Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions

Exam 1: The Equity Method of Accounting for Investments119 Questions

Exam 2: Consolidation of Financial Information107 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition122 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership116 Questions

Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions127 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues115 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes115 Questions

Exam 8: Segment and Interim Reporting116 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk93 Questions

Exam 10: Translation of Foreign Currency Financial Statements97 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards60 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission77 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations83 Questions

Exam 14: Partnerships: Formation and Operation88 Questions

Exam 15: Partnerships: Termination and Liquidation73 Questions

Exam 16: Accounting for State and Local Governments78 Questions

Exam 17: Accounting for State and Local Governments49 Questions

Exam 18: Accounting and Reporting for Private Not-For-Profit Organizations62 Questions

Exam 19: Accounting for Estates and Trusts80 Questions

Select questions type

McGraw Corp. owned all of the voting common stock of both Ritter Co. and Lawler Co. During 2013, Ritter sold inventory to Lawler. The goods had cost Ritter $65,000, and they were sold to Lawler for $100,000. At the end of 2013, Lawler still held 30% of the inventory.

Required:

How should the sale between Lawler and Ritter be accounted for in a consolidation worksheet? Show worksheet entries to support your answer.

(Essay)

4.7/5  (23)

(23)

Stark Company, a 90% owned subsidiary of Parker, Inc. sold land to Parker on May 1, 2012, for $80,000. The land originally cost Stark $85,000. Stark reported net income of $200,000, $180,000, and $220,000 for 2012, 2013, and 2014, respectively. Parker sold the land purchased from Stark in 2012 for $92,000 in 2014.

Which of the following will be included in a consolidation entry for 2012?

(Multiple Choice)

4.7/5  (32)

(32)

Patti Company owns 80% of the common stock of Shannon, Inc. In the current year, Patti reports sales of $10,000,000 and cost of goods sold of $7,500,000. For the same period, Shannon has sales of $200,000 and cost of goods sold of $160,000. During the year, Patti sold merchandise to Shannon for $60,000 at a price based on the normal markup. At the end of the year, Shannon still possesses 30 percent of this inventory.

Compute consolidated sales.

(Multiple Choice)

4.8/5  (38)

(38)

Stark Company, a 90% owned subsidiary of Parker, Inc. sold land to Parker on May 1, 2012, for $80,000. The land originally cost Stark $85,000. Stark reported net income of $200,000, $180,000, and $220,000 for 2012, 2013, and 2014, respectively. Parker sold the land purchased from Stark in 2012 for $92,000 in 2014.

Compute Parker's reported gain or loss relating to the land for 2014.

(Multiple Choice)

4.8/5  (42)

(42)

Virginia Corp. owned all of the voting common stock of Stateside Co. Both companies use the perpetual inventory method, and Virginia decided to use the partial equity method to account for this investment. During 2012, Virginia made cash sales of $400,000 to Stateside. The gross profit rate was 30% of the selling price. By the end of 2012, Stateside had sold 75% of the goods to outside parties for $420,000 cash.

Prepare the consolidation entries that should be made at the end of 2012.

(Essay)

4.9/5  (36)

(36)

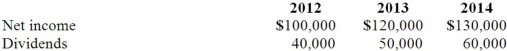

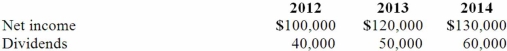

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2012.  Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.  For consolidation purposes, what amount would be debited to cost of goods sold for the 2014 consolidation worksheet with regard to the unrealized gross profit of the 2014 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to cost of goods sold for the 2014 consolidation worksheet with regard to the unrealized gross profit of the 2014 intra-entity transfer of merchandise?

(Multiple Choice)

4.7/5  (39)

(39)

Pot Co. holds 90% of the common stock of Skillet Co. During 2013, Pot reported sales of $1,120,000 and cost of goods sold of $840,000. For this same period, Skillet had sales of $420,000 and cost of goods sold of $252,000.

Included in the amounts for Pot's sales were Pot's sales for merchandise to Skillet for $140,000. There were no sales from Skillet to Pot. Intra-entity sales had the same markup as sales to outsiders. Skillet had resold all of the intra-entity purchases from Pot to outside parties during 2013. What are consolidated sales and cost of goods sold for 2013?

(Multiple Choice)

4.8/5  (43)

(43)

Hambly Corp. owned 80% of the voting common stock of Stroban Co. During 2013, Stroban sold a parcel of land to Hambly. The land had a book value of $82,000 and was sold to Hambly for $145,000. Stroban's reported net income for 2013 was $119,000.

Required:

What was the non-controlling interest's share of Stroban Co.'s net income?

(Essay)

4.8/5  (36)

(36)

Wilson owned equipment with an estimated life of 10 years when it was acquired for an original cost of $80,000. The equipment had a book value of $50,000 at January 1, 2012. On January 1, 2012, Wilson realized that the useful life of the equipment was longer than originally anticipated, at ten remaining years.

On April 1, 2012 Simon Company, a 90% owned subsidiary of Wilson Company, bought the equipment from Wilson for $68,250 and for depreciation purposes used the estimated remaining life as of that date. The following data are available pertaining to Simon's income and dividends:  Compute Wilson's share of income from Simon for consolidation for 2013.

Compute Wilson's share of income from Simon for consolidation for 2013.

(Multiple Choice)

4.8/5  (30)

(30)

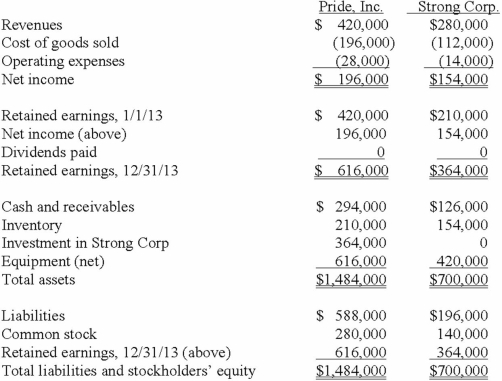

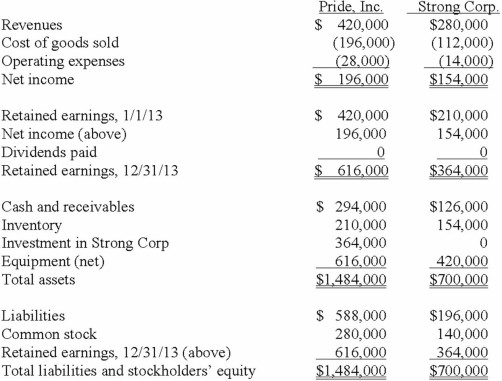

On January 1, 2013, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired.

As of December 31, 2013, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2013, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31, 2013.

What is the consolidated total for equipment (net) at December 31, 2013?

During 2013, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31, 2013.

What is the consolidated total for equipment (net) at December 31, 2013?

(Multiple Choice)

4.9/5  (40)

(40)

Strickland Company sells inventory to its parent, Carter Company, at a profit during 2012. One-third of the inventory is sold by Carter in 2012.

In the consolidation worksheet for 2012, which of the following choices would be a credit entry to eliminate the intra-entity transfer of inventory?

(Multiple Choice)

4.9/5  (38)

(38)

An intra-entity sale took place whereby the book value exceeded the transfer price of a depreciable asset. Which statement is true for the year following the sale?

(Multiple Choice)

4.8/5  (37)

(37)

Throughout 2013, Cleveland Co. sold inventory to Leeward Co., its subsidiary. From a consolidated point of view, when will the gain on this transfer be earned?

(Essay)

4.8/5  (36)

(36)

Clemente Co. owned all of the voting common stock of Snider Co. On January 2, 2012, Clemente sold equipment to Snider for $125,000. The equipment had cost Clemente $140,000. At the time of the sale, the balance in accumulated depreciation was $40,000. The equipment had a remaining useful life of five years and a $0 salvage value. Straight-line depreciation is used by both Clemente and Snider.

At what amount should the equipment (net of depreciation) be included in the consolidated balance sheet dated December 31, 2012?

(Multiple Choice)

4.8/5  (33)

(33)

Wilson owned equipment with an estimated life of 10 years when it was acquired for an original cost of $80,000. The equipment had a book value of $50,000 at January 1, 2012. On January 1, 2012, Wilson realized that the useful life of the equipment was longer than originally anticipated, at ten remaining years.

On April 1, 2012 Simon Company, a 90% owned subsidiary of Wilson Company, bought the equipment from Wilson for $68,250 and for depreciation purposes used the estimated remaining life as of that date. The following data are available pertaining to Simon's income and dividends:  Compute the amortization of gain through a depreciation adjustment for 2014 for consolidation purposes.

Compute the amortization of gain through a depreciation adjustment for 2014 for consolidation purposes.

(Multiple Choice)

4.8/5  (37)

(37)

On January 1, 2013, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired.

As of December 31, 2013, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2013, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31, 2013.

What is the total of consolidated cost of goods sold?

During 2013, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31, 2013.

What is the total of consolidated cost of goods sold?

(Multiple Choice)

4.9/5  (43)

(43)

Pepe, Incorporated acquired 60% of Devin Company on January 1, 2012. On that date Devin sold equipment to Pepe for $45,000. The equipment had a cost of $120,000 and accumulated depreciation of $66,000 with a remaining life of 9 years. Devin reported net income of $300,000 and $325,000 for 2012 and 2013, respectively. Pepe uses the equity method to account for its investment in Devin.

Compute the income from Devin reported on Pepe's books for 2013.

(Multiple Choice)

5.0/5  (32)

(32)

Pot Co. holds 90% of the common stock of Skillet Co. During 2013, Pot reported sales of $1,120,000 and cost of goods sold of $840,000. For this same period, Skillet had sales of $420,000 and cost of goods sold of $252,000.

Included in the amounts for Pot's sales were Pot's sales of merchandise to Skillet for $140,000. There were no sales from Skillet to Pot. Intra-entity sales had the same markup as sales to outsiders. Skillet still had 40% of the intra-entity sales as inventory at the end of 2013. What are consolidated sales and cost of goods sold for 2013?

(Multiple Choice)

4.8/5  (49)

(49)

What is meant by unrealized inventory gains, and how are they treated on a consolidation worksheet?

(Essay)

4.9/5  (37)

(37)

What is the purpose of the adjustments to depreciation expense within the consolidation process when there has been an intra-entity transfer of a depreciable asset?

(Essay)

4.9/5  (38)

(38)

Showing 61 - 80 of 127

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)