Exam 22: Decentralization and Performance Measurement

Exam 1: Introducing Accounting in Business257 Questions

Exam 2: Analyzing and Recording Transactions216 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements236 Questions

Exam 4: Accounting for Merchandising Operations200 Questions

Exam 5: Inventories and Cost of Sales197 Questions

Exam 6: Cash and Internal Controls198 Questions

Exam 7: Accounts and Notes Receivable170 Questions

Exam 8: Long-Term Assets205 Questions

Exam 9: Current Liabilities191 Questions

Exam 10: Long-Term Liabilities189 Questions

Exam 11: Corporate Reporting and Analysis200 Questions

Exam 12: Reporting Cash Flows175 Questions

Exam 13: Analysis of Financial Statements185 Questions

Exam 14: Managerial Accounting Concepts and Principles198 Questions

Exam 15: Job Order Costing and Analysis155 Questions

Exam 16: Process Costing191 Questions

Exam 17: Activity-Based Costing and Analysis183 Questions

Exam 18: Cost-Volume-Profit Analysis181 Questions

Exam 19: Variable Costing and Performance Reporting178 Questions

Exam 20: Master Budgets and Performance Planning164 Questions

Exam 21: Flexible Budgets and Standard Costs179 Questions

Exam 22: Decentralization and Performance Measurement154 Questions

Exam 23: Relevant Costing for Managerial Decisions140 Questions

Exam 24: Capital Budgeting and Investment Analysis144 Questions

Exam 25: Accounting With Special Journals160 Questions

Exam 26: Time Value of Money58 Questions

Exam 27: Investments and International Operations181 Questions

Exam 28: Accounting for Partnerships126 Questions

Select questions type

Departmental contribution to overhead is calculated as revenues of the department less:

(Multiple Choice)

4.8/5  (43)

(43)

The China Department of the Coulsen Department Store had sales of $282,000,cost of goods sold of $198,750,indirect expenses of $19,875,and direct expenses of $41,250 for the current period.What is the China Department's contribution to overhead as a percentage of sales?

(Essay)

4.9/5  (44)

(44)

The salaries of employees who spend all their time working in one department are:

(Multiple Choice)

4.8/5  (44)

(44)

The investment center return on total assets is __________________________ divided by ______________________________.

(Short Answer)

4.9/5  (35)

(35)

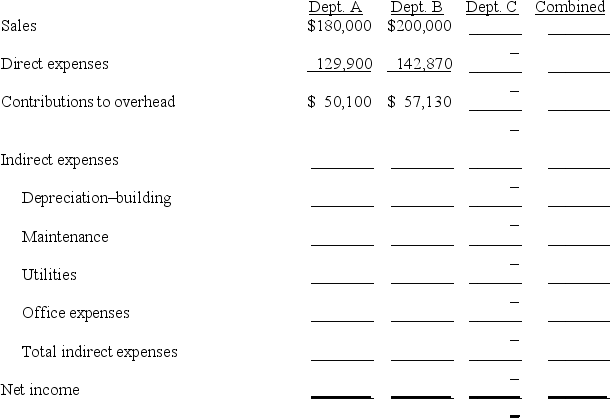

Burien,Inc.operates a retail store with two departments,A and

B. Its departmental income statement for the current year follows:

BURIEN, INC. Departmental Income Statement For Year Ended December 31 Dept. A Dept. B Combined Sales \ 180,000 \ 200,000 \ 380,000 Direct expenses 129,900 142,870 272,77 Contributions to overhead \ 50,100 \ 57,130 \ 107,23 Indirect expenses: Depreciation--building 10,000 11,760 21,760 Maintenance 1,600 1,700 3,300 Utilities 6,200 6,320 12,520 Office expenses 1,800 2,000 3,800 Total indirect expenses \1 9,600 \2 1,780 \4 1,380 Net income \3 0,500 \3 5,350 \6 5,850 Burien allocates building depreciation, maintenance, and utilities on the basis of square footage. Office expenses are allocated on the basis of sales.

Management is considering an expansion to a three-department operation. The proposed Department C would generate $120,000 in additional sales and have a 17.5% contribution to overhead. The company owns its building. Opening Department C would redistribute the square footage to each department as follows: A, 19,040; B, 21,760 sq. ft.; C, 13,600. Increases in indirect expenses would include: maintenance, $500; utilities, $3,800; and office expenses, $1,200.

Complete the following departmental income statements, showing projected results of operations for the three sales departments. (Round amounts to the nearest whole dollar.)

(Essay)

4.9/5  (33)

(33)

Joint costs can be allocated either using a physical basis or a value basis.

(True/False)

4.9/5  (39)

(39)

Vaughn Co.operates three separate departments (A,B,C).The data below are provided for the current year:

Total sales \ 120,000 (\ 40,000 from each department) Cost of goods sold 80,000 (50\% from A;25\% from B;25\% from C) Direct expense 26,000 \ \ 6,000 from A;\ 12,000 from B;\ 8,000 from C) Indirect expenses 9,000

Required: Prepare an income statement showing the departmental contributions to overhead for the current year.

(Essay)

4.8/5  (34)

(34)

A single cost incurred in producing or purchasing two or more essentially different products is a(n):

(Multiple Choice)

4.9/5  (44)

(44)

________________________________ measures the income earned per dollar of sales.

(Short Answer)

4.8/5  (43)

(43)

Match the appropriate definition (a)through (h)with the following terms:

(a) A department or unit that incurs costs without directly generating revenues.

(b) A center in which a manager is responsible for using the center's assets to generate income for the center.

(c) Costs that are incurred for the joint benefit of more than one department and cannot be readily traced to only one department.

(d) Costs readily traced to a specific department because they are incurred for the sole benefit of that department.

(e) Costs incurred to produce two or more products at the same time.

(f) Costs that a manager can strongly influence or control.

(g) A department that incurs costs and generates revenues.

(h) Assigns managers the responsibility for costs and expenses under their control.

__________ (1) Direct expenses

__________ (2) Responsibility accounting system

__________ (3) Profit center

__________ (4) Controllable costs

__________ (5) Indirect expenses

__________ (6) Cost center

__________ (7) Joint cost

__________ (8) Investment center

(Essay)

4.9/5  (38)

(38)

Reference: 22_04

Ice House Industries, Inc. has three operating departments: Cooking, Churning, and Freezing. Indirect factory costs for the current period were Administrative $560,000 and Maintenance $98,000. Administrative costs are allocated to operating departments based on the number of workers and maintenance costs are allocated to operating departments based on square footage occupied.

Cooking Department Churning Department Freezing Department Number of employees 2,940 employees 4,900 employees 1,960 employees Square feet occupied 33,250 Sq. Ft. 38,000 5q. Ft 23,750 Sq. Ft.

-Based on the above data,determine the maintenance cost allocated to each operating department of Ice House Industries,Inc.

(Multiple Choice)

4.8/5  (42)

(42)

Evaluation of the performance of a department involves only financial measures.

(True/False)

5.0/5  (40)

(40)

In producing oat bran,the joint cost of milling the oats into bran,oatmeal,and animal feed is considered a direct cost to the oat bran,because the oat bran cannot be produced without incurring the joint cost.

(True/False)

4.9/5  (32)

(32)

Reference: 22_06

Mach Co. operates three manufacturing departments as profit centers. The following information is available for its most recent year:

Cost of Direct Indirect Dept. Sales Goods Sold Expenses Expenses 1 \ 1,000,000 \ 700,000 \ 100,000 \ 80,000 2 400,000 150,000 40,000 100,000 3 700,000 300,000 150,000 20,000

-Which department has the greatest departmental contribution to overhead and what is the amount contributed?

(Multiple Choice)

4.8/5  (39)

(39)

A company produces two joint products (called 101 and 202)in a single operation that uses one raw material called Casko.Four hundred gallons of Casko were purchased at a cost of $800 and were used to produce 150 gallons of Product 101,selling for $5 per gallon,and 75 gallons of Product 202,selling for $15 per gallon.How much of the $800 cost should be allocated to each product,assuming that the company allocates cost based on sales revenue?

(Essay)

4.9/5  (35)

(35)

Reference: 22_08

Quarry Co. Smith Barney Revenue \ 412,000 \ 450,000 Costs 380,000 411,000 Average assets 400,000 600,000

-Based on the Quarry Company information,what is residual income for Smith and Barney?

(Multiple Choice)

4.9/5  (35)

(35)

The price that should be used to record transfers between divisions in the same company is called the divisional price.

(True/False)

4.8/5  (45)

(45)

Showing 41 - 60 of 154

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)