Exam 11: Property, Plant, and Equipment and Intangible Assets: Utilization and Impairment

Exam 1: Environment and Theoretical Structure of Financial Accounting135 Questions

Exam 2: Review of the Accounting Process126 Questions

Exam 3: The Balance Sheet and Financial Disclosures102 Questions

Exam 4: The Income Statement, Comprehensive Income, and the Statement of Cash Flows103 Questions

Exam 5: Income Measurement and Profitability Analysis210 Questions

Exam 6: Time Value of Money Concepts114 Questions

Exam 7: Cash and Receivables164 Questions

Exam 8: Inventories: Measurement126 Questions

Exam 9: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition120 Questions

Exam 10: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition128 Questions

Exam 11: Property, Plant, and Equipment and Intangible Assets: Utilization and Impairment146 Questions

Exam 12: Investments186 Questions

Exam 13: Current Liabilities and Contingencies153 Questions

Exam 14: Bonds and Long-Term Notes167 Questions

Exam 15: Leases160 Questions

Exam 16: Accounting for Income Taxes145 Questions

Exam 17: Pensions and Other Postretirement Benefits197 Questions

Exam 20: Accounting Changes and Error Corrections119 Questions

Exam 21: The Statement of Cash Flows Revisited155 Questions

Select questions type

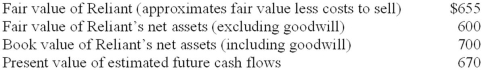

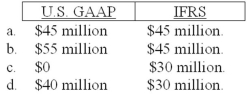

Kingston Corporation has $95 million of goodwill on its books from the 2011 acquisition of Reliant Motors. At the end of its 2013 fiscal year, management has provided the following information for its required goodwill impairment test ($ in millions):  Assuming that Reliant is considered a reporting unit for U.S. GAAP and a cash-generating unit for IFRS, the amount of goodwill impairment loss that Kingston should recognize according to U.S. GAAP and IFRS, respectively, is:

Assuming that Reliant is considered a reporting unit for U.S. GAAP and a cash-generating unit for IFRS, the amount of goodwill impairment loss that Kingston should recognize according to U.S. GAAP and IFRS, respectively, is:

(Multiple Choice)

4.8/5  (27)

(27)

Required:

Compute depreciation for 2013 and 2014 and the book value of the drill press at December 31, 2013 and 2014, assuming the double-declining-balance method is used.

(Essay)

4.8/5  (31)

(31)

In December of 2013, XL Computer's internal auditors discovered that office equipment costing $800,000 was charged to expense in 2011. The asset had an expected life of 10 years with no residual value. XL would have recorded a half year of depreciation in 2011.

Required:

Prepare the necessary correcting entry that would be made in 2013 (ignore income taxes), and the entry to record depreciation for 2013.

(Essay)

4.9/5  (36)

(36)

Recognition of impairment for property, plant, and equipment is required if book value exceeds:

(Multiple Choice)

4.9/5  (42)

(42)

Required:

Compute depreciation for 2013 and 2014 and the book value of the spooler at December 31, 2013 and 2014, assuming the sum-of-the-years'-digits method is used.

(Essay)

4.8/5  (45)

(45)

According to International Financial Reporting Standards, property, plant, and equipment must be valued at cost less accumulated depreciation.

(True/False)

4.7/5  (35)

(35)

Meca Concrete purchased a mixer on January 1, 2011, at a cost of $45,000. Straight-line depreciation for 2011 and 2012 was based on an estimated eight-year life and $3,000 estimated residual value. In 2013, Meca revised its estimate and now believes the mixer will have a total service life of only six years, and that the residual value will be only $2,000.

Required:

Compute depreciation for 2013 and 2014.

(Essay)

4.9/5  (46)

(46)

Depreciation for 2014, using double-declining balance, would be:

(Multiple Choice)

4.8/5  (31)

(31)

Murgatroyd Co. purchased equipment on January 1, 2011, for $500,000, estimating a four-year useful life and no residual value. In 2011 and 2012, Murgatroyd depreciated the asset using the sum-of-years'-digits method. In 2013, Murgatroyd changed to straight-line depreciation for this equipment. What depreciation would Murgatroyd record for the year 2013 on this equipment?

(Multiple Choice)

4.8/5  (41)

(41)

Zvinakis Mining Company paid $200,000 for the rights to mine lead in southeast Missouri. The cost to drill and erect a mine shaft was $2,400,000, and equipment to process the lead ore before shipment to the smelter was $1,800,000. The mine is expected to yield 2,000,000 tons of ore during the five years it is expected to be operating. The equipment has an estimated residual value of $150,000 when mining is concluded. The mine started operations on April 30, 2013. In 2013, 300,000 tons of ore were extracted, and in 2014, 700,000 tons were mined.

Required:

1. Compute the depletion rate and the units-of-production depreciation rate.

2. Compute depletion and depreciation for 2013 and 2014.

(Essay)

4.7/5  (44)

(44)

Using the sum-of-the-years'-digits method, depreciation for 2013 and book value at December 31, 2013, would be:

(Multiple Choice)

4.8/5  (38)

(38)

On June 30, 2011, Mobley Corporation acquired a patent for $4 million. The patent was estimated to have an eight-year life and no residual value. Mobley uses the straight-line method of amortization for intangible assets. At the beginning of January 2013, Mobley successfully defended its patent against infringement. Litigation costs totaled $650,000.

Required:

1. Calculate patent amortization for 2011 and 2012.

2. Prepare the journal entry to record the 2013 litigation costs.

3. Calculate amortization for 2013.

4. Repeat requirements 2 and 3 assuming that Mobley prepares its financial statements according to International Financial Reporting Standards.

(Essay)

4.7/5  (32)

(32)

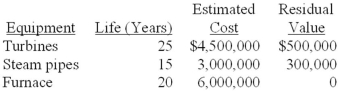

Nature Power Company uses the composite method and straight-line depreciation for its power plant equipment. Its Apple River plant, which began generating electricity January 1, 2013, had the following equipment:  Required:

1. Compute the composite depreciation rate.

2. Compute the average service life.

3. Compute 2013 depreciation.

Required:

1. Compute the composite depreciation rate.

2. Compute the average service life.

3. Compute 2013 depreciation.

(Essay)

4.8/5  (36)

(36)

Depreciation (to the nearest dollar) for 2013, using sum-of-the-years' digits, would be:

(Multiple Choice)

4.7/5  (31)

(31)

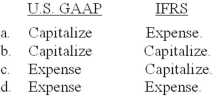

The normal treatment of litigation costs to successfully defend an intangible right under U.S. GAAP and International Financial Reporting Standards (IFRS), respectively, is:

(Multiple Choice)

4.8/5  (40)

(40)

Component depreciation, required under International Financial Reporting Standards, is allowed but rarely used by U.S. companies.

(True/False)

4.9/5  (36)

(36)

Using the double-declining balance method, depreciation for 2014 and book value at December 31, 2014, would be:

(Multiple Choice)

5.0/5  (45)

(45)

Showing 81 - 100 of 146

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)