Exam 5: Activity-Based Costing and Management

Exam 1: The Changing Role of Managerial Accounting in a Dynamic Business Environment62 Questions

Exam 2: Basic Cost Management Concepts85 Questions

Exam 3: Product Costing and Cost Accumulation in a Batch Production Environment80 Questions

Exam 4: Process Costing and Hybrid Product-Costing Systems84 Questions

Exam 5: Activity-Based Costing and Management85 Questions

Exam 6: Activity Analysis, Cost Behavior, and Cost Estimation93 Questions

Exam 7: Cost-Volume-Profit Analysis89 Questions

Exam 8: Variable Costing and the Costs of Quality and Sustainability64 Questions

Exam 9: Financial Planning and Analysis: the Master Budget95 Questions

Exam 10: Standard Costing and Analysis of Direct Costs80 Questions

Exam 11: Flexible Budgeting and Analysis of Overhead Costs91 Questions

Exam 12: Responsibility Accounting, Operational Performance Measures, and the Balanced Scorecard72 Questions

Exam 13: Investment Centers and Transfer Pricing95 Questions

Exam 14: Decision Making: Relevant Costs and Benefits90 Questions

Exam 15: Target Costing and Cost Analysis for Pricing Decisions99 Questions

Exam 16: Capital Expenditure Decisions104 Questions

Exam 17: Allocation of Support Activity Costs and Joint Costs81 Questions

Exam 18: The Sarbanes-Oxley Act, Internal Controls, and Management Accounting14 Questions

Exam 19: Compound Interest and the Concept of Present Value24 Questions

Exam 20: Inventory Management14 Questions

Select questions type

Of the following organizations, activity-based costing (ABC) cannot be used by:

(Multiple Choice)

4.7/5  (38)

(38)

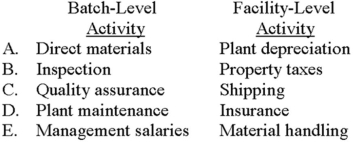

Which of the following choices correctly depicts a cost that arises from a batch-level activity and one that arises from a facility-level activity?

(Multiple Choice)

5.0/5  (49)

(49)

Assume that HiTech is using a volume-based costing system, and the preceding overhead costs are applied to all products on the basis of direct labor hours. The overhead cost that would be assigned to the Deluxe product line is closest to:

(Multiple Choice)

4.8/5  (36)

(36)

Consider the following statements regarding product-sustaining activities:

I. They must be performed for each batch of product that is made.

II. They must be performed for each unit of product that is made.

III. They are needed to support an entire product line.

Which of the above statements is (are) true?

(Multiple Choice)

4.9/5  (39)

(39)

Factory Oak produces various wooden bookcases, tables, storage units, and chairs. Which of the following would be included in a listing of the company's non-value-added activities?

(Multiple Choice)

4.8/5  (40)

(40)

St. James, Inc., currently uses traditional costing procedures, applying $800,000 of overhead to products Beta and Zeta on the basis of direct labor hours. The company is considering a shift to activity-based costing and the creation of individual cost pools that will use direct labor hours (DLH), production setups (SU), and number of parts components (PC) as cost drivers. Data on the cost pools and respective driver volumes follow. Pool No. 1 Pool No. 2 Pool No. 3 Product (Driver: DLH) (Driver: SU) (Driver: PC) Beta 1,200 45 2,250 Zeta 2,800 55 750 Pool Cost \ 160,000 \ 280,000 \ 360,000 The overhead cost allocated to Zeta by using activity-based costing procedures would be:

(Multiple Choice)

4.7/5  (40)

(40)

Alexander Corporation produces flat-screen computer monitors. Consider the following selected costs that arose during the current year:

1. Direct materials used: $3,640,000

2. Plant rent, utilities, and taxes: $1,229,000

3. New technology design engineering: $2,040,000

4. Materials receiving: $318,000

5. Manufacturing-run/set-up charges: $115,000

6. Equipment depreciation: $92,000

7. General management salaries: $1,564,000

Required:

A. A batch-level activity is performed for each batch of products rather than for each unit. In contrast, a facility-level activity is required for an entire process to occur. Examples of the latter, which support the organization as a whole, include plant maintenance and property taxes.

A. Briefly distinguish between batch-level and facility-level activities.

B. Determine the cost of the firm's unit-level, batch-level, product-sustaining, and facility-level activities.

B. Unit-level: $3,640,000 (1)

Batch-level: $318,000 (4) + $115,000 (5) = $433,000

Product-sustaining: $2,040,000 (3)

Facility-level: $1,229,000 (2) + $92,000 (6) + $1,564,000 (7) = $2,885,000

(Essay)

4.9/5  (44)

(44)

In an activity-based costing system, direct materials used would typically be classified as a unit-level cost.

(True/False)

5.0/5  (45)

(45)

Successful adoptions of activity-based costing typically occur when companies rely heavily on:

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following statements is (are) true about non-value-added activities?

I. Non-value-added activities are often unnecessary and dispensable.

II. Non-value-added activities may be necessary but are being performed in an inefficient and improvable manner.

III. Non-value-added activities can be eliminated without deterioration of product quality, performance, or perceived value.

(Multiple Choice)

4.8/5  (42)

(42)

Airstream builds recreational motor homes. All of the following activities add value to the finished product except:

(Multiple Choice)

4.8/5  (41)

(41)

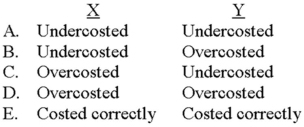

Jackson manufactures products X and Y, applying overhead on the basis of labor hours. X, a low-volume product, requires a variety of complex manufacturing procedures. Y, on the other hand, is both a high-volume product and relatively simplistic in nature. What would an activity-based costing system likely disclose about products X and Y as a result of Jackson's current accounting procedures?

(Multiple Choice)

4.7/5  (29)

(29)

In comparison with a system that uses a single, volume-based cost driver, an activity-based costing system is preferred when a company has:

(Multiple Choice)

4.8/5  (37)

(37)

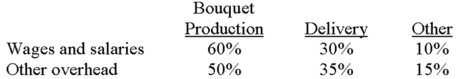

Riverside Florists uses an activity-based costing system to compute the cost of making floral bouquets and delivering the bouquets to its commercial customers. Company personnel who earn $180,000 typically perform both tasks; other firm-wide overhead is expected to total $70,000. These costs are allocated as follows:  Riverside anticipates making 20,000 bouquets and 4,000 deliveries in the upcoming year.

The cost of wages and salaries and other overhead that would be charged to each bouquet made is:

Riverside anticipates making 20,000 bouquets and 4,000 deliveries in the upcoming year.

The cost of wages and salaries and other overhead that would be charged to each bouquet made is:

(Multiple Choice)

4.8/5  (37)

(37)

St. James, Inc., currently uses traditional costing procedures, applying $800,000 of overhead to products Beta and Zeta on the basis of direct labor hours. The company is considering a shift to activity-based costing and the creation of individual cost pools that will use direct labor hours (DLH), production setups (SU), and number of parts components (PC) as cost drivers. Data on the cost pools and respective driver volumes follow. Pool No. 1 Pool No. 2 Pool No. 3 Product (Driver: DLH) (Driver: SU) (Driver: PC) Beta 1,200 45 2,250 Zeta 2,800 55 750 Pool Cost \ 160,000 \ 280,000 \ 360,000 The overhead cost allocated to Beta by using activity-based costing procedures would be:

(Multiple Choice)

4.8/5  (42)

(42)

Martin and Beasley, an accounting firm, provides consulting and tax planning services. For many years, the firm's total administrative cost (currently $270,000) has been allocated to services on this basis of billable hours to clients. A recent analysis found that 55% of the firm's billable hours to clients resulted from tax planning services, while 45% resulted from consulting services.

The firm, contemplating a change to activity-based costing, has identified three components of administrative cost, as follows: Staff support \ 200,000 In-house computing charges 50,000 Miscellaneous office costs 20,000 Total \2 70,000

A recent analysis of staff support found a strong correlation with the number of clients served. In contrast, in-house computing and miscellaneous office cost varied directly with the number of computer hours logged and number of client transactions, respectively. Consulting clients served totaled 35% of the total client base, consumed 30% of the firm's computer hours, and accounted for 20% of the total client transactions.

If Martin and Beasley switched from its current accounting method to an activity-based costing system, the amount of administrative cost chargeable to consulting services would:

(Multiple Choice)

4.9/5  (36)

(36)

Non-value-added costs occur in nonmanufacturing organizations as well as in manufacturing firms.

Required:

A. Explain what is meant by a non-value-added cost.

A. Non-value-added costs are the costs of activities that can be eliminated with no deterioration of product quality, performance, or perceived value. These activities should be eliminated to save time and money. General examples include the costs of inspection, moving, waiting, and storing.

B. Airlines:

• Vouchers for future flights that are given to passengers as a result of poor customer service.

• The cost of tracing, returning, repairing, or replacing lost or mishandled luggage.

• Additional compensation paid to flight crews attributable to cancellations or delays from problems that should have been prevented by routine maintenance.

Banks:

• The cost of correcting bank errors in customer accounts.

• The cost of performing manual banking procedures necessitated by computer system downtime.

• Losses caused by employee embezzlement and petty thefts.

• Defaulted loans made to borrowers who should have been classified as poor risks by existing credit-granting procedures.

Hotels:

• Broken dishes and glassware, loss of or damage to linens and towels.

• The cost of replacing lost room keys/entry cards.

• The cost of overstaffing the front desk during nonpeak hours.

• Excess food costs, including preparation.

B. Identify two potential non-value-added costs for each of the following service providers: airlines, banks, and hotels.

(Essay)

4.8/5  (43)

(43)

Showing 21 - 40 of 85

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)