Exam 26: Monetary Policy

Exam 1: Economics: Foundations and Models444 Questions

Exam 2: Trade-Offs, Comparative Advantage, and the Market System498 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply475 Questions

Exam 4: Economic Efficiency, Government Price Setting, and Taxes419 Questions

Exam 5: Externalities, Environmental Policy, and Public Goods266 Questions

Exam 6: Elasticity: the Responsiveness of Demand and Supply295 Questions

Exam 7: The Economics of Health Care334 Questions

Exam 8: Firms, the Stock Market, and Corporate Governance278 Questions

Exam 9: Comparative Advantage and the Gains From International Trade379 Questions

Exam 10: Consumer Choice and Behavioral Economics302 Questions

Exam 11: Technology, Production, and Costs330 Questions

Exam 12: Firms in Perfectly Competitive Markets298 Questions

Exam 13: Monopolistic Competition: the Competitive Model in a More Realistic Setting276 Questions

Exam 14: Oligopoly: Firms in Less Competitive Markets262 Questions

Exam 15: Monopoly and Antitrust Policy271 Questions

Exam 16: Pricing Strategy263 Questions

Exam 17: The Markets for Labor and Other Factors of Production286 Questions

Exam 18: Public Choice, Taxes, and the Distribution of Income258 Questions

Exam 19: GDP: Measuring Total Production and Income266 Questions

Exam 20: Unemployment and Inflation292 Questions

Exam 21: Economic Growth, the Financial System, and Business Cycles257 Questions

Exam 22: Long-Run Economic Growth: Sources and Policies268 Questions

Exam 23: Aggregate Expenditure and Output in the Short Run306 Questions

Exam 24: Aggregate Demand and Aggregate Supply Analysis284 Questions

Exam 25: Money, Banks, and the Federal Reserve System280 Questions

Exam 26: Monetary Policy277 Questions

Exam 27: Fiscal Policy303 Questions

Exam 28: Inflation, Unemployment, and Federal Reserve Policy257 Questions

Exam 29: Macroeconomics in an Open Economy278 Questions

Exam 30: The International Financial System262 Questions

Select questions type

According to the Taylor rule, does the target for the federal funds rate respond differently for an increase in inflation caused by an increase in aggregate demand and for an increase in inflation caused by a decrease in short-run aggregate supply? Explain whether there is or is not a difference in how the target for the federal funds rate changes.

Free

(Essay)

4.9/5  (35)

(35)

Correct Answer:

The target for the federal funds rate responds differently. The current inflation rate and the inflation gap are the same in both cases, but the output gap differs. The output gap (percentage difference between real GDP and potential real GDP) will be positive for the inflation caused by an increase in aggregate demand, but negative for the inflation caused by a decrease in short-run aggregate supply. The target for the federal funds rate will be higher in the case of the increase in inflation caused by an increase in aggregate demand.

An increase in the interest rate should ________ the demand for dollars and the value of the dollar, and net exports should ________.

Free

(Multiple Choice)

4.7/5  (29)

(29)

Correct Answer:

C

The Fed's two main monetary policy targets are

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

B

Which of the following situations is one in which the Fed will potentially pursue expansionary monetary policy?

(Multiple Choice)

4.8/5  (45)

(45)

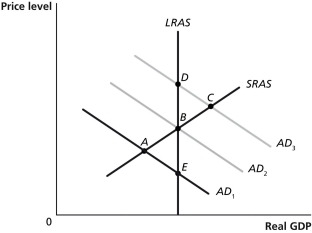

Figure 26-7  -Refer to Figure 26-7. Suppose the economy is in a recession and the Fed pursues an expansionary monetary policy. Using the static AD-AS model in the figure above, this would be depicted as a movement from

-Refer to Figure 26-7. Suppose the economy is in a recession and the Fed pursues an expansionary monetary policy. Using the static AD-AS model in the figure above, this would be depicted as a movement from

(Multiple Choice)

4.8/5  (31)

(31)

The situation in which short-term interest rates are pushed to zero, leaving the central bank unable to lower them further is known as

(Multiple Choice)

4.9/5  (36)

(36)

Expansionary monetary policy to prevent real GDP from falling below potential real GDP would cause the inflation rate to be relatively ________ and real GDP to be relatively ________.

(Multiple Choice)

5.0/5  (31)

(31)

Most economists believe that the best monetary policy target is

(Multiple Choice)

4.9/5  (34)

(34)

The Taylor rule predicted a federal funds rate which was ________ that set when Paul Volcker was chairman of the Fed, and a rate which was ________ that set when Arthur Burns chaired the Fed.

(Multiple Choice)

4.9/5  (32)

(32)

What actions should the Fed take if it believes the economy is about to experience a high rate of inflation?

(Essay)

4.8/5  (22)

(22)

The Federal Reserve System's four monetary policy goals are

(Multiple Choice)

4.8/5  (43)

(43)

Suppose you buy a house for $250,000. One year later, the market price for the house has fallen to $200,000. What is the return on your investment in the house if you made a down payment of 10 percent and took out a mortgage loan for the other 90 percent?

(Essay)

4.9/5  (40)

(40)

According to the Taylor rule, the Fed should set the target for the federal funds rate equal to the sum of the equilibrium real federal funds rate, the current inflation rate, one-half times the ________, and one-half times the ________.

(Multiple Choice)

4.7/5  (40)

(40)

When the Federal Reserve increases the money supply, at the previous equilibrium interest rate households and firms will now have

(Multiple Choice)

4.8/5  (27)

(27)

Write out the expression for the Taylor rule. Use the Taylor rule to explain how a decline in real GDP below potential GDP will affect the Federal Reserve's target for the federal funds rate.

(Essay)

4.7/5  (38)

(38)

Which of the following is true about the Federal Reserve and its ability to prevent recessions? The Federal Reserve

(Multiple Choice)

4.8/5  (43)

(43)

The smaller the fraction of an investment financed by borrowing,

(Multiple Choice)

4.8/5  (37)

(37)

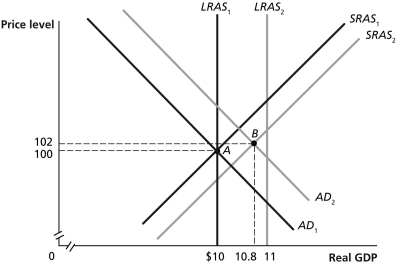

Figure 26-11  -Refer to Figure 26-11. In the dynamic model of AD-AS in the figure above, if the economy is at point A in year 1 and is expected to go to point B in year 2, the Federal Reserve would most likely

-Refer to Figure 26-11. In the dynamic model of AD-AS in the figure above, if the economy is at point A in year 1 and is expected to go to point B in year 2, the Federal Reserve would most likely

(Multiple Choice)

4.8/5  (37)

(37)

Showing 1 - 20 of 277

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)