Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law195 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Computing the Tax187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions113 Questions

Exam 6: Deductions and Losses: in General146 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses95 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses181 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions105 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Tax Credits and Payments118 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, basis Considerations, and Nontaxable Exchanges280 Questions

Exam 14: Property Transactions, capital Gains and Losses, sec1231, and Recapture Provisions145 Questions

Exam 15: Alternative Minimum Tax132 Questions

Exam 16: Accounting Periods and Methods91 Questions

Exam 17: Corporations: Introduction and Operating Rules112 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation192 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganization72 Questions

Exam 21: Partnerships163 Questions

Exam 22: S Corporations145 Questions

Exam 23: Exempt Entities141 Questions

Exam 24: Multistate Corporate Taxation196 Questions

Exam 25: Taxation of International Transactions164 Questions

Exam 26: Tax Practice and Ethics183 Questions

Exam 27: The Federal Gift and Estate Taxes167 Questions

Exam 28: Income Taxation of Trusts and Estates167 Questions

Select questions type

Currently,the Federal income tax is less progressive than it ever has been in the past.

(True/False)

4.9/5  (38)

(38)

Jason's business warehouse is destroyed by fire.As the insurance proceeds exceed the basis of the property,a gain results.If Jason shortly reinvests the proceeds in a new warehouse,no gain is recognized due to the application of the wherewithal to pay concept.

(True/False)

5.0/5  (32)

(32)

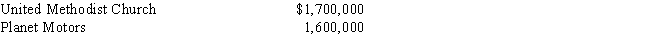

Due to the population change,the Goose Creek School District has decided to close one of its high schools.Since it has no further need of the property,the school is listed for sale.The two bids it receives are as follows:

The United Methodist Church would use the property to establish a sectarian middle school.Planet,a well-known car dealership,would revamp the property and operate it as a branch location.

If you were a member of the School District board,what factors would you consider in evaluating the two bids?

(Essay)

4.8/5  (40)

(40)

Which,if any,is not one of Adam Smith's canons (principles) of taxation?

(Multiple Choice)

4.8/5  (40)

(40)

Using the choices provided below, show the justification for each provision of the tax law listed.

a.Economic considerations

b.Social considerations

c.Equity considerations

d.Both a. and b.

-A deduction for contributions by an employee to certain retirement plans.

(Short Answer)

4.8/5  (32)

(32)

Match the statements that relate to each other. Note: Some choices may be used more than once.

a.3 years from date return is filed

b.3 years from due date of return

c.20% of underpayment

d.5% per month (25% limit)

e.0.5% per month (25% limit)

f.Conducted at IRS office

g.Conducted at taxpayer's office

h.6 years

i.45-day grace period allowed to IRS

j.No statute of limitations (period remains open)

k.75% of underpayment

l.No correct match provided

-Failure to file penalty

(Short Answer)

4.8/5  (36)

(36)

The objective of pay-as-you-go (paygo) is to improve administrative feasibility.

(True/False)

4.7/5  (28)

(28)

Before the Sixteenth Amendment to the Constitution was ratified,there was no valid Federal income tax on individuals.

(True/False)

4.8/5  (37)

(37)

One of the major reasons for the enactment of the Federal estate tax was to prevent large amounts of wealth from being accumulated within the family unit.

(True/False)

4.8/5  (34)

(34)

Various tax provisions encourage the creation of certain types of retirement plans.Such provisions can be justified on both economic and social grounds.

(True/False)

4.8/5  (19)

(19)

Logan dies with an estate worth $20 million.Under his will,$10 million passes to his wife while $10 million goes to his church.What is Logan's Federal estate tax result?

(Essay)

4.9/5  (38)

(38)

When Congress enacts a tax cut that is phased in over a period of years,revenue neutrality is achieved.

(True/False)

4.8/5  (30)

(30)

A CPA firm in California sends many of its less complex tax returns to be prepared by a group of accountants in India.If certain procedures are followed,this outsourcing of tax return preparation is proper.

(True/False)

4.8/5  (34)

(34)

If a taxpayer files early (i.e.,before the due date of the return),the statute of limitations on assessments begins on the date the return is filed.

(True/False)

4.8/5  (36)

(36)

If a "special agent" becomes involved in the audit of a return,this indicates that the IRS suspects that fraud is involved.

(True/False)

4.8/5  (40)

(40)

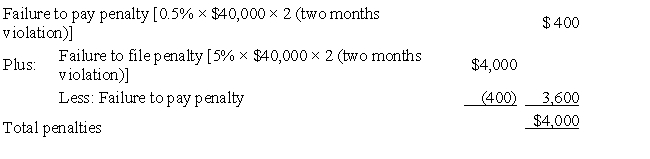

David files his tax return 45 days after the due date.Along with the return,David remits a check for $40,000 which is the balance of the tax owed.Disregarding the interest element,David's total failure to file and to pay penalties are:

(Multiple Choice)

4.8/5  (38)

(38)

Under what conditions is it permissible,from an ethical standpoint,for a CPA firm to outsource tax return preparation to a third party?

(Essay)

4.9/5  (42)

(42)

A state income tax can be imposed on nonresident taxpayers who earn income within the state on an itinerant basis.

(True/False)

4.8/5  (26)

(26)

Unlike FICA,FUTA requires that employers comply with state as well as Federal rules.

(True/False)

4.8/5  (33)

(33)

A fixture will be subject to the ad valorem tax on personalty rather than the ad valorem tax on realty.

(True/False)

4.9/5  (42)

(42)

Showing 101 - 120 of 195

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)