Exam 8: Segment and Interim Reporting

Exam 1: The Equity Method of Accounting for Investments119 Questions

Exam 2: Consolidation of Financial Information115 Questions

Exam 3: Consolidations-Subsequent to the Date of Acquisition120 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership117 Questions

Exam 5: Consolidated Financial Statements - Intra-Entity Asset Transactions127 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flo115 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income118 Questions

Exam 8: Segment and Interim Reporting113 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk93 Questions

Exam 10: Translation of Foreign Currency Financial Statements97 Questions

Exam 11: Worldwide Accounting Diversity and International Standards60 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission77 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations82 Questions

Exam 14: Partnerships: Formation and Operations88 Questions

Exam 15: Partnerships: Termination and Liquidation70 Questions

Exam 16: Accounting for State and Local Governments78 Questions

Exam 17: Accounting for State and Local Governments46 Questions

Exam 18: Accounting and Reporting for Private Not-For-Profit Organizations62 Questions

Exam 19: Accounting for Estates and Trusts80 Questions

Select questions type

Which operating segments are reportable under the asset test?

(Multiple Choice)

4.8/5  (33)

(33)

Which of the following is not correct regarding inventory procedures reported in an interim financial statement?

(Multiple Choice)

4.9/5  (39)

(39)

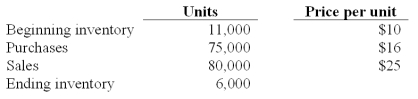

The following information for Urbanski Corporation relates to the three months ending June 30, 2011:

Answer:  Urbanski uses the LIFO method to account for inventory, and expects at least 15,000 units to be on hand in the ending inventory at year-end. Purchases made in the last six months are expected to cost an average of $18 per unit.

-Compute cost of goods sold and gross profit for the quarter ending June 30, 2011.

Urbanski uses the LIFO method to account for inventory, and expects at least 15,000 units to be on hand in the ending inventory at year-end. Purchases made in the last six months are expected to cost an average of $18 per unit.

-Compute cost of goods sold and gross profit for the quarter ending June 30, 2011.

(Essay)

4.8/5  (36)

(36)

Kurves Corp. had six different operating segments reporting the following operating profit and loss figures: Profit or Segment (Loss) \ 112,000 (196,000) 1,316,000 (616,000) (126,000) (140,000)

Which one of the following statements is true?

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following must be disclosed by a geographic segment according to U.S. GAAP?

(Multiple Choice)

4.8/5  (33)

(33)

Which of the following items of information are required to be included in interim reports for each operating segment?

(I) Revenues from external customers

(II) Segment profit or loss

(III) Reconciliation of segment profit or loss to the enterprise's total income before taxes

(IV) Intersegment revenues

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following costs require similar treatment to Property Tax Expense in an interim financial report?

1) Annual major repairs.

2) Advertising expense.

3) Bonus expense, if estimable.

4) Quantity discounts based on annual sales.

(Multiple Choice)

4.7/5  (38)

(38)

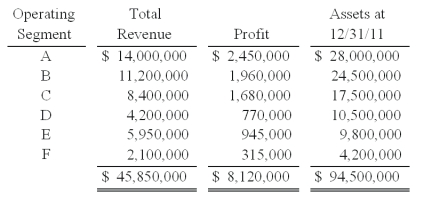

Retro Corp. was engaged solely in manufacturing operations. The following data pertain to the operating segments for 2011:  -What is the minimum amount of assets that each of these segments must own to be considered separately reportable?

-What is the minimum amount of assets that each of these segments must own to be considered separately reportable?

(Multiple Choice)

4.9/5  (38)

(38)

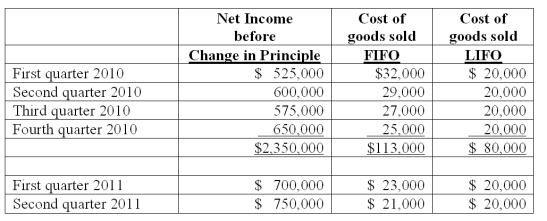

Harrison Company, Inc. began operations on January 1, 2010, and applied the LIFO method for inventory valuation. On June 10, 2011, Harrison adopted the FIFO method of accounting for inventory. Additional information is as follows:  The LIFO method was applied during the first quarter of 2011 and the FIFO method was applied during the second quarter of 2011 in computing income, above. Harrison's effective income tax rate is 40 percent. Harrison has 500,000 shares of common stock outstanding at all times.

-Prepare a schedule showing the calculation of net income and earnings per share to be reported by Harrison for the three-month period and the six-month period ended June 30, 2010 and 2011.

The LIFO method was applied during the first quarter of 2011 and the FIFO method was applied during the second quarter of 2011 in computing income, above. Harrison's effective income tax rate is 40 percent. Harrison has 500,000 shares of common stock outstanding at all times.

-Prepare a schedule showing the calculation of net income and earnings per share to be reported by Harrison for the three-month period and the six-month period ended June 30, 2010 and 2011.

(Essay)

4.8/5  (36)

(36)

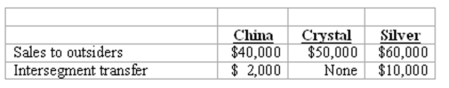

The hardware operating segment of Bloom Corporation has the following revenues for the year ended December 31, 2011:

For purposes of the revenue test, what amount will be used as total revenues of the hardware operating segment?

(Multiple Choice)

4.8/5  (35)

(35)

Cement Company, Inc. began the first quarter with 1,000 units of inventory costing $25 per unit. During the first quarter, 3,000 units were purchased at a cost of $40 per unit, and sales of 3,400 units at $65 per units were made. During the second quarter, the company expects to replace the units of beginning inventory sold at a cost of $45 per unit. Cement Company uses the LIFO method to account for inventory.

-The amount of gross profit for the first quarter is:

(Multiple Choice)

4.9/5  (38)

(38)

Which items of information are required to be included in interim reports for each operating segment?

(Essay)

4.8/5  (39)

(39)

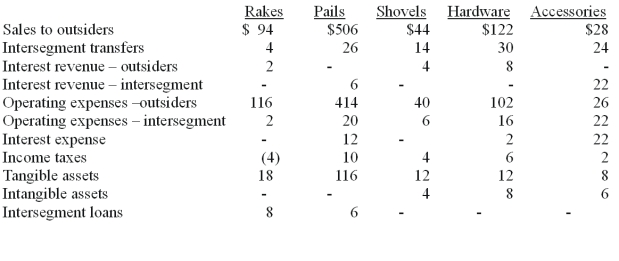

Dean Hardware, Inc. is comprised of five operating segments. Information about each of these segments is as follows (in thousands; Intersegment loans are receivables):  -Which operating segments are reportable under the revenue test?

-Which operating segments are reportable under the revenue test?

(Multiple Choice)

4.9/5  (35)

(35)

Provo, Inc. has an estimated annual tax rate of 35 percent in the first quarter of 2011. Pretax income for the first quarter was $300,000. At the end of the second quarter of 2011, Provo expects the annual tax rate to be 32 percent because of anticipated tax credits. Pretax income for the second quarter was $350,000. Assume no items in either quarter requiring the net-of-tax presentation.

-How much income tax expense is recognized in the first quarter of 2011?

(Multiple Choice)

4.9/5  (31)

(31)

Betsy Kirkland, Inc. incurred a flood loss during the first quarter of 2011 that is deemed both unusual and infrequent. The loss is considered immaterial to the twelve-month period, but is material in amount relative to the first quarter. The proper accounting treatment in the first quarter interim statement is to:

(Multiple Choice)

4.9/5  (48)

(48)

Schilling, Inc. has three operating segments with the following information:  -What is the minimum amount of revenue an operating segment must have to be considered a reportable segment?

-What is the minimum amount of revenue an operating segment must have to be considered a reportable segment?

(Multiple Choice)

4.8/5  (37)

(37)

The following items are required to be disclosed for each operating segment except:

(Multiple Choice)

4.7/5  (31)

(31)

Which one of the following items is not required to be disclosed for each operating segment?

(Multiple Choice)

4.8/5  (27)

(27)

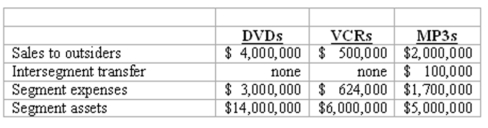

Elektronix, Inc. has three operating segments with the following information:  -What is the operating profit or loss for the VCRs segment?

-What is the operating profit or loss for the VCRs segment?

(Multiple Choice)

4.9/5  (27)

(27)

For companies that provide quarterly reports, how is the fourth quarter reported?

(Multiple Choice)

4.9/5  (31)

(31)

Showing 61 - 80 of 113

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)