Exam 3: Adjusting Accounts and Preparing Financial Statements

Exam 1: Introducing Accounting in Business280 Questions

Exam 2: Analyzing and Recording Transactions230 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements275 Questions

Exam 4: Reporting and Analyzing Merchandising Operations200 Questions

Exam 5: Reporting and Analyzing Inventories207 Questions

Exam 6: Reporting and Analyzing Cash and Internal Controls203 Questions

Exam 7: Reporting and Analyzing Receivables173 Questions

Exam 8: Reporting and Analyzing Long-Term Assets212 Questions

Exam 9: Reporting and Analyzing Current Liabilities195 Questions

Exam 10: Reporting and Analyzing Long-Term Liabilities192 Questions

Exam 11: Reporting and Analyzing Equity216 Questions

Exam 12: Reporting and Analyzing Cash Flows183 Questions

Exam 13: Analyzing and Interpreting Financial Statements190 Questions

Exam 14: Investments and International Operations179 Questions

Exam 15: Reporting and Analyzing Partnerships128 Questions

Exam 16: Reporting and Preparing Special Journals173 Questions

Select questions type

The current ratio is computed by dividing current liabilities by current assets.

Free

(True/False)

4.9/5  (43)

(43)

Correct Answer:

False

How is the profit margin calculated? Discuss its use in analyzing a company's performance.

Free

(Essay)

5.0/5  (32)

(32)

Correct Answer:

Profit margin is calculated by dividing net income by net sales.The resulting percent reflects the percent of profit a company makes for every dollar in sales.The profit margin ratio is useful in comparing a company's performance to that of its competitors and as a relative measure of the company's performance across periods.

On the work sheet,net income is entered in the Income Statement Credit column as well as the Balance Sheet Debit column.

Free

(True/False)

4.8/5  (33)

(33)

Correct Answer:

False

The following information is available for the Wooden Company:

2010 2009 2008 Net income 2,630 2,100 1,850 Net Sales 36,500 32,850 31,200 Total assets 400,000 385,000 350,000

From the information provided,calculate Wooden's profit margin ratio for each of the three years.Comment on the results,assuming that the industry average for the profit margin ratio is 6% for each of the three years.

(Essay)

4.7/5  (37)

(37)

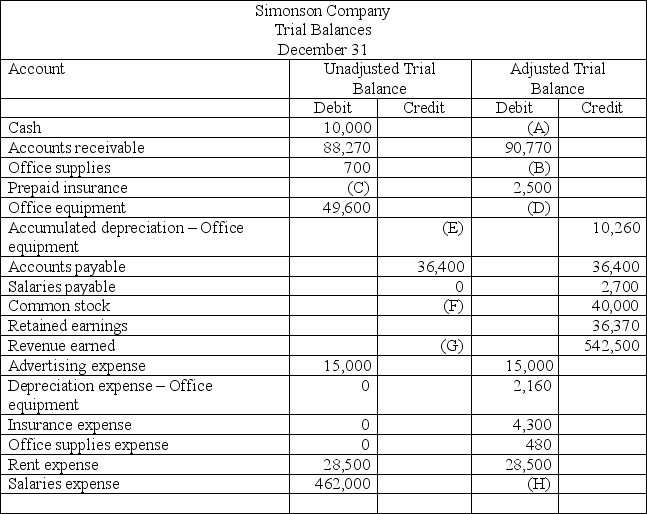

Shown below are selected data taken from the unadjusted and adjusted trial balances for the Simonson Company for the current year ended December 31.Determine the items A through H below.

(Essay)

4.8/5  (41)

(41)

Under the alternative method for accounting for unearned revenues,which of the following pairs of journal entry formats is correct?

Initial Entry Adjusting Entry

A.

Cash Unearned Consulting Revenue Unearned Consulting Revenue Consulting Revenue

B.

Cash Consulting Revenue Consulting Revenue Unearned Revenue

C.

Cash Unearned Revenue Unearned Revenue Cash

D.

Consulting Revenue Unearned Revenue Cash Consulting Revenue

E.

Cash Consulting Revenue Unearned Revenue Unearned Revenue

(Multiple Choice)

4.9/5  (30)

(30)

Before an adjusting entry is made to accrue employee salaries,Salaries Expense and Salaries Payable are both understated.

(True/False)

4.9/5  (38)

(38)

A publishing company records the subscriptions paid in advance by its customers in an account called Unearned Subscription Revenue.If the company fails to make the end-of-period adjusting entry to record the portion of the subscriptions that have been earned,one effect will be:

(Multiple Choice)

4.8/5  (40)

(40)

The periodic expense created by allocating the cost of plant and equipment to the periods in which they are used,representing the expense of using the assets is called:

(Multiple Choice)

4.8/5  (24)

(24)

Manning,Co.collected 6-months' rent in advance from a tenant on November 1 of the current year.When cash was collected,the following entry was made:

Nov. 01 Cash 15,000 Rent Revenue Earned 15,000

Prepare the required adjusting entry at December 31 of the current year.

(Essay)

4.7/5  (38)

(38)

__________________________ is the process of allocating the cost of plant assets to their expected useful lives.

(Short Answer)

4.9/5  (30)

(30)

The system of preparing financial statements based on recognizing revenues when the cash is received and reporting expenses when the cash is paid is called:

(Multiple Choice)

4.8/5  (38)

(38)

On April 1,2011,a company paid the $1,350 premium on a three-year insurance policy with benefits beginning on that date.What will be the insurance expense on the annual income statement for the year ended December 31,2011?

(Multiple Choice)

4.8/5  (39)

(39)

Due to an oversight,a company made no adjusting entry for accrued and unpaid employee wages of $24,000 on December 31.This oversight would:

(Multiple Choice)

4.8/5  (33)

(33)

Financial statements are typically prepared in the following order:

(Multiple Choice)

4.8/5  (33)

(33)

Match each definition to its term

Correct Answer:

Premises:

Responses:

(Matching)

4.8/5  (39)

(39)

A balance sheet that places the assets above the liabilities and equity is called a(n):

(Multiple Choice)

4.8/5  (42)

(42)

A company had revenue of $550,000,rent expense of $100,000,utility expense of $10,000,salary expense of $125,500,depreciation expense of $39,000,advertising expense of $40,200,dividends in the amount of $183,000,and an ending balance in retained earnings of $402,300.What is the appropriate journal entry to close income summary?

(Multiple Choice)

4.8/5  (37)

(37)

Given the table below,indicate the impact of the following errors made during the adjusting entry process.Use a "+" followed by the amount for overstatements,a "-" followed by the amount for understatements and a "0" for no effect.The first one is done as an example.

Ex.Failed to recognize that $600 of unearned revenues,previously recorded as liabilities,had been earned by year-end.

1.Failed to accrue salaries expense of $1,200.

2.Forgot to record $2,700 of depreciation on office equipment.

3.Failed to accrue $300 of interest on a note receivable.

Error Revenues Expenses Assets Liabilites Equity Ex. -\ 600 0 0 \ 600 -\ 600 1. 2. 3.

(Essay)

4.8/5  (48)

(48)

Showing 1 - 20 of 275

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)