Exam 21: The Influences of Monetary and Fiscal Policy on Aggregate Demand: How Fiscal Policy Influences Aggregate Demand

Exam 1: Ten Principles of Economics24 Questions

Exam 1: Ten Principles of Economics: How People Make Decisions139 Questions

Exam 1: Ten Principles of Economics: How People Interact103 Questions

Exam 1: Ten Principles of Economics: How the Economy As a Whole Works73 Questions

Exam 1: Ten Principles of Economics: Part A53 Questions

Exam 1: Ten Principles of Economics: Part B51 Questions

Exam 2: Thinking Like an Economist2 Questions

Exam 2: Thinking Like an Economist: The Economist As Scientist256 Questions

Exam 2: Thinking Like an Economist: The Economist As Policy Adviser67 Questions

Exam 2: Thinking Like an Economist: Why Economists Disagree17 Questions

Exam 2: Thinking Like an Economist: Lets Get Going6 Questions

Exam 2: Thinking Like an Economist: Graphing a Brief Review68 Questions

Exam 2: Thinking Like an Economist: Part A56 Questions

Exam 2: Thinking Like an Economist: Part B136 Questions

Exam 3: Interdependence and the Gains From Trade2 Questions

Exam 3: Interdependence and the Gains From Trade: A Parable for the Modern Economy60 Questions

Exam 3: Interdependence and the Gains From Trade: Comparative Advantage the Driving Force of Specialization141 Questions

Exam 3: Interdependence and the Gains From Trade: Applications of Comparative Advantage20 Questions

Exam 3: Interdependence and the Gains From Trade: Conclusion1 Questions

Exam 3: Interdependence and the Gains From Trade: Part A40 Questions

Exam 3: Interdependence and the Gains From Trade: Part B69 Questions

Exam 4: The Market Forces of Supply and Demand3 Questions

Exam 4: The Market Forces of Supply and Demand:Markets and Competition46 Questions

Exam 4: The Market Forces of Supply and Demand: Demand150 Questions

Exam 4: The Market Forces of Supply and Demand: Supply96 Questions

Exam 4: The Market Forces of Supply and Demand: Supply and Demand Together158 Questions

Exam 4: The Market Forces of Supply and DemandConclusion How Prices Allocate Resources5 Questions

Exam 4: The Market Forces of Supply and Demand: Part A38 Questions

Exam 4: The Market Forces of Supply and Demand: Part B108 Questions

Exam 5: Elasticity and Its Applications6 Questions

Exam 5: Elasticity and Its Applications: The Elasticity of Demand303 Questions

Exam 5: Elasticity and Its Applications: The Elasticity of Supply86 Questions

Exam 5:Elasticity and Its Applications: Three Applications of Supply,demand,and Elasticity48 Questions

Exam 5: Elasticity and Its Applications: Part A49 Questions

Exam 5: Elasticity and Its Applications: Part B78 Questions

Exam 6: Supply Demand and Government Policies5 Questions

Exam 6: Supply Demand and Government Policies: Controls on Prices215 Questions

Exam 6: Supply Demand and Government Policies: Taxes199 Questions

Exam 6: Supply Demand and Government Policies: Part A46 Questions

Exam 6: Supply Demand and Government Policies: Part B166 Questions

Exam 7: Consumers Producers and the Efficiency of Markets10 Questions

Exam 7: Consumers Producers and the Efficiency of Markets: Consumer Surplus98 Questions

Exam 7: Consumers Producers and the Efficiency of Markets: Producer Surplus92 Questions

Exam 7: Consumers Producers and the Efficiency of Markets: Market Efficiency123 Questions

Exam 7: Consumers Producers and the Efficiency of Markets: Conclusion Market Efficiency and Market Failure7 Questions

Exam 7: Consumers Producers and the Efficiency of Markets: Part A46 Questions

Exam 7: Consumers Producers and the Efficiency of Markets: Part B65 Questions

Exam 8: Application the Cost of Taxation5 Questions

Exam 8: Application the Cost of Taxation: The Deadweight Loss of Taxation247 Questions

Exam 8: Application the Cost of Taxation: The Determinants of the Deadweight Loss61 Questions

Exam 8: Application the Cost of Taxation: Deadweight Loss and Tax Revenue As Taxes Vary62 Questions

Exam 8: Application the Cost of Taxation: Conclusion2 Questions

Exam 8: Application the Cost of Taxation: Part A58 Questions

Exam 8: Application the Cost of Taxation: Part B59 Questions

Exam 9: Application International Trade2 Questions

Exam 9: Application International Trade: The Determinants of Trade41 Questions

Exam 9: Application International Trade: The Winners and Losers From Trade302 Questions

Exam 9: Application International Trade: The Arguments for Restricting Trade40 Questions

Exam 9: Application International Trade: Conclusion3 Questions

Exam 9: Application International Trade: Part A53 Questions

Exam 9: Application International Trade: Part B68 Questions

Exam 10: Measuring a Nations Income6 Questions

Exam 10: Measuring a Nations Income: The Economy's Income and Expenditure27 Questions

Exam 10: Measuring a Nations Income: The Measurement of GDP117 Questions

Exam 10: Measuring a Nations Income: The Components of GDP106 Questions

Exam 10: Measuring a Nations Income: Real Versus Nominal GDP52 Questions

Exam 10: Measuring a Nations Income: Is GDP a Good Measure of Economic Well-Being22 Questions

Exam 10: Measuring a Nations Income: Part A44 Questions

Exam 10: Measuring a Nations Income: Part B86 Questions

Exam 11: Measuring the Cost of Living12 Questions

Exam 11: Measuring the Cost of Living: The Consumer Price Index195 Questions

Exam 11: Measuring the Cost of Living: Correcting Economic Variables for the Effects of Inflation124 Questions

Exam 11: Measuring the Cost of Living: Part A39 Questions

Exam 11: Measuring the Cost of Living: Part B83 Questions

Exam 12: Production and Growth16 Questions

Exam 12: Production and Growth: Economic Growth Around the World54 Questions

Exam 12: Production and Growth: Productivity Its Role and Determinants159 Questions

Exam 12: Production and Growth: Economic Growth and Public Policy157 Questions

Exam 12: Production and Growth: Conclusion the Importance of Long-Run Growth2 Questions

Exam 12: Production and Growth: Part A59 Questions

Exam 12: Production and Growth: Part B62 Questions

Exam 13: Saving Investment and the Financial System8 Questions

Exam 13: Saving Investment and the Financial System: Financial Institutions in the US economy177 Questions

Exam 13: Saving Investment and the Financial System: Saving and Investment in the National Income Accounts98 Questions

Exam 13: Saving Investment and the Financial System: The Market for Loanable Funds201 Questions

Exam 13: Saving Investment and the Financial System: Part A57 Questions

Exam 13: Saving Investment and the Financial System: Part B63 Questions

Exam 14: The Basic Tools of Finance2 Questions

Exam 14: The Basic Tools of Finance: Present Value Measuring the Time Value of Money213 Questions

Exam 14: The Basic Tools of Finance: Managing Risk120 Questions

Exam 14: The Basic Tools of Finance: Asset Valuation70 Questions

Exam 14: The Basic Tools of Finance: Conclusion2 Questions

Exam 14: The Basic Tools of Finance: Part A59 Questions

Exam 14: The Basic Tools of Finance: Part B54 Questions

Exam 15: Unemployment15 Questions

Exam 15: Unemployment: Identifying Unemployment163 Questions

Exam 15: Unemployment: Job Search40 Questions

Exam 15: Unemployment: Minimum-Wage Laws39 Questions

Exam 15: Unemployment: Unions and Collective Bargaining49 Questions

Exam 15: Unemployment: The Theory of Efficiency Wages41 Questions

Exam 15: Unemployment: Part A48 Questions

Exam 15: Unemployment: Part B221 Questions

Exam 16: The Monetary System17 Questions

Exam 16: The Monetary System: The Meaning of Money100 Questions

Exam 16: The Monetary System: The Federal Reserve System52 Questions

Exam 16: The Monetary System: Banks and the Money Supply78 Questions

Exam 16: The Monetary System: The Feds Tools of Monetary Control126 Questions

Exam 16: The Monetary System: Part A64 Questions

Exam 16: The Monetary System: Part B57 Questions

Exam 17: Money Growth and Inflation22 Questions

Exam 17: Money Growth and Inflation: The Classical Theory of Inflation245 Questions

Exam 17: Money Growth and Inflation: The Costs of Inflation94 Questions

Exam 17: Money Growth and Inflation: Conclusion3 Questions

Exam 17: Money Growth and Inflation: Part A63 Questions

Exam 17: Money Growth and Inflation: Part B60 Questions

Exam 18: Open Economy Macroeconomics Basic Concepts2 Questions

Exam 18: Open Economy Macroeconomics Basic Concepts: The International Flows of Goods and Capital227 Questions

Exam 18: Open Economy Macroeconomics Basic Concepts: The Prices for International Transactions Real and Nominal Exchange Rates76 Questions

Exam 18: Open Economy Macroeconomics Basic Concepts: A First Theory of Exchange-Rate Determination Purchasing-Power Parity87 Questions

Exam 18: Open Economy Macroeconomics Basic Concepts: Part A67 Questions

Exam 18: Open Economy Macroeconomics Basic Concepts: Part B63 Questions

Exam 19: A Macroeconomic Theory of the Open Economy3 Questions

Exam 19: A Macroeconomic Theory of the Open Economy: Supply and Demand for Loanable Funds and for Foreign-Currency Exchange141 Questions

Exam 19: A Macroeconomic Theory of the Open Economy: Equilibrium in the Open Economy45 Questions

Exam 19: A Macroeconomic Theory of the Open Economy: How Policies and Events Affect an Open Economy172 Questions

Exam 19: A Macroeconomic Theory of the Open Economy: Part A47 Questions

Exam 19: A Macroeconomic Theory of the Open Economy: Part B56 Questions

Exam 20: Aggregate Demand and Aggregate Supply6 Questions

Exam 20: Aggregate Demand and Aggregate Supply: Three Key Facts About Economic Fluctuations33 Questions

Exam 20: Aggregate Demand and Aggregate Supply: Explaining Short-Run Economic Fluctuations38 Questions

Exam 20: Aggregate Demand and Aggregate Supply: The Aggregate-Demand Curve141 Questions

Exam 20: Aggregate Demand and Aggregate Supply: The Aggregate-Supply Curve95 Questions

Exam 20: Aggregate Demand and Aggregate Supply: Two Causes of Economic Fluctuations117 Questions

Exam 20: Aggregate Demand and Aggregate Supply: Part A59 Questions

Exam 20: Aggregate Demand and Aggregate Supply: Part B61 Questions

Exam 21: The Influences of Monetary and Fiscal Policy on Aggregate Demand5 Questions

Exam 21: The Influences of Monetary and Fiscal Policy on Aggregate Demand: How Monetary Policy Influences Aggregate Demand198 Questions

Exam 21: The Influences of Monetary and Fiscal Policy on Aggregate Demand: How Fiscal Policy Influences Aggregate Demand123 Questions

Exam 21: The Influences of Monetary and Fiscal Policy on Aggregate Demand: Using Policy to Stabilize the Economy73 Questions

Exam 21: The Influences of Monetary and Fiscal Policy on Aggregate Demand: Part A60 Questions

Exam 21: The Influences of Monetary and Fiscal Policy on Aggregate Demand: Part B50 Questions

Exam 22: The Short Run Trade Off Between Inflation and Unemployment11 Questions

Exam 22: The Short Run Trade Off Between Inflation and Unemployment: The Phillips Curve86 Questions

Exam 22: The Short Run Trade Off Between Inflation and Unemployment: Shifts in the Phillips Curve the Role of Expectations161 Questions

Exam 22: The Short Run Trade Off Between Inflation and Unemployment: Shifts in the Phillips Curve the Role of Supply Shocks60 Questions

Exam 22: The Short Run Trade Off Between Inflation and Unemployment: The Cost of Reducing Inflation87 Questions

Exam 22: The Short Run Trade Off Between Inflation and Unemployment: Part A62 Questions

Exam 22: The Short Run Trade Off Between Inflation and Unemployment: Part B52 Questions

Exam 23: Six Debates Over Macroeconomic Policy: Should Monetary and Fiscal Policymakers Try to Stabilize the Economy44 Questions

Exam 23: Six Debates Over Macroeconomic Policy: Should the Government Fight Recessions With Spending Hikes Rather Than Tax Cuts15 Questions

Exam 23: Six Debates Over Macroeconomic Policy: Should Monetary Policy Be Made by Rule Rather Than by Discretion37 Questions

Exam 23: Six Debates Over Macroeconomic Policy: Should the Central Bank Aim for Zero Inflation49 Questions

Exam 23: Six Debates Over Macroeconomic Policy: Should the Government Balance Its Budget38 Questions

Exam 23: Six Debates Over Macroeconomic Policy: Should the Tax Laws Be Reformed to Encourage Saving44 Questions

Exam 23: Six Debates Over Macroeconomic Policy: Conclusion1 Questions

Exam 23: Six Debates Over Macroeconomic Policy: Part A68 Questions

Exam 23: Six Debates Over Macroeconomic Policy: Part B39 Questions

Exam 24: A-Financial-Overview-Of-The-US104 Questions

Select questions type

Scenario 34-1.Take the following information as given for a small,imaginary economy:

• When income is $10,000,consumption spending is $6,500.

• When income is $11,000,consumption spending is $7,250.

-Refer to Scenario 34-1.For this economy,an initial increase of $200 in net exports translates into a(n)

(Multiple Choice)

4.7/5  (25)

(25)

Initially,the economy is in long-run equilibrium.Aggregate demand then shifts leftward by $50 billion.The government wants to increase its spending in order to avoid a recession.If the crowding-out effect is always one-third as strong as the multiplier effect,and if the MPC equals 0.6,then by how much do government purchases have to increase in order to offset the $50 billion leftward shift?

(Multiple Choice)

4.9/5  (36)

(36)

When the government reduces taxes,which of the following decreases?

(Multiple Choice)

4.9/5  (42)

(42)

Supply-side economists believe that a reduction in the tax rate

(Multiple Choice)

4.8/5  (38)

(38)

In a certain economy,when income is $400,consumer spending is $325.The value of the multiplier for this economy is 3.33.It follows that,when income is $450,consumer spending is

(Multiple Choice)

4.7/5  (39)

(39)

Scenario 34-2.The following facts apply to a small,imaginary economy.

• Consumption spending is $6,720 when income is $8,000.

• Consumption spending is $7,040 when income is $8,500.

-Refer to Scenario 34-2.The marginal propensity to consume for this economy is

(Multiple Choice)

4.9/5  (39)

(39)

Scenario 34-2.The following facts apply to a small,imaginary economy.

• Consumption spending is $6,720 when income is $8,000.

• Consumption spending is $7,040 when income is $8,500.

-Refer to Scenario 34-2.In response to which of the following events could aggregate demand increase by $1,500?

(Multiple Choice)

4.9/5  (36)

(36)

To reduce the effects of crowding out caused by an increase in government expenditures,the Federal Reserve could

(Multiple Choice)

4.8/5  (32)

(32)

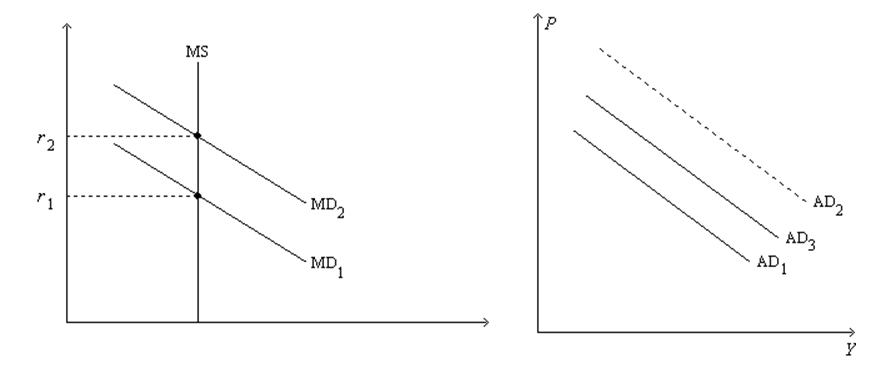

Figure 34-6.On the left-hand graph,MS represents the supply of money and MD represents the demand for money;on the right-hand graph,AD represents aggregate demand.The usual quantities are measured along the axes of both graphs.  -Refer to Figure 34-6.Suppose the multiplier is 3 and the government increases its purchases by $25 billion.Also,suppose the AD curve would shift from AD1 to AD2 if there were no crowding out;the AD curve actually shifts from AD1 to AD3 with crowding out.Finally,assume the horizontal distance between the curves AD1 and AD3 is $40 billion.The extent of crowding out,for any particular level of the price level,is

-Refer to Figure 34-6.Suppose the multiplier is 3 and the government increases its purchases by $25 billion.Also,suppose the AD curve would shift from AD1 to AD2 if there were no crowding out;the AD curve actually shifts from AD1 to AD3 with crowding out.Finally,assume the horizontal distance between the curves AD1 and AD3 is $40 billion.The extent of crowding out,for any particular level of the price level,is

(Multiple Choice)

4.9/5  (31)

(31)

A reduction in personal income taxes increases Aggregate Demand through

(Multiple Choice)

5.0/5  (40)

(40)

The government buys new weapons systems.The manufacturers of weapons pay their employees.The employees spend this money on goods and services.The firms from which the employees buy the goods and services pay their employees.This sequence of events illustrates

(Multiple Choice)

4.9/5  (32)

(32)

In 2009 President Obama and Congress increased government spending.Some economists thought this increase would have little effect on output.Which of the following would make the effect of an increase in government expenditures on aggregate demand smaller?

(Multiple Choice)

4.9/5  (37)

(37)

Assume the MPC is 0.65.Assuming only the multiplier effect matters,a decrease in government purchases of $20 billion will shift the aggregate demand curve to the

(Multiple Choice)

4.8/5  (28)

(28)

Showing 81 - 100 of 123

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)