Exam 22: Accounting for Changes and Errors

Exam 1: The Demand for and Supply of Financial Accounting Information89 Questions

Exam 2: Financial Reporting: Its Conceptual Framework87 Questions

Exam 3: Review of a Companys Accounting System146 Questions

Exam 5: The Income Statement and the Statement of Cash Flows151 Questions

Exam 6: Cash and Receivables149 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions123 Questions

Exam 8: Inventories: Special Valuation Issues148 Questions

Exam 9: Current Liabilities and Contingencies128 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments105 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal143 Questions

Exam 12: Intangibles105 Questions

Exam 13: Investments and Long-Term Receivables140 Questions

Exam 14: Financing Liabilities: Bonds and Notes Payable171 Questions

Exam 15: Contributed Capital154 Questions

Exam 17: Advanced Issues in Revenue Recognition113 Questions

Exam 18: Accounting for Income Taxes108 Questions

Exam 19: Accounting for Postretirement Benefits98 Questions

Exam 20: Accounting for Leases149 Questions

Exam 21: The Statement of Cash Flows107 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Time Value of Money Module121 Questions

Select questions type

Margaret Company purchased equipment on January 1, 2012, for $500,000. At the date of acquisition, the equipment had an estimated useful life of eight years with a $50,000 salvage value, and it was depreciated using the straight-line method. On January 1, 2017, based on updated information, Margaret decided that the equipment had a total estimated life of ten years and no salvage value. Depreciation expense on the equipment in 2017 should be

Free

(Multiple Choice)

4.8/5  (37)

(37)

Correct Answer:

D

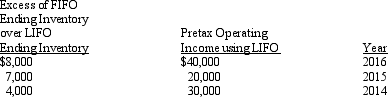

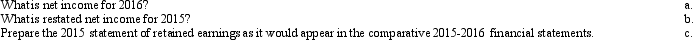

Tulip Company decided to change from LIFO to FIFO inventory costing, effective January 1, 2016. The following data were available:

The income tax rate is 35%. The company began operations on January 1, 2014, and has paid no dividends since inception.

Required:

Answer the following questions relating to the 2015-2016 comparative financial statements.

The income tax rate is 35%. The company began operations on January 1, 2014, and has paid no dividends since inception.

Required:

Answer the following questions relating to the 2015-2016 comparative financial statements.

Free

(Essay)

4.8/5  (34)

(34)

Correct Answer:

Reminder: The change in cost of goods sold resulting from the switch from LIFO to FIFO in any given year equals the change in the excess ending inventory from the end of the previous year to the end of the current year.

Which of the following is a noncounterbalancing error?

Free

(Multiple Choice)

4.8/5  (39)

(39)

Correct Answer:

C

On January 1, 2014, Dawn Company bought a machine for $60,000. It was then estimated that the useful life of the machine would be eight years with a salvage value of $8,000. On January 1, 2018, it was decided that the machine's total life from acquisition date should have been only six years with a salvage value of only $2000. The company used straight-line depreciation.

Required:

a.If an adjusting entry is necessary on January 1, 2018, prepare it.

b.Compute depreciation expense for 2018.

(Essay)

4.8/5  (29)

(29)

Exhibit 22-1 On January 1, 2014, the Chrissy Company purchased a machine for $450,000 with an estimate useful life of six years and a $30,000 salvage value. Straight-line depreciation was used for financial reporting purposes and MACRS depreciation for income tax reporting. Effective January 1, 2016, Chrissy switched to the double-declining-balance depreciation method for financial statement reporting but not for income tax purposes. Chrissy can justify the change.

-Refer to Exhibit 22-1. Assuming an income tax rate of 35%, the cumulative effect change reported in Chrissy's 2016 income statement would be

(Multiple Choice)

4.9/5  (45)

(45)

The correct 2014 net income for Magness Company, after error corrections, was $56,000. Two errors were found after net income was first reported. The January 1, 2014 inventory and the December 31, 2014, inventory were overstated by $5,000 and $10,000, respectively. The net income that must have been originally reported was

(Multiple Choice)

4.7/5  (28)

(28)

If consolidated statements are presented for the first time instead of statements of several individual companies, this change should be accounted for

(Multiple Choice)

4.9/5  (36)

(36)

The Bronson Company changed its method of determining inventories from LIFO to FIFO. This change represents a

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following statements does not properly state a basic principle for reporting an accounting change?

(Multiple Choice)

4.8/5  (41)

(41)

Generally accepted methods of accounting for a change in accounting principle include

(Multiple Choice)

4.8/5  (38)

(38)

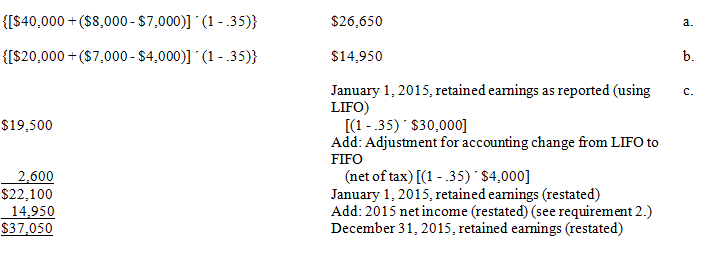

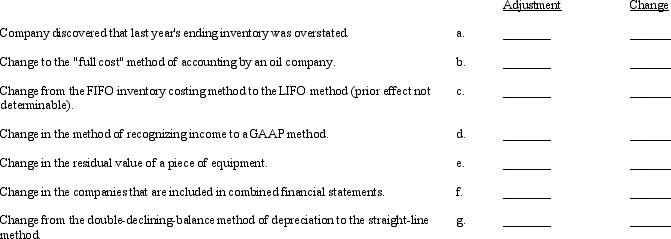

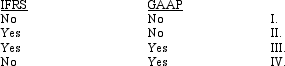

Generally accepted accounting principles have identified four types of accounting changes and two possible methods to use in accounting for these changes, as follows:

Required:

Following is a list of errors and changes. In the spaces provided, use the appropriate symbols selected from the above lists to indicate the type of change and how the change should be treated in the financial statements.

Required:

Following is a list of errors and changes. In the spaces provided, use the appropriate symbols selected from the above lists to indicate the type of change and how the change should be treated in the financial statements.

(Essay)

4.8/5  (33)

(33)

Exceptions exist in the retrospective restatement requirements when accounting for errors under

(Multiple Choice)

4.9/5  (42)

(42)

Meagan Co. has the following errors on its books as of December 31, 2016. The books for 2016 have not yet been closed.

a.On January 1, 2014, a truck had been purchased for $28,000. The truck had an estimated life of eight years, but it was expensed in error. Straight-line depreciation with $2,000 salvage value should have been used.

b.On January 1, 2015, the company recorded the purchase of a machine in exchange for a four-year, noninterest-bearing note in the amount of $20,000. Interest rates were then 10%, but no recognition was made of that fact. The present value of $1 at 10% for four periods is 0.683013. (Ignore depreciation.)

Required:

Prepare journal entries to correct these errors at December 31, 2016. Ignore income taxes.

(Essay)

4.9/5  (41)

(41)

IFRS differ from U.S. GAAP regarding the indirect effects of a change in accounting principle in that IFRS

(Multiple Choice)

4.8/5  (37)

(37)

When making a retrospective adjustment, all of the following steps are included except

(Multiple Choice)

4.7/5  (42)

(42)

If a prior-period error only affects the balance sheet, the company should

(Multiple Choice)

4.8/5  (33)

(33)

Brockmeyer, Inc. purchased some equipment on January 1, 2014, for $300,000 that had a five-year useful life and no salvage value. Brockmeyer used double-declining-balance depreciation for both financial reporting and income tax purposes. On January 1, 2016, Brockmeyer changed to the straight-line depreciation method for this equipment and can justify the change. Brockmeyer will continue to use double-declining balance depreciation for income tax reporting. Brockmeyer's income tax rate is 30%. Assuming Brockmeyer's 2016 income before depreciation and tax is $800,000, Brockmeyer's net income for 2016 would be

(Multiple Choice)

4.8/5  (35)

(35)

Showing 1 - 20 of 130

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)