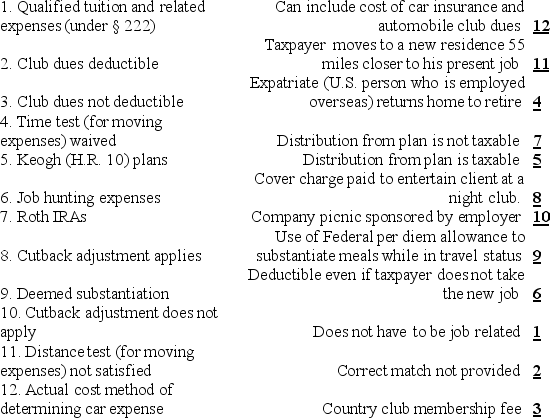

Exam 9: Deductions: Employee and Self-Employed-Related Expenses

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law155 Questions

Exam 2: Working With the Tax Law83 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions153 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions115 Questions

Exam 6: Deductions and Losses: in General154 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses115 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion116 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses140 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses105 Questions

Exam 12: Alternative Minimum Tax125 Questions

Exam 13: Tax Credits and Payment Procedures123 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations154 Questions

Exam 15: Property Transactions: Nontaxable Exchanges139 Questions

Exam 16: Property Transactions: Capital Gains and Losses76 Questions

Exam 17: Property Transactions: Section 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods107 Questions

Exam 19: Deferred Compensation104 Questions

Exam 20: Corporations and Partnerships165 Questions

Select questions type

Bill is employed as an auditor by a CPA firm.On most days,he commutes by auto from his home to the office.During one month,however,he has an extensive audit assignment closer to home.For this engagement,Bill drives directly from home to the client's premises and back.Mileage information is summarized below:

If Bill spends 21 days on the audit,what is his deductible mileage?

If Bill spends 21 days on the audit,what is his deductible mileage?

(Short Answer)

4.8/5  (37)

(37)

Arnold is employed as an assistant manager in the furniture division of a national chain of department stores.He is a recent college graduate with a degree in marketing.During 2012,he enrolls in the evening MBA program of a local university and incurs the following expenses: tuition,$4,200; books and computer supplies,$800; transportation expense to and from the university,$450; and meals while on campus,$400.Arnold is single and his annual AGI is $66,000.As to these expenses,what are Arnold's:

(Essay)

4.9/5  (37)

(37)

Daniel just graduated from college.The cost of moving his personal belongings from his parents' home to his first job site does qualify for the moving expense deduction.

(True/False)

4.8/5  (44)

(44)

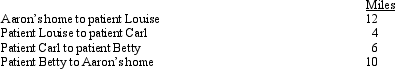

Allowing for the cutback adjustment (50% reduction for meals and entertainment),which of the following trips,if any,will qualify for the travel expense deduction?

(Multiple Choice)

5.0/5  (35)

(35)

A taxpayer who lives and works in Tulsa travels to Buffalo for five days.If three days are spent on business and two days are spent on visiting relatives,only 60% of the airfare is deductible.

(True/False)

4.8/5  (41)

(41)

A statutory employee is not a common law employee but is subject to income tax withholdings.

(True/False)

4.9/5  (37)

(37)

Employees who render an adequate accounting to the employer and are fully reimbursed will shift the 50% cutback adjustment to their employer.

(True/False)

4.9/5  (40)

(40)

Frank,a recently retired FBI agent,pays job search expenses to obtain a position with a city police department.Frank's job search expenses do not qualify as deductions.

(True/False)

4.9/5  (36)

(36)

If an individual is subject to the direction or control of another only to the extent of the end result but not as to the means of accomplishment, an employer-employee relationship does not exist.

(True/False)

5.0/5  (46)

(46)

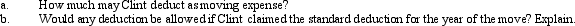

Aaron is a self-employed practical nurse who works out of his home.He provides nursing care for disabled persons living in their residences.During the day he drives his car as follows.  Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

(Multiple Choice)

4.8/5  (34)

(34)

A worker may prefer to be treated as an independent contractor (rather than an employee)for which of the following reasons:

(Multiple Choice)

4.9/5  (29)

(29)

Marcie moved from Oregon to West Virginia to accept a better job.She incurred the following unreimbursed moving expenses:

What is Nicole's moving expense deduction?

What is Nicole's moving expense deduction?

(Essay)

4.8/5  (33)

(33)

The IRS will not issue advanced rulings as to whether a worker's status is that of an employee or an independent contractor.

(True/False)

4.9/5  (37)

(37)

For the current football season,Tern Corporation pays $40,000 for a skybox (containing 12 seats)at Veterans Stadium for eight home games.Regular nonskybox seats at each game range from $120 to $150 a seat.In November,a Tern employee and ten clients use the skybox to attend a game.The event is preceded by a bona fide business discussion,and Tern spent $1,000 for food and drinks during the game.What is Tern's deduction?

(Essay)

4.9/5  (41)

(41)

Which,if any,of the following expenses is subject to the 2%-of-AGI floor?

(Multiple Choice)

4.8/5  (39)

(39)

Meg teaches the fifth grade at a local school.During the year,she spends $1,200 for school supplies for use in her classroom.On her income tax return,some of this expense is not reported and the balance is deducted in two different places.Explain what has probably happened.

(Essay)

4.8/5  (37)

(37)

When contributions are made to a Roth IRA,they are deductible by the participant.Later distributions from a the IRA,however,are fully taxed.

(True/False)

4.8/5  (38)

(38)

Edna lives and works in Cleveland.She travels to Berlin for an eight-day business meeting,after which she spends four days touring Germany.All of Edna's airfare is deductible.

(True/False)

4.8/5  (41)

(41)

Elaine,the regional sales director for a manufacturer of exercise equipment,pays $2,500 to rent a skybox for a visiting performance of the Harlem Globetrotters.The skybox holds 10 seats,and Elaine invites 7 clients to the event.Nonluxury seats range in price from $80 to $120.The refreshments provided during the event cost $600.If Elaine meets all of the requirements for deductibility (i.e.,business discussion,substantiation),she may deduct:

(Multiple Choice)

5.0/5  (34)

(34)

One indicia of independent contractor (rather than employee) status is when the individual performing the services is paid based on time spent (rather than on tasks performed).

(True/False)

4.7/5  (42)

(42)

Showing 41 - 60 of 140

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)