Exam 15: Investments and Fair Value Accounting

Exam 1: Introduction to Accounting and Business190 Questions

Exam 2: Analyzing Transactions224 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle194 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses215 Questions

Exam 7: Inventories165 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash176 Questions

Exam 9: Receivables140 Questions

Exam 10: Fixed Assets and Intangible Assets170 Questions

Exam 11: Current Liabilities and Payroll169 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies190 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends165 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes185 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows160 Questions

Exam 17: Financial Statement Analysis185 Questions

Exam 18: Managerial Accounting Concepts and Principles173 Questions

Exam 19: Job Order Costing173 Questions

Exam 20: Process Cost Systems177 Questions

Exam 21: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 22: Budgeting188 Questions

Exam 23: Performance Evaluation Using Variances From Standard Costs161 Questions

Exam 24: Performance Evaluation for Decentralized Operations200 Questions

Exam 25: Differential Analysis and Product Pricing162 Questions

Exam 26: Capital Investment Analysis179 Questions

Select questions type

What is comprehensive income? How is it calculated? What are some examples of items included in other comprehensive income? Where is comprehensive income reported?

Free

(Essay)

4.7/5  (32)

(32)

Correct Answer:

Comprehensive income is all changes in stockholders' equity during a period except those resulting from dividends and stockholders' investments.

It is calculated by adding other comprehensive income to net income.

Other comprehensive income items include unrealized gains and losses on available-for-sale-securities and other items including foreign currency and pension liability adjustments.

Comprehensive income is reported in the financial statements in one of the following ways:

1. On the income statement

2. In a separate statement of comprehensive income

3. In the statement of stockholders' equity

Fair value accounting is used more under Generally Accepted Accounting Principles (GAAP) than it is under International Financial Reporting Standards (IRFS).

Free

(True/False)

4.9/5  (39)

(39)

Correct Answer:

False

Which of the following is not a part of comprehensive income?

Free

(Multiple Choice)

4.8/5  (24)

(24)

Correct Answer:

B

An investor purchased 500 shares of common stock, $25 par, for $21,750. Subsequently, 100 shares were sold for $49.50 per share. What is the amount of gain or loss on the sale?

(Multiple Choice)

4.8/5  (42)

(42)

Gale Company owns 87% of the outstanding stock of Leonardo Company. Leonardo Company is referred to as the

(Multiple Choice)

4.9/5  (32)

(32)

Generally accepted accounting principles (GAAP) require the use of fair value accounting for all assets and liabilities.

(True/False)

4.8/5  (42)

(42)

Which of the following is not a reason to invest excess cash in temporary investments?

(Multiple Choice)

4.9/5  (38)

(38)

Investment in Bonds are reported on the balance sheet at lower of cost or market.

(True/False)

4.9/5  (36)

(36)

Purchased $400,000 of ABC Co. 5% bonds at 100 plus accrued interest of $4,500. Sold $250,000 of bonds at 97 plus accrued interest. The journal entry for the sale would include:

(Multiple Choice)

4.8/5  (37)

(37)

Although marketable securities may be retained for several years, they continue to be classified as temporary, provided they are readily marketable and can be sold for cash at any time.

(True/False)

4.9/5  (31)

(31)

The account Unrealized Gain (Loss) on Trading Securities should be included in the

(Multiple Choice)

4.8/5  (28)

(28)

Parker Company owns 83% of the outstanding stock of Tadeo Company. Parker Company is referred to as the

(Multiple Choice)

4.9/5  (38)

(38)

If the bonds are purchased between interest dates, the purchase price includes accrued interest since the last interest payment.

(True/False)

4.9/5  (33)

(33)

When a bond is purchased for an investment, the purchase price, minus the brokerage commission, plus any accrued interest is recorded.

(True/False)

4.8/5  (38)

(38)

All of the following are disadvantages of fair value use except:

(Multiple Choice)

4.8/5  (42)

(42)

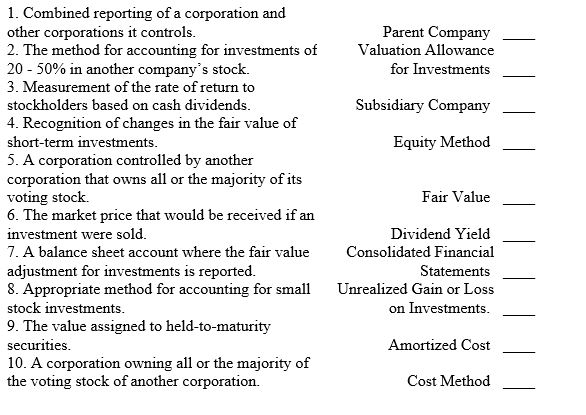

Match each of the following investment terms with the appropriate definition below.

(Essay)

4.8/5  (37)

(37)

The amount of interest paid when buying a bond as an investment should be credited to Interest Revenue.

(True/False)

5.0/5  (37)

(37)

Available-for-sale securities are securities that management expects to sell in the future, but are actively traded for profit.

(True/False)

4.9/5  (36)

(36)

Discuss the appropriate financial treatment when an investor has a greater than 50% ownership in another company.

(Essay)

4.9/5  (33)

(33)

The income statement for Hudson Company reported net income of $345,000 for the year ended December 31, 2012 before considering the following:

During the year the company purchased trading securities. At year end, the fair value of the investment portfolio was $23,000 less than cost.

The balance of retained earnings was $823,000 on December 31, 2011. Hudson Company paid $43,000 in cash dividends in 2012. Calculate the balance of retained earnings on December 31, 2012.

(Essay)

4.9/5  (36)

(36)

Showing 1 - 20 of 133

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)