Exam 6: Deductions and Losses: in General

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law159 Questions

Exam 2: Working With the Tax Law85 Questions

Exam 3: Computing the Tax150 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General153 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses97 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion116 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses166 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses103 Questions

Exam 12: Tax Credits and Payments109 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 1200 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 292 Questions

Exam 14: Property Transactions: Capital Gains and Losses, 1231, Recapture Provisions144 Questions

Exam 15: Alternative Minimum Tax125 Questions

Exam 16: Accounting Periods and Methods87 Questions

Exam 17: Corporations: Introduction and Operating Rules109 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation145 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganizations70 Questions

Exam 21: Partnerships159 Questions

Exam 22: S: Corporations159 Questions

Exam 23: Exempt Entities151 Questions

Exam 24: Multistate Corporate Taxation145 Questions

Exam 25: Taxation of International Transactions148 Questions

Exam 26: Tax Practice and Ethics147 Questions

Exam 28: Income Taxation of Trusts and Estates145 Questions

Select questions type

If a vacation home is classified as primarily personal use, part of the maintenance and utility expenses can be allocated and deducted as a rental expense.

Free

(True/False)

4.8/5  (32)

(32)

Correct Answer:

False

A football team that pays a star player an annual salary of $20 million can deduct the entire $20 million as salary expense.If the same amount is paid to the CEO of IBM, only $1 million is deductible.

Free

(True/False)

4.9/5  (39)

(39)

Correct Answer:

True

Expenses incurred for the production or collection of income generally are deductions from adjusted gross income.

Free

(True/False)

4.9/5  (37)

(37)

Correct Answer:

True

During the year, Jim rented his vacation home for 200 days and lived in it for 19 days. During the remaining days, the vacation home was available for rental use. Is the vacation home subject to the limitation on the deductions of a personal/rental vacation home?

(Essay)

4.9/5  (46)

(46)

The ordinary and necessary expenses for operating an illegal gambling operation (excluding such items as fines, bribes, and other illegal payments) are deductible.

(True/False)

4.8/5  (33)

(33)

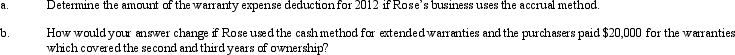

Rose's business sells air conditioners which have a one-year warranty.Based on historical data, the warranty costs amount to 14% of sales.During 2012, air conditioner sales are $300,000.Actual warranty expenses paid in 2012 are $37,000.

(Essay)

4.8/5  (36)

(36)

Depending on the nature of the expenditure, expenses incurred in a trade or business may be deductible for or from AGI.

(True/False)

4.8/5  (37)

(37)

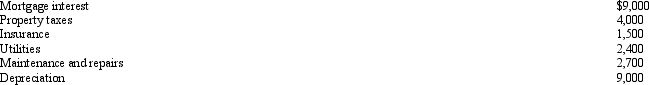

Emelie and Taylor are employed by the Federal government and own their home in Washington,

D.C.While vacationing in the summer for three weeks, they rent their home for two weeks to an Angolian diplomat for $3,000.During the third week, they permit Taylor's aunt and uncle to stay in the house with no rent being charged.Expenses associated with the home for the year are as follows:

Determine the effect of these income and expense items associated with their home if they file a joint return.

Determine the effect of these income and expense items associated with their home if they file a joint return.

(Essay)

4.7/5  (36)

(36)

Which of the following statements is correct in connection with the investigation of a business?

(Multiple Choice)

4.9/5  (39)

(39)

The income of a sole proprietorship are reported on Schedule C (Profit or Loss from Business).

(True/False)

4.9/5  (37)

(37)

On January 2, 2012, Fran acquires a business from Chuck.Among the assets purchased are the following intangibles: patent with a 7-year remaining life, a covenant not to compete for 10 years, and goodwill. Of the purchase price, $140,000 was paid for the patent and $60,000 for the covenant.The amount of the excess of the purchase price over the identifiable assets was $100,000.What is the amount of the amortization deduction for 2012?

(Multiple Choice)

4.9/5  (35)

(35)

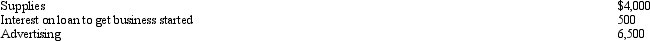

Priscella pursued a hobby of making bedspreads in her spare time.Her AGI before considering the hobby is $40,000.During the year she sold the bedspreads for $10,000.She incurred expenses as follows:  Assuming that the activity is deemed a hobby, how should she report these items on her tax return?

Assuming that the activity is deemed a hobby, how should she report these items on her tax return?

(Multiple Choice)

4.8/5  (36)

(36)

The only § 212 expenses that are deductions for AGI are those related to rent and royalty income.

(True/False)

4.8/5  (48)

(48)

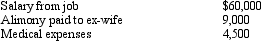

Larry, a calendar year cash basis taxpayer, has the following transactions:  Based on this information, Larry has:

Based on this information, Larry has:

(Multiple Choice)

4.9/5  (31)

(31)

Landscaping expenditures on new rental property are deductible in the year they are paid or incurred.

(True/False)

4.9/5  (42)

(42)

Alice incurs qualified moving expenses of $12,000.If she is reimbursed by her employer, the deduction is classified as a deduction for AGI.If not reimbursed, the deduction is classified as an itemized deduction.

(True/False)

4.9/5  (38)

(38)

Beige, Inc., an airline manufacturer, is conducting negotiations for the sale of military aircraft.One negotiation is with a U.S.assistant secretary of defense.She can close the deal on the purchase of 50 attack helicopters if she is paid $750,000 under the table.Another negotiation is with the minister of defense of a third world country.To complete the sale of 20 jet fighters to his government, he demands that he be paid a $1 million grease payment.Beige makes the payments and closes the deals.How much of these payments are deductible by Beige, Inc.?

(Essay)

4.9/5  (47)

(47)

Because Scott is three months delinquent on the mortgage payments for his personal residence, Jeanette (his sister) is going to cover the arrearage. Based on past experience, she does not expect to be repaid by Scott. Which of the following statements is correct?

(Multiple Choice)

4.8/5  (37)

(37)

Walter sells land with an adjusted basis of $175,000 and a fair market value of $160,000 to his mother, Shirley, for $160,000.Walter reinvests the proceeds in the stock market.Shirley holds the land for one year and a day and sells it in the marketplace for $169,000.

(Essay)

4.9/5  (38)

(38)

Showing 1 - 20 of 153

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)