Exam 9: Current Liabilities and Contingencies

Exam 1: The Demand for and Supply of Financial Accounting Information89 Questions

Exam 2: Financial Reporting: Its Conceptual Framework87 Questions

Exam 3: Review of a Companys Accounting System146 Questions

Exam 5: The Income Statement and the Statement of Cash Flows151 Questions

Exam 6: Cash and Receivables149 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions123 Questions

Exam 8: Inventories: Special Valuation Issues148 Questions

Exam 9: Current Liabilities and Contingencies128 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments105 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal143 Questions

Exam 12: Intangibles105 Questions

Exam 13: Investments and Long-Term Receivables140 Questions

Exam 14: Financing Liabilities: Bonds and Notes Payable171 Questions

Exam 15: Contributed Capital154 Questions

Exam 17: Advanced Issues in Revenue Recognition113 Questions

Exam 18: Accounting for Income Taxes108 Questions

Exam 19: Accounting for Postretirement Benefits98 Questions

Exam 20: Accounting for Leases149 Questions

Exam 21: The Statement of Cash Flows107 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Time Value of Money Module121 Questions

Select questions type

Albert Corp. introduced a new machine on January 1, 2014. The machine carried a two-year warranty against defects. The estimated warranty costs related to dollar sales were 3% in the year of sale and 5% in the year after sale. Additional information follows:

Actual Warranty \ 600 \ 40,000 2014 2,200 60,000 2015

If the expense warranty accrual method is used, what amount relating to warranty expense should be reflected on the December 31, 2015 income statement?

Free

(Multiple Choice)

4.8/5  (28)

(28)

Correct Answer:

B

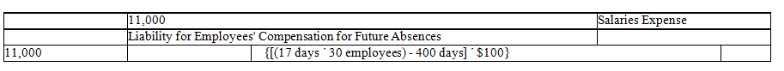

Claymont Company instituted a vacation and sick pay policy on January 1, 2014. Thirty employees, averaging $100 per day per employee, were covered under the plan. The policy allows each employee five days of sick pay and twelve days of vacation pay per year. The sick pay accumulates up to a ten-day maximum. Vacation pay accumulates without a maximum. The sick pay vests, but vacation pay does not. A total of 400 days of sick and vacation days were taken during 2014.

Required:

Prepare the December 31, 2014 year-end accrual for compensated absences.

Free

(Essay)

4.8/5  (40)

(40)

Correct Answer:

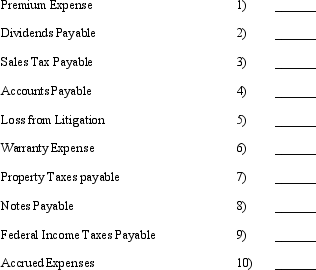

From the list of accounts below determine which ones are the following:

A) Contractual Amounts

B) Contingent Amounts

C) Amounts determined by operating activities

Required:

Write the appropriate letter for the accounts listed below.

Free

(Essay)

4.8/5  (34)

(34)

Correct Answer:

Cunningham, a branch manager, is allowed a bonus of 10% of income after bonus and tax. If the tax rate is 30% and income before bonus and tax is $200,000, what is Mr. Cunningham's bonus?

(Multiple Choice)

4.9/5  (29)

(29)

FASB recommends that assets and liabilities with differing liquidities be arranged as separate items.

(True/False)

4.9/5  (42)

(42)

Explain the deficiencies in accounting for warranty costs under the modified cash basis.

(Essay)

4.8/5  (37)

(37)

Candy's Video includes the amount of sales taxes collected directly in the price charged for merchandise, and the total amount is credited to Sales. During January, Sales was credited for $310,117.50. The January 31 adjusting entry to account for a 5% state sales tax should be

(Multiple Choice)

4.8/5  (42)

(42)

FASB established the use of the terms "probable," "reasonably possible," and "remote." It adopted these terms because

(Multiple Choice)

4.7/5  (36)

(36)

Natural Hair reports the following payroll information for May, 2014:

Savings Bonds Federal Income Gross Type of \ 200 \ 2,200 \1 0,000 Sales Office

Tax rate information follows:

7.0\% FICA 0.8\% Federal unemployment 5.4\% State employment

Assume that all wages are subject to all payroll taxes.

Required:

Prepare the journal entries to record the payment of the May, 2014, payroll and the payroll taxes imposed on the employer.

(Essay)

4.7/5  (34)

(34)

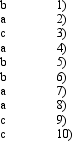

Baynard Boats, Inc. presented the following information for the year ending 2014.

1) Compute the Quick Ratio/Acid Test Ratio

2) Compute the Current Ratio

1) Compute the Quick Ratio/Acid Test Ratio

2) Compute the Current Ratio

(Essay)

4.9/5  (39)

(39)

The Antarctica Company closed its books annually on December 31, while the city in which it is located has a fiscal year beginning on April 1 and ending on March 31. Taxes on property are assessed on April 1 of each year. Property taxes in the amount of $360,000 and $390,000 were assessed on April 1, 2013 and 2014, respectively. For the year ended December 31, 2014, the Antarctica Company would report property tax expense of

(Multiple Choice)

4.7/5  (42)

(42)

What are FASB's broad guidelines for reporting assets, liabilities, and equity on the balance sheet?

(Essay)

4.9/5  (42)

(42)

Beta, Inc. had $10,000 of notes coming due on January 10, 2014. On January 5, 2014, the company used $2,000 of excess cash to pay off part of the note. On January 8, 2014, a refinancing was completed. The $2,000 payment was refunded and added back to the note balance, and the note was extended for another two years. On the December 31, 2013 balance sheet, how much of the $10,000 note should be shown as current?

(Multiple Choice)

5.0/5  (35)

(35)

Exhibit 9-5 Backhoe Company estimates its annual warranty expense at 4% of annual net sales. The following information relates to the calendar year 2013:

\ 3,000,000 Net sales Estimated liability under warranties: 100,000 January 1, 2013 80,000 December 31,2013 , after year-end adjustment

-Refer to Exhibit 9-5. The amount of expenditures for warranty costs for 2013 is

(Multiple Choice)

4.8/5  (33)

(33)

Exhibit 9-3 John Company includes three coupons in each package of cookies it sells. In exchange for 20 coupons, a customer will receive a cookie sheet. John estimates that 30% of the coupons will be redeemed. In 2014, John sold 4,000,000 boxes of cookies and purchased 150,000 Cookie sheets at $2.50 each. During the year, 970,000 coupons were redeemed.

-Refer to Exhibit 9-3. What amount should John report as estimated premium claims outstanding at December 31, 2014?

(Multiple Choice)

4.8/5  (39)

(39)

On the balance sheet, liabilities are generally classified as

(Multiple Choice)

4.8/5  (38)

(38)

Exhibit 9-4 During 2014, the Thomas Company began selling a new type of machine that carries a two-year warranty against all defects. Based on past industry and company experience, estimated warranty costs should total $2,000 per machine sold. During 2014, sales and actual warranty expenditures were $4,000,000 (80 machines) and $44,000, respectively.

-Refer to Exhibit 9-4. What amount should Thomas report as its warranty expense for 2014?

(Multiple Choice)

4.9/5  (42)

(42)

Which of the following is not an issue associated with liabilities?

(Multiple Choice)

4.9/5  (39)

(39)

Showing 1 - 20 of 128

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)