Exam 19: Decision Analysis

Exam 1: Introduction to Statistics79 Questions

Exam 2: Charts and Graphs75 Questions

Exam 3: Descriptive Statistics63 Questions

Exam 4: Probability72 Questions

Exam 5: Discrete Distributions80 Questions

Exam 6: Continuous Distributions78 Questions

Exam 7: Sampling and Sampling Distributions76 Questions

Exam 8: Statistical Inference: Estimation for Single Populations80 Questions

Exam 9: Statistical Inference: Hypothesis Testing for Single Populations79 Questions

Exam 10: Statistical Inferences About Two Populations70 Questions

Exam 11: Analysis of Variance and Design of Experiments80 Questions

Exam 12: Simple Regression Analysis and Correlation84 Questions

Exam 13: Multiple Regression Analysis80 Questions

Exam 14: Building Multiple Regression Models80 Questions

Exam 15: Time-Series Forecasting and Index Numbers77 Questions

Exam 16: Analysis of Categorical Data76 Questions

Exam 17: Nonparametric Statistics81 Questions

Exam 18: Statistical Quality Control68 Questions

Exam 19: Decision Analysis78 Questions

Select questions type

In decision-making under uncertainty,a pessimistic approach is the ___.

(Multiple Choice)

5.0/5  (31)

(31)

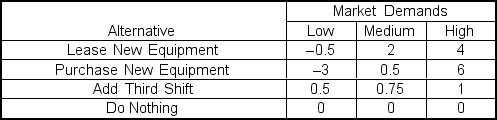

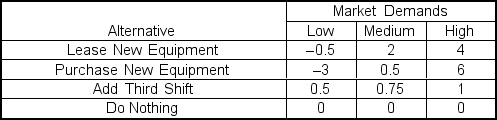

Trey Leeman,Operations Manager at National Consumers,Inc.(NCI),is evaluating alternatives for increasing capacity at NCI's Fountain Hill plant.He has identified four alternatives,and has constructed the following payoff table which shows payoffs (in $1,000,000's)for the three possible levels of market demand:  The opportunity loss for the combination "Purchase New Equipment" and "High" is ___.

The opportunity loss for the combination "Purchase New Equipment" and "High" is ___.

(Multiple Choice)

5.0/5  (37)

(37)

Trey Leeman,Operations Manager at National Consumers,Inc.(NCI),is evaluating alternatives for increasing capacity at NCI's Fountain Hill plant.He has identified four alternatives,and has constructed the following payoff table which shows payoffs (in $1,000,000's)for the three possible levels of market demand:  If Trey uses the maximax criterion,the appropriate alternative would be: ___.

If Trey uses the maximax criterion,the appropriate alternative would be: ___.

(Multiple Choice)

4.7/5  (37)

(37)

Dan Hein owns the mineral and drilling rights to a 1,000 hectare tract of land.If he drills a well and does not strike oil his net loss will be $50,000,but if he drills a well and strikes oil his net gain will be $100,000.If he does not drill,his loss is the cost of the mineral and drilling rights,which amount to $1000.The probability of the state of nature "oil in the tract" is unknown.If Dan is a pessimist,he would choose the ___.

(Multiple Choice)

4.8/5  (42)

(42)

Dan Hein owns the mineral and drilling rights to a 1,000 hectare tract of land.If he drills a well and does not strike oil his net loss will be $50,000,but if he drills a well and strikes oil his net gain will be $100,000.If he does not drill,his loss is the cost of the mineral and drilling rights,which amount to $1000.For Dan's decision problem,the variable "oil in the tract" is one of the ___.

(Multiple Choice)

4.8/5  (32)

(32)

Dan Hein owns the mineral and drilling rights to a 1,000 hectare tract of land.If he drills a well and does not strike oil his net loss will be $50,000,but if he drills a well and strikes oil his net gain will be $100,000.If he does not drill,his loss is the cost of the mineral and drilling rights,which amount to $1000.The probability of the state of nature "oil in the tract" is unknown.If Dan is an optimist,he would choose the ___.

(Multiple Choice)

4.8/5  (32)

(32)

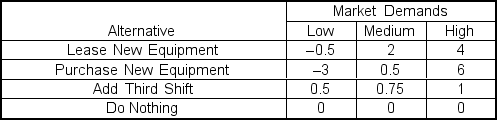

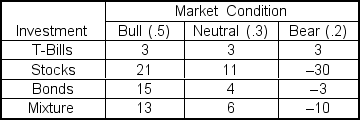

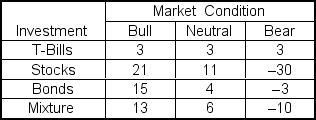

Ray Crofford is evaluating investment alternatives to invest $100,000 which he inherited from his grandfather.His investment advisor has identified four alternatives and constructed the following payoff table which shows expected profits (in $10,000's)for various market conditions:  If Ray uses the maximin criterion,the appropriate choice would be ___.

If Ray uses the maximin criterion,the appropriate choice would be ___.

(Multiple Choice)

4.8/5  (42)

(42)

In decision-making under uncertainty,an optimistic approach is the ___.

(Multiple Choice)

4.8/5  (36)

(36)

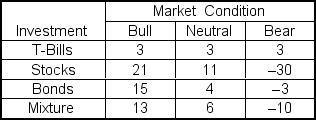

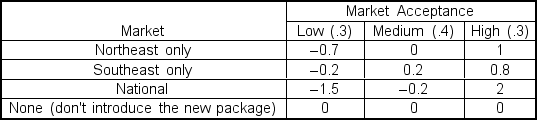

Melissa Rossi,Product Manager at National Consumers,Inc.(NCI),is evaluating alternatives for introducing a new package for toothpaste.She has identified four alternative markets,and has constructed the following table which shows NCI's rewards (in $1,000,000's)for various levels of acceptance by the markets and their probabilities:  The expected monetary payoff with perfect information is ___.

The expected monetary payoff with perfect information is ___.

(Multiple Choice)

4.8/5  (37)

(37)

Trey Leeman,Operations Manager at National Consumers,Inc.(NCI),is evaluating alternatives for increasing capacity at NCI's Fountain Hill plant.He has identified four alternatives,and has constructed the following payoff table which shows payoffs (in $1,000,000's)for the three possible levels of market demand:  If Trey uses the maximin criterion,the appropriate alternative would be: ___.

If Trey uses the maximin criterion,the appropriate alternative would be: ___.

(Multiple Choice)

4.8/5  (43)

(43)

In a decision-making scenario,if it is not known which of the states of nature will occur and further if the probabilities of occurrence of the states are also unknown,the scenario is called decision-making under double risk.

(True/False)

4.8/5  (28)

(28)

In a decision analysis problem,variables (such as investing in common stocks or corporate bonds)which are under the decision maker's control are called decision alternatives.

(True/False)

5.0/5  (33)

(33)

Dianna Ivy is evaluating a plan to expand the production facilities of International Compressors Company which manufactures natural gas compressors.Dianna feels that the price of coal is a significant factor in her decision,but she cannot control it.For her decision,the different prices of coal represent the ___.

(Multiple Choice)

4.9/5  (28)

(28)

Dan Hein owns the mineral and drilling rights to a 1,000 hectare tract of land.If he drills a well and does not strike oil his net loss will be $50,000,but if he drills a well and strikes oil his net gain will be $100,000.If he does not drill,his loss is the cost of the mineral and drilling rights,which amount to $1000.For Dan's decision problem,the variable "net loss of $50,000" is one of the ___.

(Multiple Choice)

4.8/5  (32)

(32)

Make decisions under risk by constructing decision trees,calculating expected monetary value and expected value of perfect information,and analyzing utility.

(Essay)

4.7/5  (26)

(26)

Ray Crofford is evaluating investment alternatives for the $100,000 which he inherited from his grandfather.His investment advisor has identified four alternatives and constructed the following table which shows expected profits (in $10,000's)for various market conditions and their probabilities:  The EMV of investing in Bonds is ___.

The EMV of investing in Bonds is ___.

(Multiple Choice)

4.8/5  (41)

(41)

Revise probabilities in light of sample information by using Bayesian analysis and calculating the expected value of sample information.

(Essay)

5.0/5  (40)

(40)

Ray Crofford is evaluating investment alternatives to invest $100,000 which he inherited from his grandfather.His investment advisor has identified four alternatives and constructed the following payoff table which shows expected profits (in $10,000's)for various market conditions:  If Ray uses the Hurwicz criterion with alpha = 0.9,the appropriate choice is ___.

If Ray uses the Hurwicz criterion with alpha = 0.9,the appropriate choice is ___.

(Multiple Choice)

4.9/5  (31)

(31)

The value of perfect information is the difference between the monetary payoff with perfect information and the expected monetary payoff with no information.

(True/False)

4.9/5  (45)

(45)

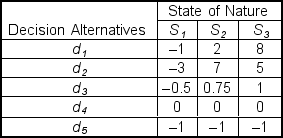

Consider the following decision table with rewards in $ millions.  The opportunity loss for the combination "S3" and "d1" is ___.

The opportunity loss for the combination "S3" and "d1" is ___.

(Multiple Choice)

4.8/5  (25)

(25)

Showing 41 - 60 of 78

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)