Exam 10: Liabilities: Current,installment Notes,and Contingencies

Exam 1: Introduction to Accounting and Business176 Questions

Exam 2: Analyzing Transactions210 Questions

Exam 3: The Adjusting Process183 Questions

Exam 4: Completing the Accounting Cycle168 Questions

Exam 5: Accounting for Merchandising Businesses205 Questions

Exam 6: Inventories161 Questions

Exam 7: Internal Control and Cash155 Questions

Exam 8: Receivables163 Questions

Exam 9: Long-Term Assets: Fixed and Intangible177 Questions

Exam 10: Liabilities: Current,installment Notes,and Contingencies188 Questions

Exam 11: Liabilities: Bonds Payable154 Questions

Exam 12: Corporations: Organization, stock Transactions, and Dividends193 Questions

Exam 13: Statement of Cash Flows175 Questions

Exam 14: Financial Statement Analysis189 Questions

Exam 15: Introduction to Managerial Accounting195 Questions

Exam 16: Job Order Costing185 Questions

Exam 17: Process Cost Systems180 Questions

Exam 18: Activity-Based Costing110 Questions

Exam 19: Cost-Volume-Profit Analysis421 Questions

Exam 20: Variable Costing for Management Analysis151 Questions

Exam 21: Budgeting181 Questions

Exam 22: Evaluating Variances From Standard Costs130 Questions

Exam 23: Evaluating Decentralized Operations175 Questions

Exam 24: Differential Analysis and Product Pricing173 Questions

Exam 25: Capital Investment Analysis186 Questions

Exam 26: Lean Manufacturing and Activity Analysis121 Questions

Select questions type

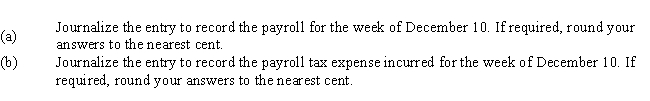

Townson Company had gross wages of $180,000 during the week ended December 10.All earnings are subject to social security tax,while the amount of wages subject to federal and state unemployment taxes was $24,000.Tax rates are as follows:

The total amount withheld from employee wages for federal income taxes was $32,000.

(Essay)

4.8/5  (36)

(36)

Chang Co.issued a $50,000,120-day,discounted note to Guarantee Bank.The discount rate is 6%.Assuming a 360-day year,the cash proceeds to Chang Co.are

(Multiple Choice)

4.8/5  (33)

(33)

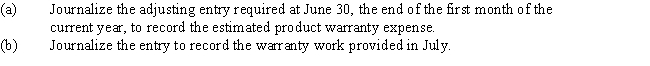

Lamar Industries warrants its products for one year.The estimated product warranty expense is 3% of sales.Sales for June were $190,000.In July,a customer received warranty repairs requiring $185 of parts and $50 of labor.

(Essay)

4.8/5  (36)

(36)

Use the following key (a-d)to identify the proper treatment of each contingent liability.

-Event is remote and amount is estimable

(Multiple Choice)

4.9/5  (39)

(39)

The journal entry to record the conversion of a $6,300 accounts payable to a note payable would be

(Multiple Choice)

4.8/5  (40)

(40)

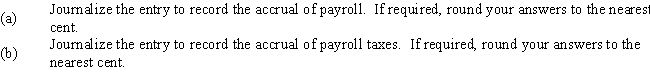

The following totals for the month of April were taken from the payroll register of Magnum Company:

The entry to record accrual of employer's payroll taxes would include a

The entry to record accrual of employer's payroll taxes would include a

(Multiple Choice)

4.8/5  (38)

(38)

Use the following key (a-d)to identify the proper treatment of each contingent liability.

-Event is probable and amount is estimable

(Multiple Choice)

4.8/5  (35)

(35)

On July 8,Jones Inc.issued an $80,000,6%,120-day note payable to Miller Company.Assume that the fiscal year of Jones ends July 31.Using a 360-day year,what is the amount of interest expense recognized by Jones in the current fiscal year? When required,round your answer to the nearest dollar.

(Multiple Choice)

4.9/5  (37)

(37)

The payroll register of Seaside Architecture Company indicates $970 of social security and $257 of Medicare tax withheld on total salaries of $16,500 for the period.Federal withholding for the period totaled $4,235.Prepare the journal entry for the period's payroll.

(Essay)

4.9/5  (42)

(42)

Payroll taxes only include social security taxes and federal unemployment and state unemployment taxes.

(True/False)

4.7/5  (34)

(34)

Assuming that all wages are subject to federal and state unemployment taxes,the employer's payroll tax expense would be

(Multiple Choice)

4.8/5  (38)

(38)

In order to be a recorded contingent liability,the liability must be possible and easily estimated.

(True/False)

4.8/5  (35)

(35)

On January 1,Gemstone Company obtained a $165,000,10-year,7% installment note from Guarantee Bank.The note requires annual payments of $23,492,with the first payment occurring on the last day of the fiscal year.The first payment consists of interest of $11,550 and principal repayment of $11,942.The journal entry to record the payment of the first annual amount due on the note would include a

(Multiple Choice)

4.9/5  (41)

(41)

The proceeds from discounting a $20,000,60-day,note payable at 6% is $20,200.

(True/False)

4.8/5  (37)

(37)

According to a summary of the payroll of Scotland Company,salaries for the period were $500,000.Federal income tax withheld was $98,000.Also,$15,000 was subject to state (4.2%)and federal (0.8%)unemployment taxes.All earnings are subject to social security tax of 6.0% and Medicare tax of 1.5%.

(Essay)

4.7/5  (27)

(27)

The journal entry a company uses to record fully funded pension rights for its salaried employees at the end of the year is

(Multiple Choice)

5.0/5  (41)

(41)

Martinez Co.borrowed $50,000 on March 1 of the current year by signing a 60-day,9%,interest-bearing note.Assuming a 360-day year,when the note is paid on April 30,the entry to record the payment should include a

(Multiple Choice)

4.8/5  (40)

(40)

On January 1,Zero Company obtained a $52,000,4-year,6.5% installment note from Regional Bank.The note requires annual payments consisting of principal and interest of $15,179,beginning on December 31 of the current year.The December 31,Year 1 carrying amount in the allocation of periodic payments table for this installment note will be equal to:

(Multiple Choice)

4.9/5  (40)

(40)

The amount borrowed is equal to the face amount of the note on an interest-bearing note payable.

(True/False)

4.8/5  (27)

(27)

Federal unemployment taxes are paid by the employer and the employee.

(True/False)

4.8/5  (44)

(44)

Showing 161 - 180 of 188

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)