Exam 15: Alternative Minimum Tax

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law159 Questions

Exam 2: Working With the Tax Law85 Questions

Exam 3: Computing the Tax150 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General153 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses97 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion116 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses166 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses103 Questions

Exam 12: Tax Credits and Payments109 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 1200 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 292 Questions

Exam 14: Property Transactions: Capital Gains and Losses, 1231, Recapture Provisions144 Questions

Exam 15: Alternative Minimum Tax125 Questions

Exam 16: Accounting Periods and Methods87 Questions

Exam 17: Corporations: Introduction and Operating Rules109 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation145 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganizations70 Questions

Exam 21: Partnerships159 Questions

Exam 22: S: Corporations159 Questions

Exam 23: Exempt Entities151 Questions

Exam 24: Multistate Corporate Taxation145 Questions

Exam 25: Taxation of International Transactions148 Questions

Exam 26: Tax Practice and Ethics147 Questions

Exam 28: Income Taxation of Trusts and Estates145 Questions

Select questions type

For the ACE adjustment, discuss the relationship between ACE and unadjusted AMTI.

Free

(Essay)

4.8/5  (33)

(33)

Correct Answer:

A positive AMT adjustment occurs if the ACE amount exceeds unadjusted AMTI.A negative AMT adjustment occurs if unadjusted AMTI exceeds the ACE amount.A negative adjustment is limited to the aggregate of the positive adjustments under ACE for prior years, reduced by the previously claimed negative adjustments.

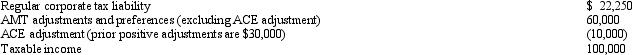

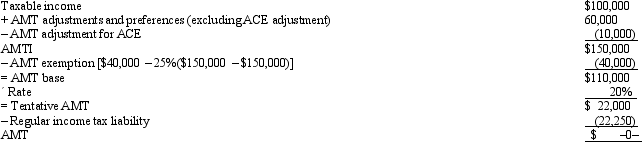

Smoke, Inc., provides you with the following information:

Calculate Smoke's AMT for 2012.

Calculate Smoke's AMT for 2012.

Free

(Essay)

4.7/5  (37)

(37)

Correct Answer:

Smoke's AMT is calculated as follows:

Which of the following itemized deductions definitely will be the same amount for the regular income tax and the AMT and thus result in no AMT adjustment in 2012?

Free

(Multiple Choice)

4.9/5  (45)

(45)

Correct Answer:

C

Tad is a vice-president of Ruby Corporation. In 2012, he acquired 800 shares of Ruby Corporation stock under the corporation's incentive stock option (ISO) plan for an option price of $33 per share. At the date of exercise in 2012, the fair market value of the stock was $43 per share. The stock became freely transferable in 2013. Tad sold the 800 shares for $50 per share in 2014. Which of the following statements is incorrect?

(Multiple Choice)

4.8/5  (40)

(40)

The AMT adjustment for mining exploration and development costs can be avoided if the taxpayer elects to write off the expenditures in the year incurred for regular income tax purposes, rather than writing off the expenditures over a 10-year period for regular income tax purposes.

(True/False)

4.8/5  (36)

(36)

In 2012, Sean incurs $90,000 of mining exploration expenditures, and deducts the entire amount for regular income tax purposes.Which of the following statements is correct?

(Multiple Choice)

4.9/5  (38)

(38)

Celia and Amos, who are married filing jointly, have one dependent and do not itemize deductions. They have taxable income of $82,000 and tax preferences of $53,000 in 2012. What is their AMT base for 2012?

(Multiple Choice)

4.9/5  (36)

(36)

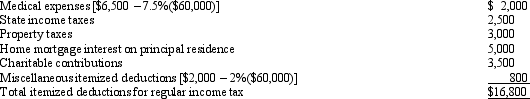

In calculating her taxable income, Rhonda deducts the following itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

(Essay)

4.8/5  (32)

(32)

In determining the amount of the AMT adjustments, discuss the difference in the treatment of a building placed in service after 1986 and before January 1, 1999 and a building placed in service after December 31, 1998.

(Essay)

4.8/5  (39)

(39)

Prior to the effect of tax credits, Eunice's regular income tax liability is $325,000 and her tentative AMT is $312,000.Eunice has general business credits available of $20,000.Calculate Eunice's tax liability after tax credits.

(Multiple Choice)

4.7/5  (30)

(30)

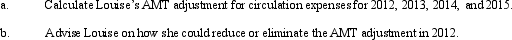

In 2012, Louise incurs circulation expenses of $330,000 which she deducts in calculating taxable income.

(Essay)

4.9/5  (40)

(40)

Is it possible that no AMT adjustment is necessary for medical expenses in calculating AMTI even though the floor limitation is different (7.5% of AGI for regular income tax compared to 10% for AMT purposes)?

(Essay)

4.7/5  (40)

(40)

Frederick sells land and building whose adjusted basis for regular income tax purposes is $345,000 and for AMT purposes is $380,000.The sales proceeds are $850,000.Determine the effect on:

(Essay)

4.9/5  (31)

(31)

Assuming no phaseout, the AMT exemption amount for a married taxpayer filing separately for 2012 is less than the AMT exemption amount for C corporations.

(True/False)

4.7/5  (36)

(36)

Negative AMT adjustments for the current year caused by timing differences are offset by the positive AMT adjustments for prior tax years also caused by timing differences.

(True/False)

4.9/5  (34)

(34)

Interest income on private activity bonds issued before 2009, reduced by expenses incurred in carrying the bonds, is a tax preference item that is included in computing AMTI.

(True/False)

4.7/5  (40)

(40)

The net capital gain included in an individual taxpayer's AMT base is eligible for the alternative tax rate on net capital gain. This favorable alternative rate applies both in calculating the regular income tax and the AMT.

(True/False)

4.7/5  (40)

(40)

The AMT adjustment for research and experimental expenditures can be avoided if the taxpayer capitalizes the expenditures and amortizes them over a 10-year period.

(True/False)

4.9/5  (35)

(35)

Ashlyn is subject to the AMT in 2012.She calculates her AMT base to be $200,000.What are the AMT rates that apply for Ashlyn?

(Essay)

4.8/5  (31)

(31)

Showing 1 - 20 of 125

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)