Exam 9: Deductions: Employee and Self-Employed-Related Expenses

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law155 Questions

Exam 2: Working With the Tax Law83 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions153 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions115 Questions

Exam 6: Deductions and Losses: in General154 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses115 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion116 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses140 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses105 Questions

Exam 12: Alternative Minimum Tax125 Questions

Exam 13: Tax Credits and Payment Procedures123 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations154 Questions

Exam 15: Property Transactions: Nontaxable Exchanges139 Questions

Exam 16: Property Transactions: Capital Gains and Losses76 Questions

Exam 17: Property Transactions: Section 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods107 Questions

Exam 19: Deferred Compensation104 Questions

Exam 20: Corporations and Partnerships165 Questions

Select questions type

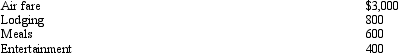

Regarding § 222 (qualified higher education deduction for tuition and related expenses),comment on the following:

(Essay)

4.8/5  (34)

(34)

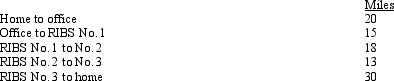

Alfredo,a self-employed patent attorney,flew from his home in Chicago to Miami,had lunch alone at the airport,conducted business in the afternoon,and returned to Chicago in the evening.His expenses were as follows:

What is Alfredo's deductible expense for the trip?

What is Alfredo's deductible expense for the trip?

(Essay)

4.9/5  (36)

(36)

A taxpayer who claims the standard deduction will not avoid the 2% floor on unreimbursed employee expenses.

(True/False)

4.9/5  (46)

(46)

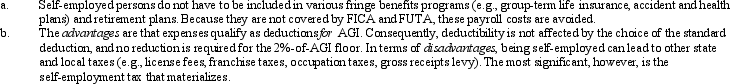

One of the tax advantages of being self-employed (rather than being an employee)is:

(Multiple Choice)

4.9/5  (39)

(39)

A moving expense deduction is allowed even if at the time of the move the taxpayer did not have a job at the new location.

(True/False)

4.9/5  (29)

(29)

An education expense deduction is not allowed if the education results in a promotion or pay raise for the employee.

(True/False)

4.9/5  (29)

(29)

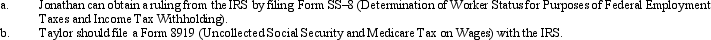

If a business retains someone to provide services,that person may either be an employee or be self-employed (i.e.,independent contractor).

(Essay)

4.9/5  (28)

(28)

Travel status requires that the taxpayer be away from home overnight.

(Essay)

4.9/5  (42)

(42)

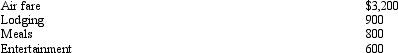

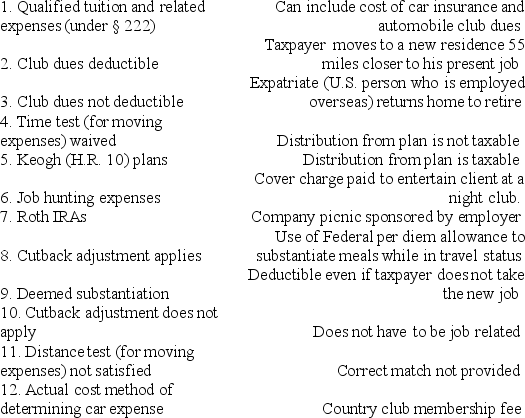

During the year,Walt went from Louisville to Hawaii on business.Preceding a five-day business meeting,he spent four days vacationing at the beach.Excluding the vacation costs,his expenses for the trip are:  Presuming no reimbursement,deductible expenses are:

Presuming no reimbursement,deductible expenses are:

(Multiple Choice)

4.8/5  (35)

(35)

Ava holds two jobs and attends graduate school on weekends.The education improves her skills,but does not qualify her for a new trade of business.Before going to the second job,she returns home for dinner.Relevant mileage is as follows?

How much of the mileage qualifies for deduction purposes?

How much of the mileage qualifies for deduction purposes?

(Essay)

4.8/5  (37)

(37)

During the year,Peggy went from Nashville to Quito (Ecuador)on business.She spent four days on business,two days on travel,and four days on vacation.Disregarding the vacation costs,Peggy's unreimbursed expenses are:  Peggy's deductible expenses are:

Peggy's deductible expenses are:

(Multiple Choice)

4.8/5  (32)

(32)

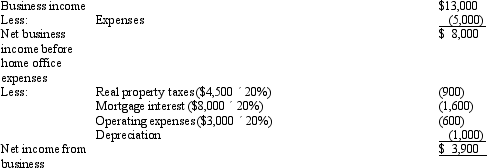

In the case of an office in the home deduction,the exclusive business use test does not apply when the home is used as a daycare center.

(True/False)

4.7/5  (34)

(34)

Once set for a year,when might the IRS change the rate for the automatic mileage method?

(Essay)

4.7/5  (35)

(35)

Once the actual cost method is used,a taxpayer cannot change to the automatic mileage method in a later year.

(True/False)

4.8/5  (37)

(37)

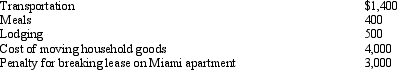

Due to a merger,Allison transfers from Miami to Chicago.Under a new job description,she is reclassified from employee to independent contractor status.Her moving expenses,which are not reimbursed,are as follows:  Allison's deductible moving expense is:

Allison's deductible moving expense is:

(Multiple Choice)

4.9/5  (26)

(26)

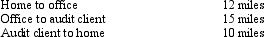

Aiden is the city sales manager for "Wings," a national fast food franchise.Every working day,Aiden drives his car as follows:  Aiden's deductible mileage is:

Aiden's deductible mileage is:

(Multiple Choice)

4.9/5  (40)

(40)

Elsie lives and works in Detroit.She is the regional sales manager for a national fast-food chain.Due to unusual developments,she is compelled to work six straight weeks in the Cleveland area.Instead of spending the weekend there,she flies home every Friday night and returns early Monday morning.The cost of coming home for the weekend approximates $600.Had she stayed in Cleveland,deductible meals and lodging would have been $700.How much,if any,may Elsie deduct as to each weekend?

(Essay)

4.9/5  (38)

(38)

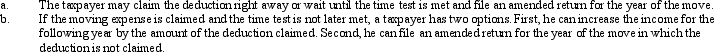

A taxpayer just changed jobs and incurred unreimbursed moving expenses.

(Essay)

4.9/5  (39)

(39)

Tired of renting,Dr.Smith buys the academic robes she will wear at her college's graduation procession.The cost of this attire qualifies as a uniform expense.

(True/False)

5.0/5  (43)

(43)

Dave is the regional manager for a national chain of auto-parts stores and is based in Salt Lake City.When the company opens new stores in Boise,Dave is given the task of supervising their initial operation.For three months,he works weekdays in Boise and returns home on weekends.He spends $410 returning to Salt Lake City but would have spent $350 had he stayed in Boise for the weekend.As to the weekend trips,how much,if any,qualifies as a deduction?

(Multiple Choice)

4.8/5  (44)

(44)

Showing 101 - 120 of 140

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)