Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions

Exam 1: The Equity Method of Accounting for Investments119 Questions

Exam 2: Consolidation of Financial Information107 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition122 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership116 Questions

Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions127 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues115 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes115 Questions

Exam 8: Segment and Interim Reporting116 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk93 Questions

Exam 10: Translation of Foreign Currency Financial Statements97 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards60 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission77 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations83 Questions

Exam 14: Partnerships: Formation and Operation88 Questions

Exam 15: Partnerships: Termination and Liquidation73 Questions

Exam 16: Accounting for State and Local Governments78 Questions

Exam 17: Accounting for State and Local Governments49 Questions

Exam 18: Accounting and Reporting for Private Not-For-Profit Organizations62 Questions

Exam 19: Accounting for Estates and Trusts80 Questions

Select questions type

Why do intra-entity transfers between the component companies of a business combination occur so frequently?

(Essay)

4.9/5  (39)

(39)

Walsh Company sells inventory to its subsidiary, Fisher Company, at a profit during 2012. One-third of the inventory is sold by Walsh uses the equity method to account for its investment in Fisher.

In the consolidation worksheet for 2012, which of the following choices would be a debit entry to eliminate unrealized intra-entity gross profit with regard to the 2012 intra-entity sales?

(Multiple Choice)

4.8/5  (30)

(30)

During 2013, Edwards Co. sold inventory to its parent company, Forsyth Corp. Forsyth still owned the entire inventory purchased at the end of 2013. Why must the gross profit on the sale be deferred when consolidated financial statements are prepared at the end of 2013?

(Essay)

4.9/5  (36)

(36)

Stark Company, a 90% owned subsidiary of Parker, Inc. sold land to Parker on May 1, 2012, for $80,000. The land originally cost Stark $85,000. Stark reported net income of $200,000, $180,000, and $220,000 for 2012, 2013, and 2014, respectively. Parker sold the land purchased from Stark in 2012 for $92,000 in 2014.

Compute Stark's reported gain or loss relating to the land for 2014.

(Multiple Choice)

4.9/5  (39)

(39)

Strayten Corp. is a wholly owned subsidiary of Quint Inc. Quint decided to use the initial value method to account for this investment. During 2013, Strayten sold Quint goods which had cost $48,000. The selling price was $64,000. Quint still had one-eighth of the goods purchased from Strayten on hand at the end of 2013.

Required:

Prepare Consolidation Entry *G, which would have to be recorded at the end of 2013.

(Essay)

4.9/5  (33)

(33)

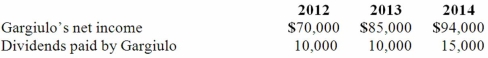

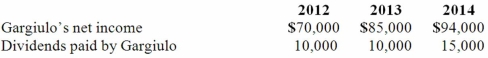

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2012.  Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.  Compute the non-controlling interest in Gargiulo's net income for 2012.

Compute the non-controlling interest in Gargiulo's net income for 2012.

(Multiple Choice)

4.9/5  (31)

(31)

Gentry Inc. acquired 100% of Gaspard Farms on January 5, 2012. During 2012, Gentry sold Gaspard Farms for $625,000 goods which had cost $425,000. Gaspard Farms still owned 12% of the goods at the end of the year. In 2013, Gentry sold goods with a cost of $800,000 to Gaspard Farms for $1,000,000, and Gaspard Farms still owned 10% of the goods at year-end. For 2013, cost of goods sold was $5,400,000 for Gentry and $1,200,000 for Gaspard Farms. What was consolidated cost of goods sold for 2013?

(Multiple Choice)

4.8/5  (30)

(30)

Stiller Company, an 80% owned subsidiary of Leo Company, purchased land from Leo on March 1, 2012, for $75,000. The land originally cost Leo $60,000. Stiller reported net income of $125,000 and $140,000 for 2012 and 2013, respectively. Leo uses the equity method to account for its investment.

Compute income from Stiller on Leo's books for 2012.

(Multiple Choice)

4.8/5  (28)

(28)

Pepe, Incorporated acquired 60% of Devin Company on January 1, 2012. On that date Devin sold equipment to Pepe for $45,000. The equipment had a cost of $120,000 and accumulated depreciation of $66,000 with a remaining life of 9 years. Devin reported net income of $300,000 and $325,000 for 2012 and 2013, respectively. Pepe uses the equity method to account for its investment in Devin.

Compute the non-controlling interest in the net income of Devin for 2013.

(Multiple Choice)

4.7/5  (35)

(35)

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2012.  Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.  For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2012 consolidation worksheet entry with regard to the unrealized gross profit of the 2012 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2012 consolidation worksheet entry with regard to the unrealized gross profit of the 2012 intra-entity transfer of merchandise?

(Multiple Choice)

4.9/5  (35)

(35)

Parent sold land to its subsidiary for a gain in 2010. The subsidiary sold the land externally for a gain in 2013. Which of the following statements is true?

(Multiple Choice)

4.8/5  (42)

(42)

An intra-entity sale took place whereby the transfer price was less than the book value of a depreciable asset. Which statement is true for the year following the sale?

(Multiple Choice)

4.8/5  (31)

(31)

Pepe, Incorporated acquired 60% of Devin Company on January 1, 2012. On that date Devin sold equipment to Pepe for $45,000. The equipment had a cost of $120,000 and accumulated depreciation of $66,000 with a remaining life of 9 years. Devin reported net income of $300,000 and $325,000 for 2012 and 2013, respectively. Pepe uses the equity method to account for its investment in Devin.

What is the consolidated gain or loss on equipment for 2012?

(Multiple Choice)

4.9/5  (38)

(38)

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2012.  Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.  Compute the equity in earnings of Gargiulo reported on Posito's books for 2013.

Compute the equity in earnings of Gargiulo reported on Posito's books for 2013.

(Multiple Choice)

4.8/5  (36)

(36)

An intra-entity sale took place whereby the transfer price exceeded the book value of a depreciable asset. Which statement is true for the year following the sale?

(Multiple Choice)

4.8/5  (43)

(43)

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2012.  Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.  For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2013 consolidation worksheet entry with regard to the unrealized gross profit of the 2012 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2013 consolidation worksheet entry with regard to the unrealized gross profit of the 2012 intra-entity transfer of merchandise?

(Multiple Choice)

4.8/5  (40)

(40)

Stark Company, a 90% owned subsidiary of Parker, Inc. sold land to Parker on May 1, 2012, for $80,000. The land originally cost Stark $85,000. Stark reported net income of $200,000, $180,000, and $220,000 for 2012, 2013, and 2014, respectively. Parker sold the land purchased from Stark in 2012 for $92,000 in 2014.

Compute the gain or loss relating to the land that will be reported in consolidated net income for 2014.

(Multiple Choice)

4.8/5  (40)

(40)

When comparing the difference between an upstream and downstream transfer of inventory, and using the initial value method, which of the following statements is true when there is a non-controlling interest?

(Multiple Choice)

4.9/5  (31)

(31)

Strickland Company sells inventory to its parent, Carter Company, at a profit during 2012. One-third of the inventory is sold by Carter in 2012.

In the consolidation worksheet for 2012, which of the following choices would be a credit entry to eliminate unrealized intra-entity gross profit with regard to the 2012 intra-entity sales?

(Multiple Choice)

4.9/5  (36)

(36)

On November 8, 2013, Power Corp. sold land to Wood Co., its wholly owned subsidiary. The land cost $61,500 and was sold to Wood for $89,000. From the perspective of the combination, when is the gain on the sale of the land realized?

(Multiple Choice)

4.9/5  (39)

(39)

Showing 21 - 40 of 127

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)