Exam 6: Deductions and Losses: in General

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law195 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Computing the Tax187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions113 Questions

Exam 6: Deductions and Losses: in General146 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses95 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses181 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions105 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Tax Credits and Payments118 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, basis Considerations, and Nontaxable Exchanges280 Questions

Exam 14: Property Transactions, capital Gains and Losses, sec1231, and Recapture Provisions145 Questions

Exam 15: Alternative Minimum Tax132 Questions

Exam 16: Accounting Periods and Methods91 Questions

Exam 17: Corporations: Introduction and Operating Rules112 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation192 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganization72 Questions

Exam 21: Partnerships163 Questions

Exam 22: S Corporations145 Questions

Exam 23: Exempt Entities141 Questions

Exam 24: Multistate Corporate Taxation196 Questions

Exam 25: Taxation of International Transactions164 Questions

Exam 26: Tax Practice and Ethics183 Questions

Exam 27: The Federal Gift and Estate Taxes167 Questions

Exam 28: Income Taxation of Trusts and Estates167 Questions

Select questions type

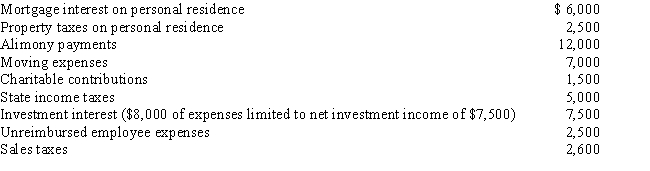

Arnold and Beth file a joint return.Use the following data to calculate their deduction for AGI.

(Essay)

4.8/5  (34)

(34)

Robin and Jeff own an unincorporated hardware store.They determine their salaries at the end of the year by using the amount required to reduce the net income of the hardware store to $0.Based on this policy,Robin and Jeff each receive a total salary of $125,000.This is paid as follows: $8,000 per month and $29,000 on December 31.Determine the amount of the salary deduction.

(Essay)

4.8/5  (28)

(28)

For an activity classified as a hobby,the expenses are categorized as follows:

(1) Amounts that affect adjusted basis and would be deductible under other Code sections if the activity had been engaged in for profit (e.g.,depreciation,amortization,and depletion).

(2) Amounts deductible under other Code sections without regard to the nature of the activity,such as property taxes and home mortgage interest.

(3) Amounts deductible under other Code sections if the activity had been engaged in for profit,but only if those amounts do not affect adjusted basis (e.g.,maintenance,utilities,and supplies).

If these expenses exceed the gross income from the activity and are thus limited,the sequence in which they are deductible is:

(Multiple Choice)

4.7/5  (37)

(37)

Sandra sold 500 shares of Wren Corporation to Bob,her brother,for its fair market value.She had paid $26,000 for the stock.Calculate Sandra's and Bob's gain or loss under the following circumstances:

a.Sandra sold the shares to Bob for $20,000. One year later, Bob sold them for $18,000.

b.Sandra sold the shares to Bob for $30,000. One year later, Bob sold them for $27,000.

c.Sandra sold the shares to Bob for $20,000. One year later, Bob sold them for $28,000.

(Essay)

5.0/5  (39)

(39)

For a taxpayer who is engaged in a trade or business,the cost of investigating a business in the same field is deductible only if the taxpayer acquires the business.

(True/False)

4.9/5  (41)

(41)

Jacques,who is not a U.S.citizen,makes a contribution to the campaign of a candidate for governor.Cassie,a U.S.citizen,also makes a contribution to the same campaign fund.If contributions by noncitizens are illegal under state law,the contribution by Cassie is deductible,while that by Jacques is not.

(True/False)

4.9/5  (36)

(36)

What are the relevant factors to be considered in determining whether an activity is profit-seeking or a hobby?

(Essay)

4.9/5  (37)

(37)

Under the "one-year rule" for the current period deduction of prepaid expenses of cash basis taxpayers,the asset must expire or be consumed by the end of the tax year following the year of payment.

(True/False)

4.8/5  (39)

(39)

If an item such as property taxes and home mortgage interest exceed the income from a hobby,the excess amount of this item over the hobby income can be deducted if the taxpayer itemizes deductions.

(True/False)

4.8/5  (30)

(30)

Alfred's Enterprises,an unincorporated entity,pays employee salaries of $100,000 during the year.At the end of the year,$12,000 of additional salaries have been earned but not paid until the beginning of the next year.

a.Determine the amount of the deduction for salaries if Alfred is a cash method taxpayer.

b.Determine the amount of the deduction for salaries if Alfred is an accrual method taxpayer.

(Essay)

4.9/5  (35)

(35)

Abner contributes $2,000 to the campaign of the Tea Party candidate for governor,$1,000 to the campaign of the Tea Party candidate for senator,and $500 to the campaign of the Tea Party candidate for mayor.Can Abner deduct these political contributions?

(Essay)

4.9/5  (42)

(42)

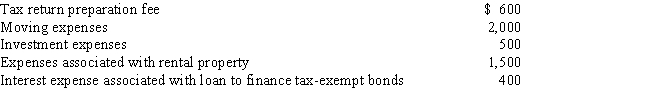

Cory incurred and paid the following expenses:

Calculate the amount that Cory can deduct (before any percentage limitations).

Calculate the amount that Cory can deduct (before any percentage limitations).

(Multiple Choice)

4.7/5  (37)

(37)

If part of a shareholder/employee's salary is classified as unreasonable,determine the effect on the:

a.Shareholder/employee's gross income.

b.Corporation's taxable income.

(Essay)

4.7/5  (37)

(37)

Investigation of a business unrelated to one's present business never results in a current period deduction of the entire amount if the amount of the investigation expenses exceeds $5,000.

(True/False)

4.8/5  (28)

(28)

Are there any exceptions to the rule that personal expenditures cannot be deducted?

(Essay)

4.9/5  (35)

(35)

All domestic bribes (i.e.,to a U.S.official) are disallowed as deductions.

(True/False)

4.8/5  (42)

(42)

Alice incurs qualified moving expenses of $12,000.If she is reimbursed by her employer,the deduction is classified as a deduction for AGI.If not reimbursed,the deduction is classified as an itemized deduction.

(True/False)

4.8/5  (36)

(36)

During 2016,the first year of operations,Silver,Inc.,pays salaries of $175,000.At the end of the year,employees have earned salaries of $20,000,which are not paid by Silver until early in 2017.What is the amount of the deduction for salary expense?

(Multiple Choice)

4.9/5  (40)

(40)

Petula's business sells heat pumps which have a one-year warranty.Based on historical data,the warranty costs amount to 11% of sales.During 2017,heat pump sales are $400,000.Actual warranty expenses paid in 2017 are $40,000.

a.Determine the amount of the warranty expense deduction for 2017 if Petula's business uses the accrual method.

b.How would your answer change if Petula used the cash method for extended warranties and the purchasers paid $25,000 for the warranties which covered the second and third years of ownership?

(Essay)

4.8/5  (31)

(31)

Showing 61 - 80 of 146

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)