinner.Relevant mileage is as follows?

How much of the mileage qualifies for deduction purposes?

How much of the mileage qualifies for deduction purposes?

(Essay)

4.8/5  (31)

(31)

Regarding § 222 (qualified higher education deduction for tuition and related expenses), comment on the following:

(Essay)

4.7/5  (35)

(35)

For tax purposes, "travel" is a broader classification than "transportation."

(True/False)

4.8/5  (35)

(35)

Corey performs services for Sophie. Which, if any, of the following factors indicate that Corey is an independent contractor, rather than an employee?

(Multiple Choice)

4.9/5  (31)

(31)

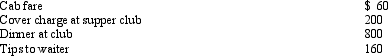

Henry entertains several of his key clients on January 1 of the current year.Expenses paid by Henry are as follows:  Presuming proper substantiation, Henry's deduction is:

Presuming proper substantiation, Henry's deduction is:

(Multiple Choice)

4.9/5  (38)

(38)

Contributions to a Roth IRA can be made up to the due date (excluding extensions) of the taxpayer's income tax return.

(True/False)

4.9/5  (42)

(42)

After graduating from college with a degree in chemistry, Alberto obtains a job as a chemist with DuPont.Alberto's job search expenses qualify as deductions.

(True/False)

4.9/5  (29)

(29)

Showing 1 - 20 of 166

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)