Exam 18: Managerial Accounting Concepts and Principles

Exam 1: Introduction to Accounting and Business190 Questions

Exam 2: Analyzing Transactions224 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle194 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses215 Questions

Exam 7: Inventories165 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash176 Questions

Exam 9: Receivables140 Questions

Exam 10: Fixed Assets and Intangible Assets170 Questions

Exam 11: Current Liabilities and Payroll169 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies190 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends165 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes185 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows160 Questions

Exam 17: Financial Statement Analysis185 Questions

Exam 18: Managerial Accounting Concepts and Principles173 Questions

Exam 19: Job Order Costing173 Questions

Exam 20: Process Cost Systems177 Questions

Exam 21: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 22: Budgeting188 Questions

Exam 23: Performance Evaluation Using Variances From Standard Costs161 Questions

Exam 24: Performance Evaluation for Decentralized Operations200 Questions

Exam 25: Differential Analysis and Product Pricing162 Questions

Exam 26: Capital Investment Analysis179 Questions

Select questions type

Conversion costs consist of product costs and period costs.

Free

(True/False)

4.8/5  (35)

(35)

Correct Answer:

False

Which of the following is false in regards to direct materials for an auto manufacturer?

Free

(Multiple Choice)

4.7/5  (40)

(40)

Correct Answer:

D

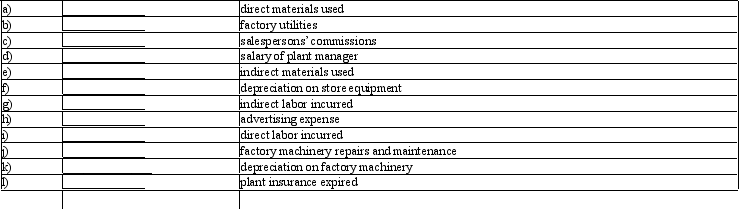

Classify the following costs as either a product cost or a period cost:

Free

(Essay)

4.7/5  (35)

(35)

Correct Answer:

a) product

b) product

c) period

d) product

e) product

f) period

g) product

h) period

i) product

j) product

k) product

l) product

Conversion costs are the combination of direct labor, direct material and factory overhead costs.

(True/False)

4.8/5  (38)

(38)

All of the following would probably be considered a direct material except:

(Multiple Choice)

4.8/5  (46)

(46)

At the beginning of 2011, the Gilbert Company's work in process inventory account had a balance of $30,000. During 2011, $68,000 of direct materials were used in production, and $66,000 of direct labor costs were incurred. Factory overhead in 2011 amounted to $90,000. Cost of goods manufactured is $230,000 in 2011. The balance in work in process inventory on December 31, 2011, is:

(Multiple Choice)

4.9/5  (32)

(32)

A company manufactured 50,000 units of a product at a cost of $450,000. They sold 40,000 units for $15 each. What is the gross margin?

(Multiple Choice)

4.8/5  (32)

(32)

A staff department or unit is one that provides services, assistance, and advice to the departments with line or other staff responsibilities.

(True/False)

4.8/5  (41)

(41)

The following information is available for Carter Corporation for 2012:

1) Materials inventory decreased $4,000 during 2012.

2) Materials inventory on December 31, 2012, was 50% of materials inventory on January 1, 2012.

3) Beginning work in process inventory was $145,000.

4) Ending finished goods inventory was $65,000.

5) Purchases of direct materials were $154,700.

6) Direct materials used were 2.5 times the cost of direct labor.

7) Total manufacturing costs incurred were $246,400, 80% of cost of goods manufactured and $156,000 less than cost of goods sold.

Compute:

a) finished goods inventory on January 1, 2012

b) work in process inventory on December 31, 2012

c) direct labor incurred

d) factory overhead incurred

e) direct materials used

f) materials inventory on January 1, 2012

g) materials inventory on December 31, 2012

Note to students: The answers are not necessarily calculated in alphabetical order.

(Essay)

5.0/5  (34)

(34)

Cost of goods manufactured during 2011 is $240, work in process inventory on December 31, 2011, is $50. Work in process inventory during 2011 decreased by 60%. Total manufacturing costs incurred during 2011 amount to:

(Multiple Choice)

4.8/5  (40)

(40)

Period costs are operating costs that are expensed in the period in which the goods are sold.

(True/False)

4.8/5  (39)

(39)

Controlling deals with choosing goals and deciding how to achieve them.

(True/False)

4.9/5  (30)

(30)

Manufacturers use labor, plant, and equipment to convert direct materials into finished products.

(True/False)

5.0/5  (31)

(31)

If the cost of materials is not a significant portion of the total product cost, the materials may be classified as part of factory overhead cost.

(True/False)

4.9/5  (34)

(34)

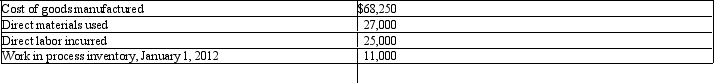

Reedy Company reports the following information for 2012:  Factory overhead is 75% of the cost of direct labor. Work in process inventory on December 31, 2012, is:

Factory overhead is 75% of the cost of direct labor. Work in process inventory on December 31, 2012, is:

(Multiple Choice)

5.0/5  (40)

(40)

Prime costs are the combination of direct materials and direct labor costs.

(True/False)

4.9/5  (41)

(41)

Planning is the process of monitoring operating results and comparing actual results with the expected results.

(True/False)

4.8/5  (42)

(42)

Rent expense on a factory building would be treated as a(n):

(Multiple Choice)

4.8/5  (28)

(28)

Showing 1 - 20 of 173

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)