Exam 14: Investments and International Operations

Exam 1: Introducing Accounting in Business280 Questions

Exam 2: Analyzing and Recording Transactions230 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements275 Questions

Exam 4: Reporting and Analyzing Merchandising Operations200 Questions

Exam 5: Reporting and Analyzing Inventories207 Questions

Exam 6: Reporting and Analyzing Cash and Internal Controls203 Questions

Exam 7: Reporting and Analyzing Receivables173 Questions

Exam 8: Reporting and Analyzing Long-Term Assets212 Questions

Exam 9: Reporting and Analyzing Current Liabilities195 Questions

Exam 10: Reporting and Analyzing Long-Term Liabilities192 Questions

Exam 11: Reporting and Analyzing Equity216 Questions

Exam 12: Reporting and Analyzing Cash Flows183 Questions

Exam 13: Analyzing and Interpreting Financial Statements190 Questions

Exam 14: Investments and International Operations179 Questions

Exam 15: Reporting and Analyzing Partnerships128 Questions

Exam 16: Reporting and Preparing Special Journals173 Questions

Select questions type

If a long-term investment in an equity security gives the investor significant influence over the investee,the investment is classified as available-for-sale.

(True/False)

4.8/5  (49)

(49)

Trading securities are securities that are purchased by trading other securities rather than by paying cash.

(True/False)

4.9/5  (33)

(33)

The following information is available from the financial statements of Cosmotropolis

2009 2010 2011 Total assets, December 31 \ 341,585 \ 395,412 \ 922,357 Net income 35,550 49,512 68,149

What is Cosmotropolis' return on total assets for 2010?

(Short Answer)

4.9/5  (42)

(42)

A U.S.Company's credit sale to an international customer to be paid in a foreign currency requires using the same exchange rate for the date of sale and the cash payment date.

(True/False)

4.8/5  (30)

(30)

Any cash dividends received from equity securities are recorded as Dividend Expense.

(True/False)

4.9/5  (33)

(33)

Long-term investments include investments in land or other assets not used in a company's operations.

(True/False)

4.8/5  (36)

(36)

Foreign exchange rates fluctuate due to many factors including changing political and economic conditions.

(True/False)

4.8/5  (33)

(33)

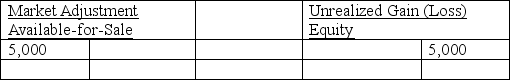

On May 1,Franke Co.purchases 2,000 shares of Computech stock for $25,000.This investment is considered to be an available-for-sale investment.On July 31 (Franke's year-end),the stock had a market value of $28,000.Franke should record a credit to Unrealized Gain-Equity for $3,000.

(True/False)

4.9/5  (36)

(36)

Haladam Company had the following transactions relating to investments in trading securities during the year.Prepare the required general journal entries for these transactions.

May 4 Haladam purchased 600 shares of Cob Company stock at per share plus a brokerage fee.

July 1 Haladam received a \$2.50 per share cash dividend on the Cob Company stock.

Sept. 15 Sold 300 shares of the Cob Company stock for per share, less a brokerage fee.

Dec. 31 The market value of the Cob Company stock (the only investment that Haladam owns) is \$124 per share. The balance of the Market Adjustment - Trading a zero balance prior to adjustment.

(Essay)

4.9/5  (33)

(33)

On January 4,2008,Larsen Company purchased 5,000 shares of Warner Company for $59,500 plus a broker's fee of $1,000.Warner Company has a total of 25,000 shares of common stock outstanding and it is presumed the Larsen Company will have a significant influence over Warner.During each of the next two years,Warner declared and paid cash dividends of $0.85 per share.Its net income was $72,000 and $67,000 for 2008 and 2009,respectively.The January 12,2010 entry to record the sale of 3,000 shares of Warner Company stock for $39,000 cash should be:

(Multiple Choice)

4.9/5  (36)

(36)

The price of one currency stated in terms of another currency is referred to as the:

(Multiple Choice)

4.7/5  (38)

(38)

If a company owns more than 20% of the stock of another company and the stock is being held as a long-term investment,which method would the investor normally use to account for this investment?

(Multiple Choice)

4.9/5  (47)

(47)

On January 2,Froxel Company purchased 10,000 shares of Sandia Corp.Common Stock at $19 per share plus a $3,000 commission.This represents 30% of Sandia Corp.'s outstanding stock.On August 6,Sandia Corp.declared and paid cash dividends of $1.75 per share and on December 31 it reported net income of $150,000.Prepare the necessary entries Froxel Company must make to account for these transactions and events.

(Essay)

4.9/5  (36)

(36)

A controlling influence over the investee is based on the investor owning voting stock exceeding:

(Multiple Choice)

4.8/5  (35)

(35)

If the exchange rate for Canadian and U.S.dollars is 0.7382 to 1,this implies that 2 Canadian dollars will buy 1.48 worth of U.S.dollars.

(True/False)

4.9/5  (35)

(35)

A company had investments in long-term available-for-sale securities.At the end of the current year the company's portfolio had a $731,000 cost and $730,000 market value.

What is the current year's adjustment to market value given the following account balances at the end of the prior year?

(Multiple Choice)

4.8/5  (43)

(43)

Showing 81 - 100 of 179

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)