Exam 18: Public Choice,taxes,and the Distribution of Income

Exam 1: Economics: Foundations and Models233 Questions

Exam 2: Trade-Offs, comparative Advantage, and the Market System259 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply242 Questions

Exam 4: Economic Efficiency, government Price Setting, and Taxes208 Questions

Exam 5: Externalities, environmental Policy, and Public Goods267 Questions

Exam 6: Elasticity: The Responsiveness of Demand and Supply295 Questions

Exam 7: The Economics of Health Care169 Questions

Exam 8: Firms, the Stock Market, and Corporate Governance278 Questions

Exam 9: Comparative Advantage and the Gains From International Trade189 Questions

Exam 10: Consumer Choice and Behavioral Economics302 Questions

Exam 11: Technology, production, and Costs330 Questions

Exam 12: Firms in Perfectly Competitive Markets298 Questions

Exam 13: Monopolistic Competition: the Competitive Model in a More Realistic Setting278 Questions

Exam 14: Oligopoly: Firms in Less Competitive Markets262 Questions

Exam 15: Monopoly and Antitrust Policy271 Questions

Exam 16: Pricing Strategy263 Questions

Exam 17: The Markets for Labor and Other Factors of Production286 Questions

Exam 18: Public Choice,taxes,and the Distribution of Income258 Questions

Select questions type

Which of the following is used to argue that the self-interest of public policymakers will often lead to actions that are inconsistent with the preferences of the voters they represent?

(Multiple Choice)

4.8/5  (35)

(35)

What is the term that explains why voters often lack knowledge of pending legislation,and lack knowledge of the views of candidates for office on a range of issues that affect their own (the voters')welfare?

(Multiple Choice)

4.8/5  (40)

(40)

The horizontal-equity principle of taxation is not easy to use in practice because

(Multiple Choice)

4.9/5  (41)

(41)

A study by the Congressional Budget Office (CBO)regarding the corporate income tax included the following statement: "A corporation may write its check to the Internal Revenue Service for payment of the corporate income tax,but the money must come from somewhere..." The comments that followed this statement argued that

(Multiple Choice)

4.8/5  (35)

(35)

If you pay $2,000 in taxes on an income of $20,000,and a tax of $3,500 on an income of $30,000,then over this range of income the tax is

(Multiple Choice)

4.7/5  (37)

(37)

The "ability-to-pay" principle of taxation is the normative idea that

(Multiple Choice)

4.8/5  (35)

(35)

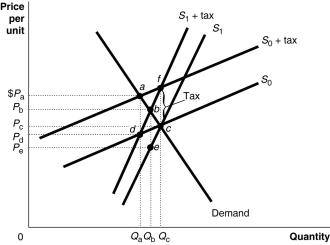

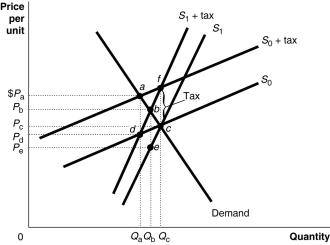

Figure 18-2  Figure 18-2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

-Refer to Figure 18-2.If the government imposes an excise tax of $1.00 on every unit sold,the consumer's burden of the tax

Figure 18-2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

-Refer to Figure 18-2.If the government imposes an excise tax of $1.00 on every unit sold,the consumer's burden of the tax

(Multiple Choice)

4.8/5  (38)

(38)

If you pay $2,000 in taxes on an income of $20,000,and a tax of $3,000 on an income of $30,000,then over this range of income the tax is

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following is not an example of rent seeking behavior?

(Multiple Choice)

4.8/5  (36)

(36)

Economist Kenneth Arrow has shown mathematically that no system of voting will consistently represent the underlying preferences of voters.This finding is called

(Multiple Choice)

4.8/5  (36)

(36)

Suppose the equilibrium price and quantity of a 12-pack of Dr.Pepper are $5.00 and 10,000 12-packs,respectively,and the government decides to impose a $1.00 tax on every 12-pack of carbonated soft drinks.Draw two supply and demand graphs,one showing the excess burden of the tax when supply is less elastic and the other showing the excess burden of the tax when supply is more elastic.Identify the excess burden of the tax on each graph.On which graph is the excess burden the greatest?

(Essay)

4.9/5  (38)

(38)

A tax imposed by a state or local government on retail sales of most products is

(Multiple Choice)

4.7/5  (34)

(34)

Figure 18-2  Figure 18-2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

-Refer to Figure 18-2.If the government imposes an excise tax of $1.00 on every unit sold,the consumer's burden of the tax

Figure 18-2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

-Refer to Figure 18-2.If the government imposes an excise tax of $1.00 on every unit sold,the consumer's burden of the tax

(Multiple Choice)

4.8/5  (47)

(47)

Which of the following is a consequence of the voting paradox?

(Multiple Choice)

4.8/5  (31)

(31)

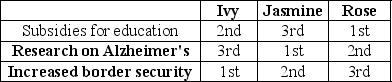

Table 18-1

Suppose $1 billion is available in the budget and Congress is considering allocating the funds to one of the following three alternatives: 1) Subsidies for education, 2) Research on Alzheimer's or 3) Increased border security. Table 18-1 shows three voters' rankings of the alternatives.

-Refer to Table 18-1.Suppose a series of votes are taken in which each pair of alternatives is considered in turn.The first pair considered is between subsidies for education and research on Alzheimer's.The second pair considered is between Alzheimer's research and increased border security.The third pair considered is between education subsidies and increased border security.In this case,the collective preferences of the voters

Suppose $1 billion is available in the budget and Congress is considering allocating the funds to one of the following three alternatives: 1) Subsidies for education, 2) Research on Alzheimer's or 3) Increased border security. Table 18-1 shows three voters' rankings of the alternatives.

-Refer to Table 18-1.Suppose a series of votes are taken in which each pair of alternatives is considered in turn.The first pair considered is between subsidies for education and research on Alzheimer's.The second pair considered is between Alzheimer's research and increased border security.The third pair considered is between education subsidies and increased border security.In this case,the collective preferences of the voters

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following groups had the highest poverty rate in 2011 in the United States?

(Multiple Choice)

4.8/5  (40)

(40)

The idea that individuals should be taxed in proportion to the marginal benefits that they receive from public goods is called

(Multiple Choice)

4.7/5  (32)

(32)

Showing 141 - 160 of 258

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)