Exam 17: Advanced Issues in Revenue Recognition

Exam 1: The Demand for and Supply of Financial Accounting Information89 Questions

Exam 2: Financial Reporting: Its Conceptual Framework87 Questions

Exam 3: Review of a Companys Accounting System146 Questions

Exam 5: The Income Statement and the Statement of Cash Flows151 Questions

Exam 6: Cash and Receivables149 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions123 Questions

Exam 8: Inventories: Special Valuation Issues148 Questions

Exam 9: Current Liabilities and Contingencies128 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments105 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal143 Questions

Exam 12: Intangibles105 Questions

Exam 13: Investments and Long-Term Receivables140 Questions

Exam 14: Financing Liabilities: Bonds and Notes Payable171 Questions

Exam 15: Contributed Capital154 Questions

Exam 17: Advanced Issues in Revenue Recognition113 Questions

Exam 18: Accounting for Income Taxes108 Questions

Exam 19: Accounting for Postretirement Benefits98 Questions

Exam 20: Accounting for Leases149 Questions

Exam 21: The Statement of Cash Flows107 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Time Value of Money Module121 Questions

Select questions type

Under GAAP, the franchisor recognizes the initial franchise fee as revenue when it has substantially performed all material services. What does substantial performance mean?

Free

(Essay)

4.8/5  (43)

(43)

Correct Answer:

1) the franchisor has no obligation to refund any cash received or forgive any unpaid notes receivable.

2) the franchisor has performed substantially all the services as required under the franchise agreement.

Which one of the following types of service costs are deferred and expensed only when the related service revenue is recognized?

Free

(Multiple Choice)

4.9/5  (33)

(33)

Correct Answer:

D

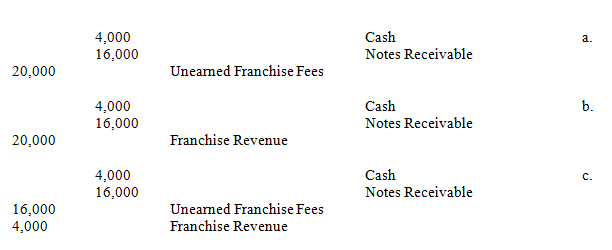

Bel Air, Inc. sold a franchise that required an initial franchise fee of $20,000. A 20% down payment was required, and the balance was covered by the issuance of a 6% note, payable by the franchisee in ten equal annual installments. The collectibility of the note was reasonably assured.

Required:

Prepare the appropriate journal entry to record this franchise fee if:

a.The refund period had expired but all material services had not been substantially performed by the franchisor.

b.The refund period had expired and the franchisor had performed all material services for the franchisee.

c.The refund period had expired, the down payment represents payment for material services performed, and material services remain to be performed.

Free

(Essay)

4.8/5  (33)

(33)

Correct Answer:

SEC Staff Accounting Bulletin 106 summarizes the SEC's view of when recognition of revenue should occur.

(True/False)

4.8/5  (34)

(34)

If material, the gross profit from installment sales should be

(Multiple Choice)

4.7/5  (33)

(33)

The QD Company sells franchises. The company charges $50,000 for the initial franchise fee. A down payment of $10,000 is required as part of the franchise agreement. A note payable for the remaining balance is issued at a 10% interest rate payable in four equal annual installments.

Required:

For each of the following independent situations prepare the necessary journal entries for QD to record the initial franchise fee.

(Essay)

4.8/5  (37)

(37)

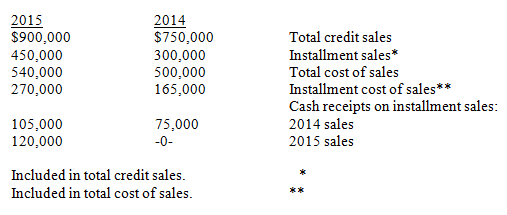

Frederick Corporation incurred the following activity during its first two years of operations:  Required:

Determine the following items for both 2014 and 2015:

a.Gross profit realized on installment sales.

b.Total gross profit.

c.Net amount for installment accounts receivable shown on the balance sheet.

Required:

Determine the following items for both 2014 and 2015:

a.Gross profit realized on installment sales.

b.Total gross profit.

c.Net amount for installment accounts receivable shown on the balance sheet.

(Essay)

4.8/5  (35)

(35)

Theoretically, for revenue to be recognized the risks and benefits of ownership must have been transferred to the buyer. This refers to

(Multiple Choice)

4.7/5  (47)

(47)

For long-term construction contracts, when there is not assurance that the buyer can be expected to satisfy its obligations under a contract, which of the following revenue recognition methods is preferable?

(Multiple Choice)

4.9/5  (36)

(36)

When Partial Billings exceeds Construction in Progress, under the completed-contract method the two accounts are reported together on the balance sheet in the

(Multiple Choice)

4.9/5  (44)

(44)

The percentage-of-completion method and the proportional performance method are methods that recognize revenue at a point in the earnings process completed.

(True/False)

5.0/5  (41)

(41)

What conditions must be met for the selling company of retail land recognizes revenue and related expenses in the period of the sale on the accrual basis?

(Essay)

4.7/5  (41)

(41)

GAAP requires the completed-contract method to be used when the

(Multiple Choice)

4.8/5  (33)

(33)

Aberdeen Company sold an asset for $450,000 during 2014, its first year of operations. The asset cost Aberdeen $300,000, and the sale was recorded using the cost recovery method. Cash collections were as follows: $100,000 in 2014; $200,000 in 2015; and $150,000 in 2016.

Required:

a.Prepare all journal entries connected with the sale for all three years.

b.Show how the net amount of the accounts receivable would be disclosed on the 2015 balance sheet.

(Essay)

4.9/5  (32)

(32)

Exhibit 17-4 The following information is provided for Fort Myers Company:  Fort Myers used the installment sales method.

-Refer to Exhibit 17-4. How much gross profit did Fort Myers Company report in 2015?

Fort Myers used the installment sales method.

-Refer to Exhibit 17-4. How much gross profit did Fort Myers Company report in 2015?

(Multiple Choice)

4.8/5  (38)

(38)

On January 1, 2014, Reids, Inc. sold a risky investment for $1,400 that had been purchased for $1,000. It was decided to use the cost recovery method of revenue recognition. Cash collections on accounts receivable related to the asset were as follows:  Which of the following represent the realized gross profit that Reids should recognize for each year?

Which of the following represent the realized gross profit that Reids should recognize for each year?

(Multiple Choice)

4.9/5  (39)

(39)

Exhibit 17-4 The following information is provided for Fort Myers Company:  Fort Myers used the installment sales method.

-Refer to Exhibit 17-4. How much gross profit did Fort Myers Company report in 2014?

Fort Myers used the installment sales method.

-Refer to Exhibit 17-4. How much gross profit did Fort Myers Company report in 2014?

(Multiple Choice)

4.9/5  (39)

(39)

A company may not use the installment method of revenue recognition for a sales transaction that

(Multiple Choice)

4.9/5  (34)

(34)

Showing 1 - 20 of 113

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)