Exam 10: Fixed Assets and Intangible Assets

Exam 1: Introduction to Accounting and Business190 Questions

Exam 2: Analyzing Transactions224 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle194 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses215 Questions

Exam 7: Inventories165 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash176 Questions

Exam 9: Receivables140 Questions

Exam 10: Fixed Assets and Intangible Assets170 Questions

Exam 11: Current Liabilities and Payroll169 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies190 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends165 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes185 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows160 Questions

Exam 17: Financial Statement Analysis185 Questions

Exam 18: Managerial Accounting Concepts and Principles173 Questions

Exam 19: Job Order Costing173 Questions

Exam 20: Process Cost Systems177 Questions

Exam 21: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 22: Budgeting188 Questions

Exam 23: Performance Evaluation Using Variances From Standard Costs161 Questions

Exam 24: Performance Evaluation for Decentralized Operations200 Questions

Exam 25: Differential Analysis and Product Pricing162 Questions

Exam 26: Capital Investment Analysis179 Questions

Select questions type

When a plant asset is traded for another similar asset, losses on the asset traded are recognized.

Free

(True/False)

4.9/5  (36)

(36)

Correct Answer:

False

On June 1, 2014, Aaron Company purchased equipment at a cost of $120,000 that has a depreciable cost of $90,000 and an estimated useful life of 3 years and 30,000 hours. Using straight line depreciation, calculate depreciation expense for the first year.

Free

(Multiple Choice)

4.8/5  (39)

(39)

Correct Answer:

A

An intangible asset is one that has a physical existence.

Free

(True/False)

4.8/5  (27)

(27)

Correct Answer:

False

The double-declining-balance method is an accelerated depreciation method.

(True/False)

4.9/5  (24)

(24)

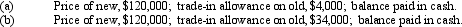

Machinery acquired at a cost of $80,000 and on which there is accumulated depreciation of $55,000 (including depreciation for the current year to date) is exchanged for similar machinery. For financial reporting purposes, present entries to record the disposition of the old machinery and the acquisition of new machinery under each of the following assumptions:

(Essay)

4.9/5  (29)

(29)

The double declining balance depreciation method calculates depreciation each year by taking twice the straight line rate times the book value of the asset at the beginning of each year.

(True/False)

4.9/5  (31)

(31)

On December 31, Strike Company has decided to sell one of its batting cages. The initial cost of the equipment was $310,000 with an accumulated depreciation of $260,000. Depreciation has been taken up to the end of the year. The company found a company that is willing to buy the equipment for $55,000. What is the amount of the gain or loss on this transaction?

(Multiple Choice)

4.8/5  (41)

(41)

The method used to calculate the depletion of a natural resource is the straight line method.

(True/False)

4.8/5  (36)

(36)

The cost of computer equipment does include the consultant's fee to supervise installation of the equipment.

(True/False)

4.8/5  (37)

(37)

The book value of a fixed asset reported on the balance sheet represents its market value on that date.

(True/False)

4.9/5  (44)

(44)

When the amount of use of a fixed asset varies from year to year, the method of determining depreciation expense that best matches allocation of cost with revenue is

(Multiple Choice)

4.8/5  (35)

(35)

An asset was purchased for $58,000 and originally estimated to have a useful life of 10 years with a residual value of $3,000. After two years of straight line depreciation, it was determined that the remaining useful life of the asset was only 2 years with a residual value of $2,000.

a) Determine the amount of the annual depreciation for the first two years.

b) Determine the book value at the end of the 2nd year.

c) Determine the depreciation expense for each of the remaining years after revision.

(Essay)

4.8/5  (32)

(32)

Equipment with a cost of $220,000 has an estimated residual value of $30,000 and an estimated life of 10 years or 19,000 hours. It is to be depreciated by the straight-line method. What is the amount of depreciation for the first full year, during which the equipment was used 2,100 hours?

(Multiple Choice)

4.8/5  (37)

(37)

On July 1st, Hartford Construction purchases a bulldozer for $228,000. The equipment has a 9 year life with a residual value of $16,000. Hartford uses units-of-production method depreciation and the bulldozer is expected to yield 26,500 operating hours.

(a) Calculate the depreciation expense per hour of operation.

(b) The bulldozer is operated 1,250 hours in the first year, 2,755 hours in the second year, and 1,225 hours in the third year of operations. Journalize the depreciation expense for each year.

(Essay)

4.8/5  (24)

(24)

A machine with a cost of $75,000 has an estimated residual value of $5,000 and an estimated life of 4 years or 18,000 hours. What is the amount of depreciation for the second full year, using the double declining-balance method?

(Multiple Choice)

4.8/5  (33)

(33)

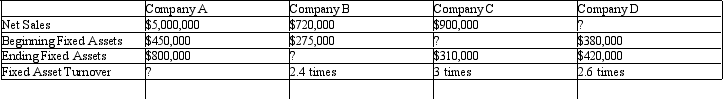

Fill in the missing numbers using the formula for Fixed Asset Turnover:

(Essay)

5.0/5  (29)

(29)

Expenditures that add to the utility of fixed assets for more than one accounting period are

(Multiple Choice)

4.9/5  (35)

(35)

Costs associated with normal research and development activities should be treated as intangible assets.

(True/False)

4.7/5  (44)

(44)

The difference between the balance in a fixed asset account and its related accumulated depreciation account is the asset's book value.

(True/False)

4.8/5  (36)

(36)

Showing 1 - 20 of 170

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)