Exam 16: Statement of Cash Flows

Exam 1: Introduction to Accounting and Business190 Questions

Exam 2: Analyzing Transactions224 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle194 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses215 Questions

Exam 7: Inventories165 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash176 Questions

Exam 9: Receivables140 Questions

Exam 10: Fixed Assets and Intangible Assets170 Questions

Exam 11: Current Liabilities and Payroll169 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies190 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends165 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes185 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows160 Questions

Exam 17: Financial Statement Analysis185 Questions

Exam 18: Managerial Accounting Concepts and Principles173 Questions

Exam 19: Job Order Costing173 Questions

Exam 20: Process Cost Systems177 Questions

Exam 21: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 22: Budgeting188 Questions

Exam 23: Performance Evaluation Using Variances From Standard Costs161 Questions

Exam 24: Performance Evaluation for Decentralized Operations200 Questions

Exam 25: Differential Analysis and Product Pricing162 Questions

Exam 26: Capital Investment Analysis179 Questions

Select questions type

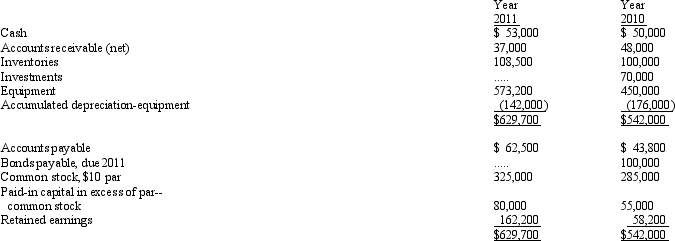

The comparative balance sheet of Posner Company, for 2011 and the preceding year ended December 31, 2010, appears below in condensed form:

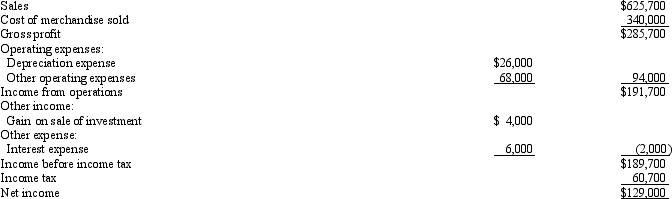

The income statement for the current year is as follows:

The income statement for the current year is as follows:

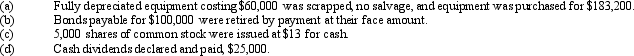

Additional data for the current year are as follows:

Additional data for the current year are as follows:

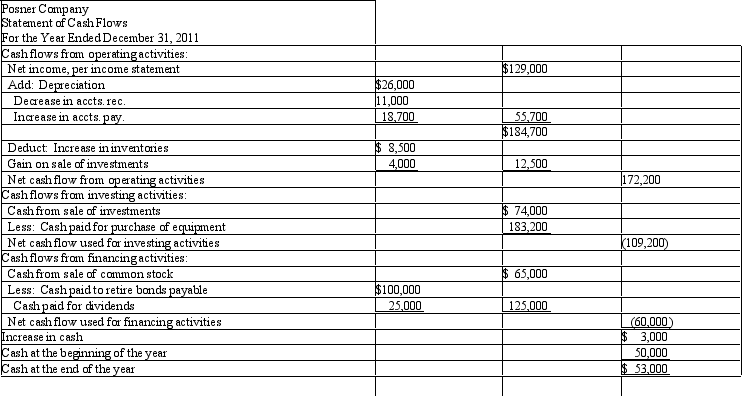

Prepare a statement of cash flows, using the indirect method of reporting cash flows from operating activities.

Prepare a statement of cash flows, using the indirect method of reporting cash flows from operating activities.

Free

(Essay)

4.8/5  (30)

(30)

Correct Answer:

The direct method of preparing the operating activities section of the statement of cash flows reports major classes of gross cash receipts and gross cash payments.

Free

(True/False)

4.8/5  (40)

(40)

Correct Answer:

True

The cost of merchandise sold during the year was $45,000. Merchandise inventories were $13,500 and $10,500 at the beginning and end of the year, respectively. Accounts payable were $7,000 and $5,000 at the beginning and end of the year, respectively. Using the direct method of reporting cash flows from operating activities, cash payments for merchandise total

Free

(Multiple Choice)

4.8/5  (28)

(28)

Correct Answer:

B

On the statement of cash flows, the cash flows from operating activities section would include

(Multiple Choice)

4.8/5  (35)

(35)

Which one of the following below would not be classified as an operating activity?

(Multiple Choice)

4.8/5  (34)

(34)

Depreciation on factory equipment would be reported in the statement of cash flows prepared by the indirect method in

(Multiple Choice)

4.7/5  (37)

(37)

In preparing the cash flows from operating activities section of the statement of cash flows by the indirect method, the net decrease in inventories from the beginning to the end of the period is added to net income for the period.

(True/False)

4.8/5  (26)

(26)

An analysis of the general ledger accounts indicates that equipment, with an original cost of $134,000 and accumulated depreciation of $105,000 on the date of sale, was sold for $20,000 during the year. Using this information, indicate the items to be reported on the statement of cash flows using the indirect method.

(Essay)

4.9/5  (36)

(36)

If cash dividends of $135,000 were paid during the year and the company sold 1,000 shares of common stock at $30 per share, the statement of cash flows would report net cash flow from financing activities as $165,000.

(True/False)

4.9/5  (32)

(32)

To determine cash payments for operating expenses for the cash flow statement using the direct method, a decrease in accrued expenses is added to operating expenses other than depreciation.

(True/False)

4.8/5  (35)

(35)

Cash flows from financing activities, as part of the statement of cash flows, include payments for dividends.

(True/False)

4.8/5  (39)

(39)

On the statement of cash flows, the cash flows from investing activities section would include

(Multiple Choice)

4.8/5  (38)

(38)

Baxter Company reported a net loss of $13,000 for the year ended December 31, 2010. During the year, accounts receivable decreased by $5,000, merchandise inventory increased by $8,000, accounts payable increased by $10,000, and depreciation expense of $4,000 was recorded. During 2010, operating activities

(Multiple Choice)

4.9/5  (42)

(42)

Land costing $140,000 was sold for $173,000 cash. The gain on the sale was reported on the income statement as other income. On the statement of cash flows, what amount should be reported as an investing activity from the sale of land?

(Multiple Choice)

4.8/5  (35)

(35)

Repayments of bonds would be shown as a cash outflow in the investing section of the statement of cash flows.

(True/False)

4.8/5  (45)

(45)

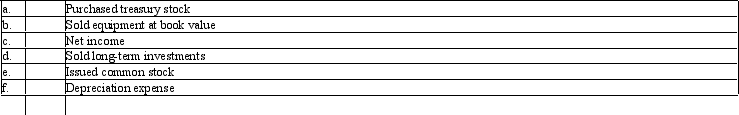

For each of the following, identify whether it would be disclosed as an operating (O), financing (F), or investing (I) activity on the statement of cash flows under the indirect method.

(Essay)

4.9/5  (31)

(31)

Free cash flow is the measure of operating cash flow available for corporate purposes after providing sufficient fixed asset additions to maintain current productive capacity and dividends.

(True/False)

4.9/5  (30)

(30)

In preparing the statement of cash flows, the correct order of reporting cash activities is Financing, Operating, Investing.

(True/False)

4.8/5  (33)

(33)

The manner of reporting cash flows from investing and financing activities will be different under the direct method as compared to the indirect method.

(True/False)

4.7/5  (42)

(42)

Showing 1 - 20 of 160

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)