Exam 14: Financing Liabilities: Bonds and Notes Payable

Exam 1: The Demand for and Supply of Financial Accounting Information89 Questions

Exam 2: Financial Reporting: Its Conceptual Framework87 Questions

Exam 3: Review of a Companys Accounting System146 Questions

Exam 5: The Income Statement and the Statement of Cash Flows151 Questions

Exam 6: Cash and Receivables149 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions123 Questions

Exam 8: Inventories: Special Valuation Issues148 Questions

Exam 9: Current Liabilities and Contingencies128 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments105 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal143 Questions

Exam 12: Intangibles105 Questions

Exam 13: Investments and Long-Term Receivables140 Questions

Exam 14: Financing Liabilities: Bonds and Notes Payable171 Questions

Exam 15: Contributed Capital154 Questions

Exam 17: Advanced Issues in Revenue Recognition113 Questions

Exam 18: Accounting for Income Taxes108 Questions

Exam 19: Accounting for Postretirement Benefits98 Questions

Exam 20: Accounting for Leases149 Questions

Exam 21: The Statement of Cash Flows107 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Time Value of Money Module121 Questions

Select questions type

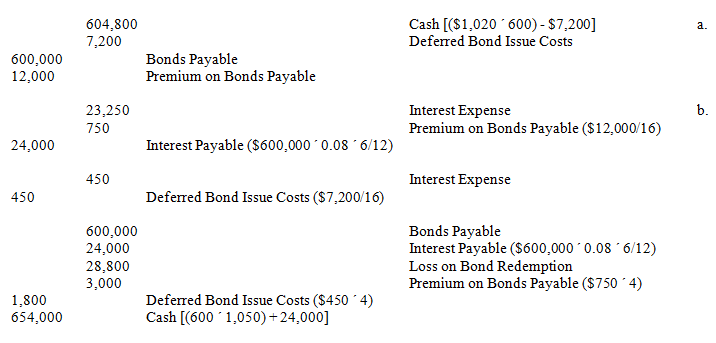

On January 1, 2014, the Rangler Company issued $600,000 of eight-year bonds at 102. The stated annual interest rate is 8%, and interest is paid on June 30 and December 31. The bonds are callable at 105 plus accrued interest. The bond issue costs were $7,200. The Rangler Company uses the straight-line method to amortize bond discounts and premiums.

Required:

a.Prepare the journal entry(ies) to record the issuance of the bonds and the bond issue costs.

b.At the end of the sixth year, the company retired the bonds. Prepare the journal entries to record the related interest and retirement.

Free

(Essay)

4.8/5  (34)

(34)

Correct Answer:

How is the issue price for a bond determined? What three alternatives are available when selling a bond?

Free

(Essay)

4.7/5  (37)

(37)

Correct Answer:

The issue price for a bond is determined by taking the present value associated with the principle and interest portions of the bond using the effective interest rate.

Bonds can be issued at par, discount, or premium. If a bond is issued at par, the stated rate and the effective interest rate are the same. If the bond is issued at a discount, it is being issued lower than face value. This occurs when the stated rate on the bond is lower than an alternative investment on the market. In order to entice investors to purchase the bond it is offered at a discount. If a bond is issued at a premium, it is being issued at more than face value. This occurs when the stated interest rate is higher than the current market rate.

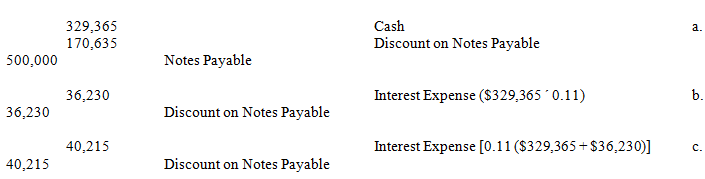

Orange Mfg. Co. issued a four-year non-interest-bearing note with a face value of $500,000. Orange received $329,365, resulting in an effective 11% interest rate.

Required:

Prepare journal entries to:

a.Issue the note

b.Record interest at the end of the first year

c.Record interest at the end of the second year

(Note: round all answers to the nearest dollar.)

Free

(Essay)

4.9/5  (32)

(32)

Correct Answer:

On January 1, 2014, Cooper Corporation issued $800,000 of 12.5% bonds due January 1, 2021, at 101. The bonds pay interest semiannually on June 30 and December 31. Each $1,000 bond carried 10 warrants which allowed the acquired to exchange 1 share of $10 par common stock for $50. Some time after the bonds were issued the bonds were quoted at 98 ex rights and each individual warrant was quoted at $5. Subsequently, on April 30, 2015, 2,000 rights were exercised.

Required:

1. Prepare the journal entry to record the bond issue.

2. Prepare the journal entries on April 30, 2015, to record the exchange of the warrants for common shares.

(Essay)

4.7/5  (30)

(30)

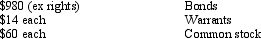

Exhibit 14-8 Yoho Corp. issued $500,000 of its ten-year 6% bonds at 104. Each $1,000 bond carries ten warrants. Each warrant allows the holder to purchase one share of $10 par common stock for $50. Following the sale, relevant market values were:  -Refer to Exhibit 14-8. The entry to record the exercise of 1,500 warrants would include a

-Refer to Exhibit 14-8. The entry to record the exercise of 1,500 warrants would include a

(Multiple Choice)

4.9/5  (33)

(33)

A theoretical difference between the effective interest method and the straight-line amortization method is that

(Multiple Choice)

4.8/5  (38)

(38)

In June 2016, Goslyn Corporation issued a three-year non-interest-bearing note with a face value of $15,000 and received cash of $11,025.00 in exchange. The difference between the face value and the cash proceeds is accounted for as

(Multiple Choice)

4.7/5  (42)

(42)

If the contract rate of interest is less than the effective interest rate the issuer of the bonds will record a premium.

(True/False)

4.8/5  (37)

(37)

Debenture Bonds are only issued to companies with an excellent credit rating.

(True/False)

4.9/5  (26)

(26)

When the market rate of interest is equal to the contract rate of interest, the bonds should sell at

(Multiple Choice)

4.8/5  (33)

(33)

When the market rate of interest is greater than the contract rate of interest, the bonds should sell at

(Multiple Choice)

4.9/5  (47)

(47)

Siena sold $120,000 of 6% bonds for $127,125. Each $1,000 bond carried ten warrants and each warrant allowed the holder to acquire one share of $5 par common stock for $25 a share. After the issuance of the securities, the bonds were quoted at 108 and the warrants were quoted at $12. Later, one-fourth of the rights were exercised.

Required:

Journalize the exercise of the warrants.

(Essay)

4.8/5  (37)

(37)

On July 1, 2013, Rio Corporation issued bonds with a face value of $100,000 and 12% interest payable semiannually. The bonds mature on June 30, 2018. The market rate of interest at the time of issuance was 14%, so the bonds were issued at a discount of $7,054. Using the effective interest method, the amount of discount that should be amortized by Rio on December 31, 2013, is

(Multiple Choice)

4.9/5  (44)

(44)

On January 1, 2013, the Keller Co. issued $140,000 of 20-year 8% bonds for $172,000. Interest was payable annually. The effective yield was 6%. The effective interest method was used to amortize the premium. What amount of premium would be amortized for the year ended December 31, 2013?

(Multiple Choice)

4.8/5  (42)

(42)

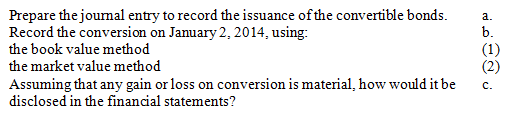

The following events relate to Mathers Corporation's issue of convertible debentures:

•On January 1, 2012, the Mathers Corporation issued $500,000 of 12% convertible bonds for $460,000. The bonds are due on January 1, 2022, and interest is paid on July 1 and January 1. Each $1,000 bond is convertible into 30 shares of common stock with a par value of $1 per share. On the date of bond issuance, a share of common stock was selling at $24.

•On January 2, 2014, 12% convertible bonds with a face value of $300,000 were converted into common stock. The market value of the common stock on the date of conversion was $40 per share. Mathers uses the straight-line method to amortize premiums and discounts.

Required:

(Essay)

4.8/5  (34)

(34)

Barley, Inc. sold $30,000 of 8% bonds for $40,200. Each $1,000 bond carried eight rights and each right allowed the holder to acquire one share of $10 par stock for $16 a share. After the issuance of the securities, the bonds were quoted at 104 and the rights were quoted at $4 each. Later, one-half of the rights were exercised. At date of exercise, how much should be credited to Additional Paid-in Capital?

(Multiple Choice)

4.9/5  (34)

(34)

Showing 1 - 20 of 171

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)