Exam 4: The Balance Sheet and the Statement of Shareholders Equity

Exam 1: The Demand for and Supply of Financial Accounting Information89 Questions

Exam 2: Financial Reporting: Its Conceptual Framework87 Questions

Exam 3: Review of a Companys Accounting System146 Questions

Exam 5: The Income Statement and the Statement of Cash Flows151 Questions

Exam 6: Cash and Receivables149 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions123 Questions

Exam 8: Inventories: Special Valuation Issues148 Questions

Exam 9: Current Liabilities and Contingencies128 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments105 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal143 Questions

Exam 12: Intangibles105 Questions

Exam 13: Investments and Long-Term Receivables140 Questions

Exam 14: Financing Liabilities: Bonds and Notes Payable171 Questions

Exam 15: Contributed Capital154 Questions

Exam 17: Advanced Issues in Revenue Recognition113 Questions

Exam 18: Accounting for Income Taxes108 Questions

Exam 19: Accounting for Postretirement Benefits98 Questions

Exam 20: Accounting for Leases149 Questions

Exam 21: The Statement of Cash Flows107 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Time Value of Money Module121 Questions

Select questions type

Mark to Market is another name for fair value accounting which has becoming increasingly popular with U.S. GAAP for the valuation of gains and losses associated with assets and liabilities.

Free

(True/False)

4.7/5  (39)

(39)

Correct Answer:

False

Certain differences exist between IFRS and U.S. GAAP financial statement reporting. Which of the following is false?

Free

(Multiple Choice)

4.8/5  (37)

(37)

Correct Answer:

C

Trademarks or acquired brand names are not amortized but are reviewed annually for impairment.

Free

(True/False)

4.9/5  (32)

(32)

Correct Answer:

True

What three processes must be completed in order for the elements of the balance sheet to be reported by a specific company?

(Essay)

4.9/5  (34)

(34)

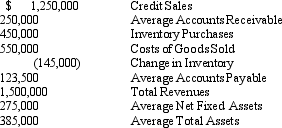

The following is from the financial reports of Sledge Company:  Required:

Calculate the following to three decimal places:

Calculate the following to three decimal places:

a)Fixed Asset Turnover

b)Total Asset Turnover

c)Accounts Payable Turnover

d)Accounts Payable Turnover in Days

e)Accounts Receivable Turnover

f)Accounts Receivable Turnover in Days

Required:

Calculate the following to three decimal places:

Calculate the following to three decimal places:

a)Fixed Asset Turnover

b)Total Asset Turnover

c)Accounts Payable Turnover

d)Accounts Payable Turnover in Days

e)Accounts Receivable Turnover

f)Accounts Receivable Turnover in Days

(Essay)

5.0/5  (46)

(46)

A friend comes to you with a set of financial statements that he thinks contains an error. The footnotes contain a note on a bond issue sold after the end of the reporting period. Your friend is sure this is an error because the transaction occurred after the cutoff date for the financial statements.

Required:

Explain to your friend why certain items that occur after the end of an accounting period are included in the financial statements and the manner in which they can be disclosed.

(Essay)

4.7/5  (33)

(33)

GAAP disclosures for fair value measurements now require that fair value measurements using Level 3 inputs include all of the following except

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following account titles are not allowed under GAAP?

(Multiple Choice)

4.8/5  (42)

(42)

From what two perspectives does the balance sheet report the financial position of a company?

(Short Answer)

4.9/5  (39)

(39)

In order for an external user of a company's financial statements to fully understand the in workings of the company, their accounting policies, practices, and methods must be disclosed. The disclosure of revenue recognition and asset allocations is important. When is it particularly important for this information to be disclosed?

(Essay)

4.9/5  (40)

(40)

To be recognized in the financial statements, an item must meet the definition of an element and be

(Multiple Choice)

4.9/5  (33)

(33)

Information about a company's operating capability may be helpful to external users in

(Multiple Choice)

4.9/5  (43)

(43)

Which of the following statements is false regarding the hierarchy of fair value measurements now provided in GAAP?

(Multiple Choice)

4.8/5  (42)

(42)

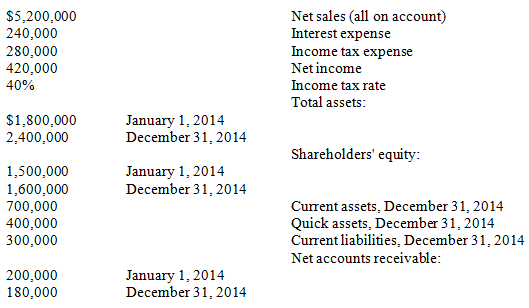

Exhibit 4-1 Given the following information for Blue Bell Company:  -Refer to Exhibit 4-1. Blue Bell's current ratio at December 31, 2014 was

-Refer to Exhibit 4-1. Blue Bell's current ratio at December 31, 2014 was

(Multiple Choice)

4.8/5  (38)

(38)

Individual assets are measured using one of five alternative methods. These methods are listed below, followed by a series of descriptive statements. a. historical cost

b. current replacement cost

c. fair value

d. net realizable value

e. present value

1.The amount of cash into which an asset is expected to be converted, less any expected conversion costs.

2.The amount of cash that would be required to obtain the same asset on the date of the balance sheet.

3.The net amount of discounted expected cash flows relating to the asset.

4.The amount of cash that could be obtained on the balance sheet date if the asset were sold in its present condition in an orderly liquidation.

5.The amount of cash paid for the asset when it was originally acquired.

Required:

Match each measurement alternative with its descriptive statement by placing the appropriate letter in the space provided.

(Essay)

4.8/5  (36)

(36)

A comparison of a company's performance with that of its competitors is known as

(Multiple Choice)

5.0/5  (34)

(34)

Which of the following is not included in comprehensive income?

(Multiple Choice)

4.8/5  (34)

(34)

A reader might find information about gain contingencies in an annual report by examining

(Multiple Choice)

4.9/5  (41)

(41)

A leased asset under capital lease is disclosed on the balance sheet at its

(Multiple Choice)

4.9/5  (30)

(30)

Under IFRS, liabilities and shareholders' equity on the balance sheet usually appear in which order?

(Multiple Choice)

4.9/5  (45)

(45)

Showing 1 - 20 of 112

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)