Exam 19: Variable Costing and Performance Reporting

Exam 1: Introducing Accounting in Business257 Questions

Exam 2: Analyzing and Recording Transactions216 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements236 Questions

Exam 4: Accounting for Merchandising Operations200 Questions

Exam 5: Inventories and Cost of Sales197 Questions

Exam 6: Cash and Internal Controls198 Questions

Exam 7: Accounts and Notes Receivable170 Questions

Exam 8: Long-Term Assets205 Questions

Exam 9: Current Liabilities191 Questions

Exam 10: Long-Term Liabilities189 Questions

Exam 11: Corporate Reporting and Analysis200 Questions

Exam 12: Reporting Cash Flows175 Questions

Exam 13: Analysis of Financial Statements185 Questions

Exam 14: Managerial Accounting Concepts and Principles198 Questions

Exam 15: Job Order Costing and Analysis155 Questions

Exam 16: Process Costing191 Questions

Exam 17: Activity-Based Costing and Analysis183 Questions

Exam 18: Cost-Volume-Profit Analysis181 Questions

Exam 19: Variable Costing and Performance Reporting178 Questions

Exam 20: Master Budgets and Performance Planning164 Questions

Exam 21: Flexible Budgets and Standard Costs179 Questions

Exam 22: Decentralization and Performance Measurement154 Questions

Exam 23: Relevant Costing for Managerial Decisions140 Questions

Exam 24: Capital Budgeting and Investment Analysis144 Questions

Exam 25: Accounting With Special Journals160 Questions

Exam 26: Time Value of Money58 Questions

Exam 27: Investments and International Operations181 Questions

Exam 28: Accounting for Partnerships126 Questions

Select questions type

The traditional costing approach assigns all manufacturing costs to products.

(True/False)

4.8/5  (38)

(38)

The data needed for cost-volume-profit analysis is readily available if the income statement is prepared under absorption costing.

(True/False)

4.8/5  (29)

(29)

Triton Industries reports the following information regarding its production cost:

Units produced 77,000 units Direct labor \ 27 per unit Direct materials \ 12 per unit Variable overhead \ 2,541,000 in total Fixed overhead \ 3,311,000 in total

a.Compute production cost per unit under variable costing.

b.Compute production cost per unit under absorption costing.

(Essay)

4.9/5  (34)

(34)

When excess capacity exists,managers should accept a special order if the special order price exceeds the ________________________.

(Short Answer)

4.8/5  (38)

(38)

_______________ and _______________ are product costs that can be directly traced to the product.

(Short Answer)

4.7/5  (36)

(36)

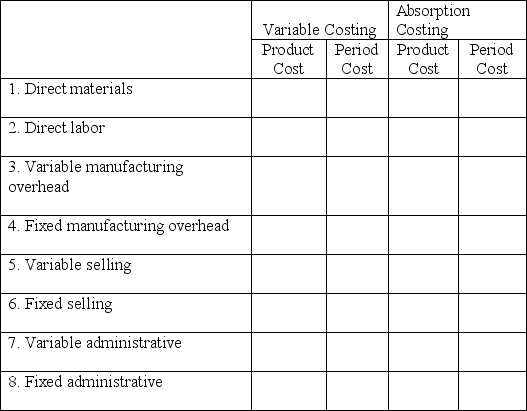

Identify the treatment of each of the following costs under variable costing and absorption costing:

(Essay)

4.8/5  (36)

(36)

Swisher,Incorporated reports the following annual cost data for its single product:

Normal production level 30,000 units Direct materials \ 6.40 per unit Direct labor \ 3.93 per unit Variable overhead \ 5.80 per unit Fixed overhead \ 150,000 in total

This product is normally sold for $48 per unit.If Swisher increases its production to 50,000 units,while sales remain at the current 30,000 unit level,by how much would the company's gross margin increase or decrease under variable costing?

(Multiple Choice)

4.8/5  (29)

(29)

Countdown Inc.sold 17,000 units of its product at a price of $81 per unit.Total variable cost per unit is $72.09,consisting of $69.05 in variable production cost and $3.04 in variable selling and administrative cost.Compute the contribution margin for the company.

(Essay)

4.8/5  (36)

(36)

Dent Corporation had net income of $182,000 based on variable costing.Beginning and ending inventories were 5,000 units and 8,000 units,respectively.Assume the fixed overhead per unit was $3 for both the beginning and ending inventory.What is net income under absorption costing?

(Multiple Choice)

4.9/5  (34)

(34)

Under absorption costing,which of the following statements is not true?

(Multiple Choice)

4.8/5  (42)

(42)

During a given year,if a company produces more units than it sells,then ending inventory units will be less than beginning inventory units.

(True/False)

4.9/5  (46)

(46)

Assume a company had the following production costs:

Direct labor \ 20,000 Direct material \ 30,000 Variable overhead \ 40,000 Fixed overhead \ 50,000

Under absorption costing,the total production cost per unit when 4,000 units are produced would be $22.50.

(True/False)

4.8/5  (35)

(35)

Multiplying the contribution margin ratio by the expected change in sales equals the expected change in contribution margin.

(True/False)

4.9/5  (44)

(44)

Shore Company reports the following information regarding its production cost.

Units produced 28,000 units Direct labor \ 23 per unit Direct materials \ 24 per unit Variable overhead \ 280,000 total Fixed overhead \ 94,920 total

Compute production cost per unit under absorption costing.

(Multiple Choice)

4.9/5  (39)

(39)

Given the following data,calculate product cost per unit under variable costing.

Direct labor \ 7 per unit Direct materials \ 1 per unit Overhead Total variable overhead \ 20,000 Total fixed overhead \ 90,000 Expected units to be produced 40,000 units

(Multiple Choice)

4.9/5  (35)

(35)

Given the following data,total product cost per unit under absorption costing is $9.14.

Direct labor \ 0.72 per unit Direct materials \ 0.80 per unit Overhead Total variable overhead \ 202,500 Total fixed overhead \ 140,400 Expected units to be produced 45,000 units

(True/False)

4.9/5  (33)

(33)

Heather,Incorporated reports the following annual cost data for its single product:

Normal production and sales level 60,000 units Direct materials \ 9.00 per unit Direct labor \ 6.50 per unit Variable overhead \ 11.00 per unit Fixed overhead \ 720,000 in total

This product is normally sold for $56 per unit.If Heather increases its production to 80,000 units while sales remain at the current 60,000 unit level,by how much would the company's gross margin increase or decrease under absorption costing? Assume the company has idle capacity to double current production.

(Essay)

4.9/5  (31)

(31)

How will net income under variable costing compare to net income under absorption costing in the following three situations? Explain briefly the cause of any differences.

(a) Units produced equal units sold

(b) Units produced exceed units sold

(c) Units produced are less than units sold

(Essay)

4.9/5  (40)

(40)

Showing 41 - 60 of 178

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)