Exam 18: Public Choice,taxes,and the Distribution of Income

Exam 1: Economics: Foundations and Models233 Questions

Exam 2: Trade-Offs, comparative Advantage, and the Market System259 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply242 Questions

Exam 4: Economic Efficiency, government Price Setting, and Taxes208 Questions

Exam 5: Externalities, environmental Policy, and Public Goods267 Questions

Exam 6: Elasticity: The Responsiveness of Demand and Supply295 Questions

Exam 7: The Economics of Health Care169 Questions

Exam 8: Firms, the Stock Market, and Corporate Governance278 Questions

Exam 9: Comparative Advantage and the Gains From International Trade189 Questions

Exam 10: Consumer Choice and Behavioral Economics302 Questions

Exam 11: Technology, production, and Costs330 Questions

Exam 12: Firms in Perfectly Competitive Markets298 Questions

Exam 13: Monopolistic Competition: the Competitive Model in a More Realistic Setting278 Questions

Exam 14: Oligopoly: Firms in Less Competitive Markets262 Questions

Exam 15: Monopoly and Antitrust Policy271 Questions

Exam 16: Pricing Strategy263 Questions

Exam 17: The Markets for Labor and Other Factors of Production286 Questions

Exam 18: Public Choice,taxes,and the Distribution of Income258 Questions

Select questions type

When the demand for a product is more elastic than the supply

(Multiple Choice)

4.8/5  (33)

(33)

Compare the distribution of income in the United States with the distribution of income in other high-income countries.

(Essay)

4.9/5  (35)

(35)

The median voter theorem states that the outcome of a majority vote is likely to represent the preferences of the voter who is in the political middle.

(True/False)

4.8/5  (41)

(41)

If official poverty statistics for the United States included transfer payments individuals receive from the government,such as Social Security payments and other non-cash benefits such as food stamps,

(Multiple Choice)

4.9/5  (33)

(33)

Between 1980 and 2011,income inequality in the United States has increased in part due to expanding international trade.How does expanding international trade contribute to income inequality?

(Multiple Choice)

4.9/5  (37)

(37)

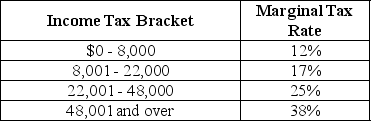

Table 18-6

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Calpernia.

-Refer to Table 18-6.Calculate the income tax paid by Sasha,a single taxpayer with an income of $60,000.

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Calpernia.

-Refer to Table 18-6.Calculate the income tax paid by Sasha,a single taxpayer with an income of $60,000.

(Multiple Choice)

4.9/5  (36)

(36)

Between 1970 and 2006,the poverty rate in East Asia declined dramatically from about 60 percent to less than 2 percent,while the poverty rate in Sub-Saharan Africa decreased from 40 percent to only 32 percent.The main reason for this is that

(Multiple Choice)

4.8/5  (40)

(40)

Suppose the government imposes an 8 percent sales tax on clothing items and the tax is levied on sellers.Who pays for the tax in this situation? (Assume that the demand curve is downward-sloping and that the supply curve is upward-sloping.)

(Multiple Choice)

4.8/5  (37)

(37)

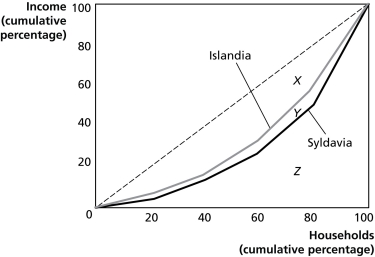

Which of the following summarizes the information provided by a Lorenz curve?

(Multiple Choice)

4.8/5  (30)

(30)

The largest source of revenue for the federal government of the United States is from

(Multiple Choice)

4.7/5  (36)

(36)

The proposition that the outcome of a majority vote is likely to represent the preferences of the voter who is in the political middle is called

(Multiple Choice)

4.8/5  (32)

(32)

Article Summary

In 2012, Colorado and Washington legalized marijuana for recreational use, and one of the major selling points in each state's pro-marijuana campaign was the possibility of generating millions of dollars in tax revenue from sales which could be used for funding general education. The Colorado legislature was weighing a proposal to tax marijuana at 30 percent, of which 15 percent would be a sales tax on consumers and 15 percent an excise tax on growers. Washington has set a tax rate of 44 percent on consumers and 25 percent each for growers and retailers. Since the legalization of marijuana is relatively new, projecting the economic impact of its sale is difficult, leading to many questions as to the quantities that will be produced and sold and what actual tax revenues will be generated.

Source: Elizabeth Dwoskin, "Colorado and Washington Try to Figure Out How to Tax Marijuana," Bloomberg Businessweek, April 26, 2013.

-Refer to the Article Summary.Colorado is weighing a proposal to tax marijuana at 30 percent,of which 15 percent would be a sales tax on consumers and 15 percent would be an excise tax on growers.Suppose the actual burden of the tax falls 80 percent on consumers and 20 percent on producers.In this case,consumers will actually bear the tax burden of ________ percent of the selling price and producers will actually bear the tax burden of ________ percent of the selling price.

(Multiple Choice)

4.9/5  (34)

(34)

If the government wants to minimize the welfare loss of a tax,it should tax goods with more inelastic demands or supplies.

(True/False)

4.9/5  (40)

(40)

Figure 18-6  Figure 18-6 shows the Lorenz curves for Islandia and Syldavia.

-Refer to Figure 18-6.Which country has the more unequal distribution of income?

Figure 18-6 shows the Lorenz curves for Islandia and Syldavia.

-Refer to Figure 18-6.Which country has the more unequal distribution of income?

(Multiple Choice)

4.9/5  (43)

(43)

The person or firm that pays a tax bears the burden of the tax.

(True/False)

4.8/5  (40)

(40)

Showing 221 - 240 of 258

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)