Exam 14: Property Transactions, capital Gains and Losses, sec1231, and Recapture Provisions

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law195 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Computing the Tax187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions113 Questions

Exam 6: Deductions and Losses: in General146 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses95 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses181 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions105 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Tax Credits and Payments118 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, basis Considerations, and Nontaxable Exchanges280 Questions

Exam 14: Property Transactions, capital Gains and Losses, sec1231, and Recapture Provisions145 Questions

Exam 15: Alternative Minimum Tax132 Questions

Exam 16: Accounting Periods and Methods91 Questions

Exam 17: Corporations: Introduction and Operating Rules112 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation192 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganization72 Questions

Exam 21: Partnerships163 Questions

Exam 22: S Corporations145 Questions

Exam 23: Exempt Entities141 Questions

Exam 24: Multistate Corporate Taxation196 Questions

Exam 25: Taxation of International Transactions164 Questions

Exam 26: Tax Practice and Ethics183 Questions

Exam 27: The Federal Gift and Estate Taxes167 Questions

Exam 28: Income Taxation of Trusts and Estates167 Questions

Select questions type

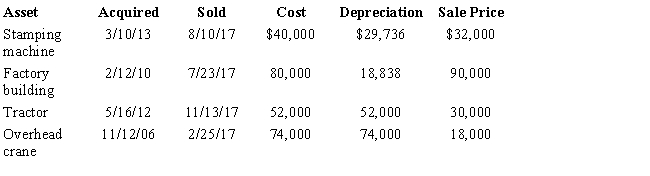

The chart below describes the § 1231 assets sold by the Ecru Company (a sole proprietorship) this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $4,000.

(Essay)

4.8/5  (40)

(40)

Rental use depreciable machinery held more than 12 months is an example of a § 1231 asset.

(True/False)

4.9/5  (37)

(37)

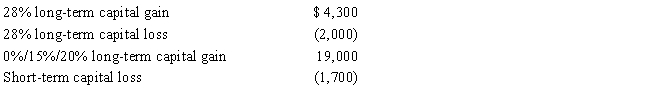

Harold is a head of household,has $27,000 of taxable income in 2017 from non-capital gain or loss sources,and has the following capital gains and losses:

Ignore standard deductions and exemptions.What is Harold's taxable income and the tax on that taxable income?

Ignore standard deductions and exemptions.What is Harold's taxable income and the tax on that taxable income?

(Essay)

4.9/5  (41)

(41)

In 2017,an individual taxpayer has $863,000 of taxable income that includes $48,000 of 0%/15%/20% long-term capital gain.Which of the following statements is correct?

(Multiple Choice)

5.0/5  (43)

(43)

Section 1231 property generally does not include accounts receivables arising in the ordinary course of business.

(True/False)

4.7/5  (43)

(43)

On January 10,2017,Wally sold an option for $2,000 on vacant land he held as an investment.He had purchased the land in 2013 for $76,000.The option allowed the option holder to purchase the property for $122,000 plus the cost of the option.On March 1,2017,the option holder exercised the option.What is the amount and nature of Wally's gain or loss from disposition of the land?

(Essay)

4.8/5  (34)

(34)

Property sold to a related party that is depreciable by the purchaser may cause the seller to have ordinary gain.

(True/False)

4.8/5  (40)

(40)

Carol had the following transactions during 2017: a painting held for two years and sold at a gain of $85,000; 100 shares of Gray stock held six months and sold for a loss of $6,000; 50 shares of Yellow stock held 18 months and sold for a gain of $36,000.Carol also had $264,000 of taxable income from other sources than these property transactions.What is Carol's net capital gain or loss and what is her taxable income?

(Essay)

4.8/5  (30)

(30)

Why is it generally better to have a net § 1231 gain year followed by a net § 1231 loss year rather than a net § 1231 loss year followed by a net § 1231 gain year?

(Essay)

4.7/5  (29)

(29)

Larry was the holder of a patent on a video game.During 2017,he sold all substantial rights in the patent for $365,000 in cash and a 3% royalty on the purchaser's first $10,200,000 of sales each year related to the product in which the patent is incorporated.Larry had not reduced the patent to practice.He had a $86,000 basis for the patent.During 2017,he received $30,000 in royalties.What is the nature and amount of Larry's gain?

(Essay)

4.8/5  (35)

(35)

A security that was purchased by an individual and qualifies as § 1244 stock becomes worthless.The taxpayer is single and the loss is $30,000.The loss is treated as an ordinary loss.

(True/False)

4.8/5  (40)

(40)

A retail building used in the business of a sole proprietor is sold on March 10,2017,for $342,000.The building was acquired in 2007 for $400,000 and straight-line depreciation of $104,000 had been taken on the building.What is the maximum unrecaptured § 1250 gain from the disposition of this building?

(Multiple Choice)

4.8/5  (41)

(41)

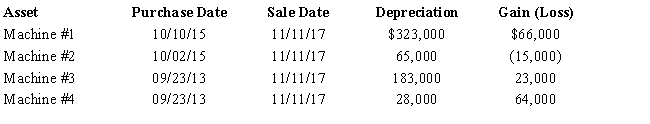

A business taxpayer sold all the depreciable assets of the business,calculated the gains and losses,and would like to know the final character of those gains and losses.The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets.The taxpayer had unrecaptured § 1231 lookback loss of $12,000.What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self-employment tax deduction.)

(Essay)

4.9/5  (41)

(41)

White Company acquires a new machine for $75,000 and uses it in White's manufacturing operations.A few months after White places the machine in service,it discovers that the machine is not suitable for White's business.White had fully expensed the machine in the year of acquisition using § 179.White sells the machine for $60,000 in the tax year after it was acquired,but held the machine only for a total of 10 months.What was the tax status of the machine when it was disposed of and the amount of the gain or loss?

(Multiple Choice)

4.9/5  (41)

(41)

To compute the holding period,start counting on the day after the property was acquired and include the day of disposition.

(True/False)

4.7/5  (36)

(36)

The Code contains two major depreciation recapture provisions: § 1245 and § 1250.

(True/False)

4.8/5  (40)

(40)

"Collectibles" held long-term and sold at a gain are subject to maximum tax rate of 28%.An individual taxpayer recently sold an antique car for $40,000.The car had been held for several years and $30,000 was originally paid for it.Explain why the car is or is not a collectible.

(Essay)

4.9/5  (40)

(40)

Michael is in the business of creating posters (display art) for the movie industry.He creates a poster and sells it for a lump sum.He has:

(Multiple Choice)

4.9/5  (38)

(38)

Describe the circumstances in which the potential § 1245 depreciation recapture is extinguished.

(Essay)

4.7/5  (36)

(36)

Showing 121 - 140 of 145

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)