Exam 19: Decision Analysis

Exam 1: Introduction to Statistics79 Questions

Exam 2: Charts and Graphs75 Questions

Exam 3: Descriptive Statistics63 Questions

Exam 4: Probability72 Questions

Exam 5: Discrete Distributions80 Questions

Exam 6: Continuous Distributions78 Questions

Exam 7: Sampling and Sampling Distributions76 Questions

Exam 8: Statistical Inference: Estimation for Single Populations80 Questions

Exam 9: Statistical Inference: Hypothesis Testing for Single Populations79 Questions

Exam 10: Statistical Inferences About Two Populations70 Questions

Exam 11: Analysis of Variance and Design of Experiments80 Questions

Exam 12: Simple Regression Analysis and Correlation84 Questions

Exam 13: Multiple Regression Analysis80 Questions

Exam 14: Building Multiple Regression Models80 Questions

Exam 15: Time-Series Forecasting and Index Numbers77 Questions

Exam 16: Analysis of Categorical Data76 Questions

Exam 17: Nonparametric Statistics81 Questions

Exam 18: Statistical Quality Control68 Questions

Exam 19: Decision Analysis78 Questions

Select questions type

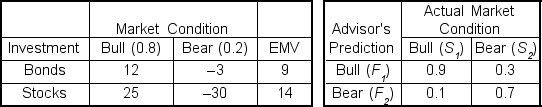

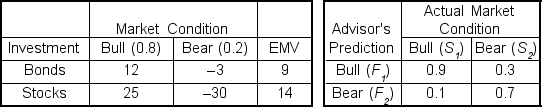

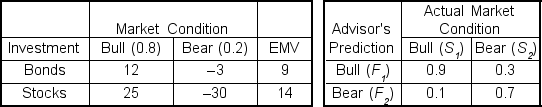

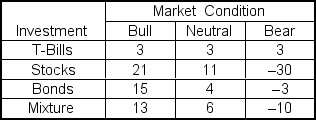

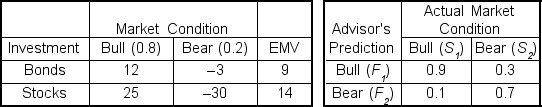

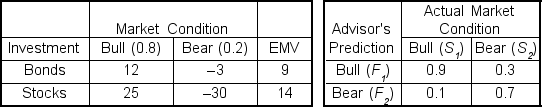

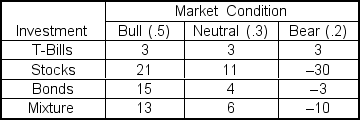

Ray Crofford is evaluating investment alternatives for the $100,000 which he inherited from his grandfather.His investment advisor has identified two alternatives and constructed the following tables which show (1)expected profits (in $10,000's)for various market conditions and their probabilities,and (2)the advisor's track record on predicting Bull and Bear markets:  If the advisor predicts a Bear market the revised probability of a Bear market,P (S2|F2),is ___.

If the advisor predicts a Bear market the revised probability of a Bear market,P (S2|F2),is ___.

(Multiple Choice)

4.8/5  (37)

(37)

Ray Crofford is evaluating investment alternatives for the $100,000 which he inherited from his grandfather.His investment advisor has identified two alternatives and constructed the following tables which show (1)expected profits (in $10,000's)for various market conditions and their probabilities,and (2)the advisor's track record on predicting Bull and Bear markets:  If the advisor predicts a Bear market the EMV of the Bonds alternative,using revised probabilities,is ___.

If the advisor predicts a Bear market the EMV of the Bonds alternative,using revised probabilities,is ___.

(Multiple Choice)

4.8/5  (28)

(28)

Ray Crofford is evaluating investment alternatives for the $100,000 which he inherited from his grandfather.His investment advisor has identified two alternatives and constructed the following tables which show (1)expected profits (in $10,000's)for various market conditions and their probabilities,and (2)the advisor's track record on predicting Bull and Bear markets:  If the advisor predicts a Bull market the EMV of the Stocks alternative,using revised probabilities,is ___.

If the advisor predicts a Bull market the EMV of the Stocks alternative,using revised probabilities,is ___.

(Multiple Choice)

4.8/5  (38)

(38)

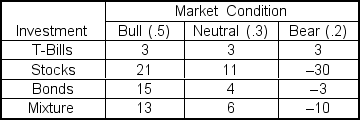

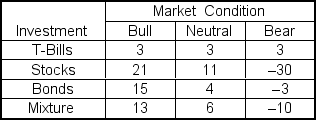

Ray Crofford is evaluating investment alternatives for the $100,000 which he inherited from his grandfather.His investment advisor has identified four alternatives and constructed the following table which shows expected profits (in $10,000's)for various market conditions and their probabilities:  The expected monetary payoff with perfect information is ___.

The expected monetary payoff with perfect information is ___.

(Multiple Choice)

4.8/5  (39)

(39)

Ray Crofford is evaluating investment alternatives to invest $100,000 which he inherited from his grandfather.His investment advisor has identified four alternatives and constructed the following payoff table which shows expected profits (in $10,000's)for various market conditions:  For the 'T-Bills' and 'Bonds' choices,the indifference value of Hurwicz's alpha is ___.

For the 'T-Bills' and 'Bonds' choices,the indifference value of Hurwicz's alpha is ___.

(Multiple Choice)

4.8/5  (36)

(36)

In a decision-making under uncertainty scenario,the best decision alternative based on the strategy of minmax regret will always have zero regret.

(True/False)

4.9/5  (33)

(33)

In decision-making under risk,the expected monetary value without information is ___.

(Multiple Choice)

4.8/5  (30)

(30)

Ray Crofford is evaluating investment alternatives for the $100,000 which he inherited from his grandfather.His investment advisor has identified two alternatives and constructed the following tables which show (1)expected profits (in $10,000's)for various market conditions and their probabilities,and (2)the advisor's track record on predicting Bull and Bear markets:  The EMV of this investment opportunity with the advisor's prediction is ___.

The EMV of this investment opportunity with the advisor's prediction is ___.

(Multiple Choice)

4.9/5  (37)

(37)

In a decision analysis problem,variables (such as investing in common stocks or corporate bonds)which are under the decision maker's control are called ___.

(Multiple Choice)

4.9/5  (36)

(36)

Ray Crofford is evaluating investment alternatives for the $100,000 which he inherited from his grandfather.His investment advisor has identified two alternatives and constructed the following tables which show (1)expected profits (in $10,000's)for various market conditions and their probabilities,and (2)the advisor's track record on predicting Bull and Bear markets:  If the advisor predicts a Bull market,the revised probability of a Bull market,P (S1|F1),is ___.

If the advisor predicts a Bull market,the revised probability of a Bull market,P (S1|F1),is ___.

(Multiple Choice)

4.8/5  (39)

(39)

The expected monetary value without information is $60,and the expected monetary payoff with perfect information is $120.The expected value of perfect information is __.

(Multiple Choice)

4.8/5  (44)

(44)

In a decision analysis problem,variables (such as general macroeconomic conditions)which are not under the decision maker's control are called prior probabilities.

(True/False)

5.0/5  (32)

(32)

The expected monetary value without information is $2,500,and the expected monetary payoff with perfect information is $5,000.The expected value of perfect information is ___.

(Multiple Choice)

4.7/5  (35)

(35)

In a decision-making under risk scenario,the expected monetary value of a decision alternative is the arithmetic average of the payoffs to the decision alternative in each state of the nature.

(True/False)

4.8/5  (38)

(38)

Dan Hein owns the mineral and drilling rights to a 1,000 hectare tract of land.If he drills a well and does not strike oil his net loss will be $50,000,but if he drills a well and strikes oil his net gain will be $100,000.If he does not drill,his loss is the cost of the mineral and drilling rights,which amount to $1000.For Dan's decision problem,the variable "drill the well" is one of the ___.

(Multiple Choice)

4.8/5  (26)

(26)

In a decision-making under risk scenario,the expected monetary value of a decision alternative is the weighted average (using the probability of each state of nature as the weight)of the payoffs to the decision alternative in each state of the nature.

(True/False)

4.9/5  (31)

(31)

In a decision analysis problem,variables (such as benefits or rewards that result from investments in common stocks or corporate bonds and from a new product launch)which result from selecting a particular decision alternative are called posterior probabilities.

(True/False)

4.9/5  (37)

(37)

Ray Crofford is evaluating investment alternatives to invest $100,000 which he inherited from his grandfather.His investment advisor has identified four alternatives and constructed the following payoff table which shows expected profits (in $10,000's)for various market conditions:  If Ray uses the Hurwicz criterion with alpha = 0.5,the appropriate choice is ___.

If Ray uses the Hurwicz criterion with alpha = 0.5,the appropriate choice is ___.

(Multiple Choice)

4.8/5  (40)

(40)

Ray Crofford is evaluating investment alternatives for the $100,000 which he inherited from his grandfather.His investment advisor has identified four alternatives and constructed the following table which shows expected profits (in $10,000's)for various market conditions and their probabilities:  The expected value of perfect information is ___.

The expected value of perfect information is ___.

(Multiple Choice)

4.8/5  (46)

(46)

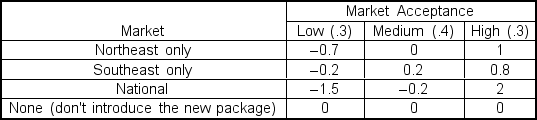

Melissa Rossi,Product Manager at National Consumers,Inc.(NCI),is evaluating alternatives for introducing a new package for toothpaste.She has identified four alternative markets,and has constructed the following table which shows NCI's rewards (in $1,000,000's)for various levels of acceptance by the markets and their probabilities:  The expected value of perfect information is ___.

The expected value of perfect information is ___.

(Multiple Choice)

4.9/5  (40)

(40)

Showing 21 - 40 of 78

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)