Exam 3: Computing the Tax

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law159 Questions

Exam 2: Working With the Tax Law85 Questions

Exam 3: Computing the Tax150 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General153 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses97 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion116 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses166 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses103 Questions

Exam 12: Tax Credits and Payments109 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 1200 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 292 Questions

Exam 14: Property Transactions: Capital Gains and Losses, 1231, Recapture Provisions144 Questions

Exam 15: Alternative Minimum Tax125 Questions

Exam 16: Accounting Periods and Methods87 Questions

Exam 17: Corporations: Introduction and Operating Rules109 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation145 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganizations70 Questions

Exam 21: Partnerships159 Questions

Exam 22: S: Corporations159 Questions

Exam 23: Exempt Entities151 Questions

Exam 24: Multistate Corporate Taxation145 Questions

Exam 25: Taxation of International Transactions148 Questions

Exam 26: Tax Practice and Ethics147 Questions

Exam 28: Income Taxation of Trusts and Estates145 Questions

Select questions type

During 2012, Marvin had the following transactions:  Marvin's AGI is:

Marvin's AGI is:

Free

(Multiple Choice)

4.8/5  (33)

(33)

Correct Answer:

C

Mr.Lee is a citizen and resident of Hong Kong, while Mr.Anderson is a citizen and resident of the U.S.In the taxation of income, Hong Kong uses a territorial approach, while the U.S.follows the global system.In terms of effect, explain what this means to Mr.Lee and Mr.Anderson.

Free

(Essay)

4.9/5  (32)

(32)

Correct Answer:

Mr.Lee is taxed only on the income he receives from Hong Kong, while Mr.Anderson is taxed on his global income.Under the U.S.approach, a citizen or resident is taxed on a worldwide basis.Since the U.S.system could lead to the same income being taxed twice, various relief provisions are necessitated (e.g., foreign tax credit).

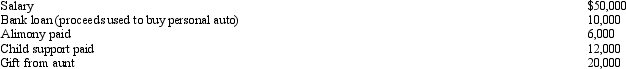

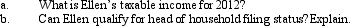

Ellen, age 39 and single, furnishes more than 50% of the support of her parents, who do not live with her.Ellen practices as a self-employed interior decorator and has gross income in 2012 of $120,000.Her deductions are as follows: $30,000 business and $8,100 itemized.

Free

(Essay)

4.8/5  (38)

(38)

Correct Answer:

Tom is single and for 2012 has AGI of $50,000. He is age 70 and has no dependents. For 2012, he has itemized deductions from AGI of $7,000.Determine Tom's taxable income for 2012.

(Essay)

4.8/5  (36)

(36)

In which, if any, of the following situations may the individual not be claimed as a dependent of the taxpayer?

(Multiple Choice)

4.9/5  (42)

(42)

Kyle, whose wife died in December 2009, filed a joint tax return for 2009.He did not remarry, but has continued to maintain his home in which his two dependent children live.What is Kyle's filing status as to 2012?

(Multiple Choice)

4.8/5  (41)

(41)

The major advantage of being classified as an abandoned spouse is that the taxpayer is treated for tax purposes as being single and not married.This means that an abandoned spouse can use the more favorable tax rates available to single persons than those available to married persons filing separately.Comment on the accuracy of this conclusion.

(Essay)

4.8/5  (31)

(31)

When the kiddie tax applies and the parents are divorced, the applicable parent (for determining the parental tax) is the one who has custody.

(True/False)

4.8/5  (40)

(40)

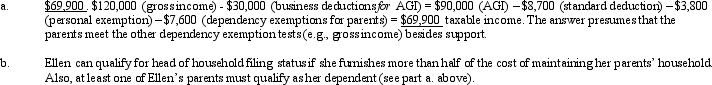

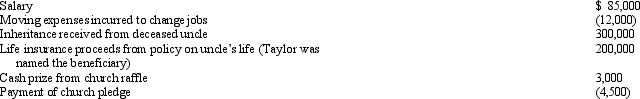

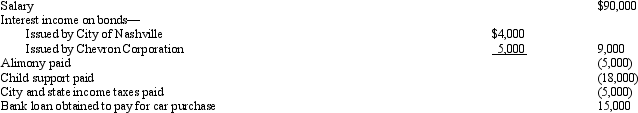

Taylor had the following transactions for 2012:

What is Taylor's AGI for 2012?

What is Taylor's AGI for 2012?

(Essay)

4.9/5  (41)

(41)

Howard, age 82, dies on January 2, 2012.On Howard's final income tax return, the full amount of the basic and additional standard deductions will be allowed even though Howard lived for only 2 days during the year.

(True/False)

4.8/5  (32)

(32)

In which, if any, of the following situations will the kiddie tax not apply?

(Multiple Choice)

4.9/5  (41)

(41)

For the qualifying relative category (for dependency exemption purposes):

(Multiple Choice)

4.8/5  (40)

(40)

Jason and Peg are married and file a joint return.Both are over 65 years of age and Jason is blind.Their standard deduction for 2012 is $15,350 ($11,900 + $1,150 + $1,150 + $1,150).

(True/False)

4.7/5  (41)

(41)

In terms of the tax formula applicable to individual taxpayers, which, if any, of the following statements is correct?

(Multiple Choice)

5.0/5  (34)

(34)

During the year, Kim sold the following assets: business auto for a $1,000 loss, stock investment for a $1,000 loss, and pleasure yacht for a $1,000 loss.Presuming adequate income, how much of these losses may Kim claim?

(Multiple Choice)

4.9/5  (43)

(43)

Keith, age 17 and single, earns $3,000 during 2012.Keith's parents cannot claim him as a dependent even if he does not live with them.

(True/False)

5.0/5  (45)

(45)

Ethan had the following transactions during 2012:

What is Ethan's AGI for 2012?

What is Ethan's AGI for 2012?

(Essay)

4.9/5  (43)

(43)

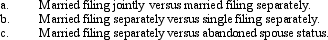

Contrast the tax consequences resulting from the following filing status situations:

(Essay)

4.7/5  (40)

(40)

Showing 1 - 20 of 150

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)