Exam 26: Capital Investment Analysis

Exam 1: Introduction to Accounting and Business190 Questions

Exam 2: Analyzing Transactions224 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle194 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses215 Questions

Exam 7: Inventories165 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash176 Questions

Exam 9: Receivables140 Questions

Exam 10: Fixed Assets and Intangible Assets170 Questions

Exam 11: Current Liabilities and Payroll169 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies190 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends165 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes185 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows160 Questions

Exam 17: Financial Statement Analysis185 Questions

Exam 18: Managerial Accounting Concepts and Principles173 Questions

Exam 19: Job Order Costing173 Questions

Exam 20: Process Cost Systems177 Questions

Exam 21: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 22: Budgeting188 Questions

Exam 23: Performance Evaluation Using Variances From Standard Costs161 Questions

Exam 24: Performance Evaluation for Decentralized Operations200 Questions

Exam 25: Differential Analysis and Product Pricing162 Questions

Exam 26: Capital Investment Analysis179 Questions

Select questions type

A company is planning to purchase a machine that will cost $24,000, have a six-year life, and have no salvage value. The company expects to sell the machine's output of 3,000 units evenly throughout each year. Total income over the life of the machine is estimated to be $12,000. The machine will generate cash flows per year of $6,000. The accounting rate of return for the machine is 16.7%.

Free

(True/False)

4.9/5  (36)

(36)

Correct Answer:

True

Which of the following is a method of analyzing capital investment proposals that ignores present value?

Free

(Multiple Choice)

5.0/5  (31)

(31)

Correct Answer:

D

Which of the following is not considered as a complicating factor in capital investment decisions?

Free

(Multiple Choice)

4.9/5  (43)

(43)

Correct Answer:

C

Decisions to install new equipment, replace old equipment, and purchase or construct a new building are examples of

(Multiple Choice)

4.8/5  (38)

(38)

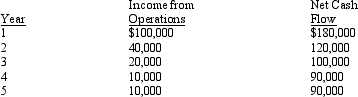

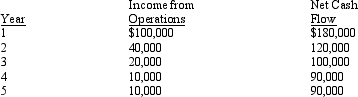

The management of Idaho Corporation is considering the purchase of a new machine costing $430,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability in this situation:  The net present value for this investment is:

The net present value for this investment is:

(Multiple Choice)

4.8/5  (32)

(32)

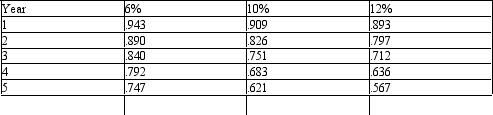

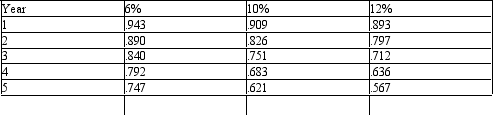

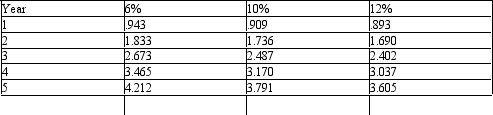

Below is a table for the present value of $1 at Compound interest.  Below is a table for the present value of an annuity of $1 at compound interest.

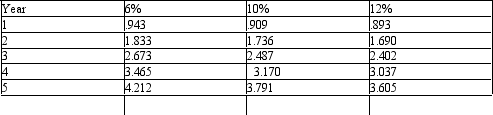

Below is a table for the present value of an annuity of $1 at compound interest.

Using the tables above, if an investment is made now for $23,500 that will generate a cash inflow of $8,000 a year for the next 4 years, what would be the net present value (rounded to the nearest dollar) of the investment, (assuming an earnings rate of 10%)?

Using the tables above, if an investment is made now for $23,500 that will generate a cash inflow of $8,000 a year for the next 4 years, what would be the net present value (rounded to the nearest dollar) of the investment, (assuming an earnings rate of 10%)?

(Multiple Choice)

4.8/5  (37)

(37)

The expected average rate of return for a proposed investment of $4,800,000 in a fixed asset, using straight line depreciation, with a useful life of 20 years, no residual value, and an expected total net income of $10,560,000 is:

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following is a present value method of analyzing capital investment proposals?

(Multiple Choice)

4.9/5  (40)

(40)

The process by which management allocates available investment funds among competing investment proposals is called:

(Multiple Choice)

5.0/5  (36)

(36)

Hazard Company is considering the acquisition of a machine that costs $525,000. The machine is expected to have a useful life of 6 years, a negligible residual value, an annual cash flow of $150,000, and annual operating income of $87,500. What is the estimated cash payback period for the machine?

(Multiple Choice)

5.0/5  (31)

(31)

The methods of evaluating capital investment proposals can be separated into two general groups--present value methods and:

(Multiple Choice)

4.9/5  (31)

(31)

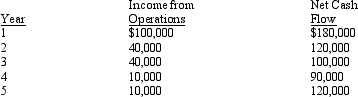

The management of Dakota Corporation is considering the purchase of a new machine costing $420,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability in this situation:  The present value index for this investment is:

The present value index for this investment is:

(Multiple Choice)

4.8/5  (26)

(26)

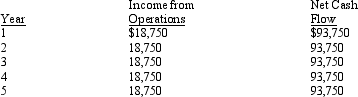

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability in this situation:  The cash payback period for this investment is:

The cash payback period for this investment is:

(Multiple Choice)

4.7/5  (31)

(31)

The management of Nebraska Corporation is considering the purchase of a new machine costing $490,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability in this situation:  The cash payback period for this investment is:

The cash payback period for this investment is:

(Multiple Choice)

4.8/5  (37)

(37)

For years one through five, a proposed expenditure of $250,000 for a fixed asset with a 5-year life has expected net income of $40,000, $35,000, $25,000, $25,000, and $25,000, respectively, and net cash flows of $90,000, $85,000, $75,000, $75,000, and $75,000, respectively. The cash payback period is 3 years.

(True/False)

4.8/5  (39)

(39)

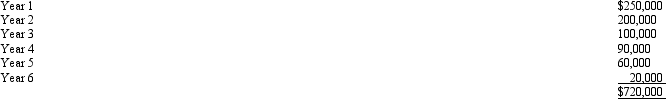

Proposals L and K each cost $500,000, have 6-year lives, and have expected total cash flows of $720,000. Proposal L is expected to provide equal annual net cash flows of $140,000, while the net cash flows for Proposal K are as follows:

Determine the cash payback period for each proposal. Round your answers to two decimal places.

Determine the cash payback period for each proposal. Round your answers to two decimal places.

(Essay)

5.0/5  (35)

(35)

Which of the following can be used to place capital investment proposals involving different amounts of investment on a comparable basis for purposes of net present value analysis?

(Multiple Choice)

4.8/5  (30)

(30)

Below is a table for the present value of $1 at compound interest.  Below is a table for the present value of an annuity of $1 at compound interest.

Below is a table for the present value of an annuity of $1 at compound interest.

Using the tables above, what would be the present value of $15,000 (rounded to the nearest dollar) to be received at the end of each of the next two years, assuming an earnings rate of 6%?

Using the tables above, what would be the present value of $15,000 (rounded to the nearest dollar) to be received at the end of each of the next two years, assuming an earnings rate of 6%?

(Multiple Choice)

4.7/5  (28)

(28)

A company is considering purchasing a machine for $21,000. The machine will generate income from operations of $2,000; annual cash flows from the machine will be $3,500. The payback period for the new machine is 6 years.

(True/False)

4.9/5  (38)

(38)

A present value index can be used to rank competing capital investment proposals when the net present value method is used.

(True/False)

4.8/5  (40)

(40)

Showing 1 - 20 of 179

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)