Exam 11: Property, Plant, and Equipment and Intangible Assets: Utilization and Impairment

Exam 1: Environment and Theoretical Structure of Financial Accounting135 Questions

Exam 2: Review of the Accounting Process126 Questions

Exam 3: The Balance Sheet and Financial Disclosures102 Questions

Exam 4: The Income Statement, Comprehensive Income, and the Statement of Cash Flows103 Questions

Exam 5: Income Measurement and Profitability Analysis210 Questions

Exam 6: Time Value of Money Concepts114 Questions

Exam 7: Cash and Receivables164 Questions

Exam 8: Inventories: Measurement126 Questions

Exam 9: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition120 Questions

Exam 10: Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition128 Questions

Exam 11: Property, Plant, and Equipment and Intangible Assets: Utilization and Impairment146 Questions

Exam 12: Investments186 Questions

Exam 13: Current Liabilities and Contingencies153 Questions

Exam 14: Bonds and Long-Term Notes167 Questions

Exam 15: Leases160 Questions

Exam 16: Accounting for Income Taxes145 Questions

Exam 17: Pensions and Other Postretirement Benefits197 Questions

Exam 20: Accounting Changes and Error Corrections119 Questions

Exam 21: The Statement of Cash Flows Revisited155 Questions

Select questions type

Robertson Inc. prepares its financial statements according to International Financial Reporting Standards. At the end of its 2013 fiscal year, the company chooses to revalue its equipment. The equipment cost $540,000, had accumulated depreciation of $240,000 at the end of the year after recording annual depreciation, and had a fair value of $330,000. After the revaluation, the accumulated depreciation account will have a balance of:

(Multiple Choice)

4.8/5  (46)

(46)

Activity-based methods of depreciation are appropriate for assets whose service life is a function of use rather than time.

(True/False)

4.9/5  (32)

(32)

Using the double-declining balance method, depreciation for 2013 and the book value at December 31, 2013, would be:

(Multiple Choice)

4.8/5  (46)

(46)

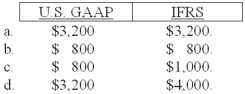

Calloway Shoes purchased a delivery truck on September 30, 2013, for $32,000. The estimated useful life of the truck is 10 years with no residual value. After five years, the refrigeration unit will need to be replaced. The $8,000 cost of the unit is included in the cost of the truck. Calloway uses the straight-line depreciation method. Depreciation for 2013 under U.S. GAAP and International Financial Reporting Standards (IFRS), respectively, is:

(Multiple Choice)

4.9/5  (40)

(40)

Briefly discuss the factors that determine the service life of a depreciable asset.

(Essay)

4.9/5  (49)

(49)

A change in the estimated recoverable units used to compute depletion requires retroactive adjustments to the financial statements.

(True/False)

4.8/5  (35)

(35)

Depreciation (to the nearest dollar) for 2014, using sum-of-the-years' digits, would be:

(Multiple Choice)

4.8/5  (46)

(46)

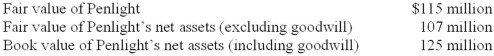

In 2011, Quasar Ltd. acquired all of the common stock of Penlight Laser for $124 million. The fair value of Penlight's identifiable tangible and intangible assets totaled $205 million, and the fair value of liabilities assumed by Quasar was $95 million. Quasar performed a required goodwill impairment test at the end of its fiscal year ended December 31, 2013. Management has provided the following information:  Required:

1. Determine the amount of goodwill that resulted from the Penlight acquisition.

2. Determine the amount of goodwill impairment loss that Quasar should recognize at the end of 2013, if any.

3. If an impairment loss is required, prepare the journal entry to record the loss.

Required:

1. Determine the amount of goodwill that resulted from the Penlight acquisition.

2. Determine the amount of goodwill impairment loss that Quasar should recognize at the end of 2013, if any.

3. If an impairment loss is required, prepare the journal entry to record the loss.

(Essay)

4.7/5  (39)

(39)

Using the double-declining balance method, depreciation for 2014 would be:

(Multiple Choice)

4.9/5  (36)

(36)

Compute depreciation for 2013 and 2014 and the book value of the machinery at December 31, 2013 and 2014, assuming double-declining balance method is used.

(Essay)

4.7/5  (30)

(30)

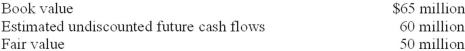

Wilson Inc. owns equipment for which it paid $70 million. At the end of 2013, it had accumulated depreciation on the equipment of $12 million. Due to adverse economic conditions, Wilson's management determined that it should assess whether an impairment loss should be recognized for the equipment. The estimated undiscounted future cash flows to be provided by the equipment total $60 million, and the equipment's fair value at that point is $50 million. Under these circumstances, Wilson:

(Multiple Choice)

4.8/5  (27)

(27)

In 2012, Antle Inc. had acquired Demski Co. and recorded goodwill of $245 million as a result. The net assets (including goodwill) from Antle's acquisition of Demski Co. had a 2013 year-end book value of $580 million. Antle assessed the fair value of Demski at this date to be $700 million, while the fair value of all of Demski's identifiable tangible and intangible assets (excluding goodwill) was $550 million. The amount of the impairment loss that Antle would record for goodwill at the end of 2013 is:

(Multiple Choice)

4.8/5  (33)

(33)

Impairment loss is the difference between book value and the recoverable amount. The recoverable amount is $94 million, the higher of the present value of estimated future cash flows ($94 million) and the fair value less costs to sell ($90 million).

(Essay)

4.9/5  (45)

(45)

Once selected for existing assets, a company must consistently use the same method of depreciation for all subsequent fixed asset acquisitions.

(True/False)

4.9/5  (34)

(34)

The loss would appear in the income statement along with other operating expenses.

3.

(Essay)

4.7/5  (43)

(43)

At the end of its 2013 fiscal year, a triggering event caused Janero Corporation to perform an impairment test for one of its manufacturing facilities. The following information is available:  The manufacturing facility is:

The manufacturing facility is:

(Multiple Choice)

4.9/5  (33)

(33)

An impairment loss is indicated because the estimated undiscounted sum of future cash flows of $110 million is less than the book value of $121 million.

The amount of the loss to be reported is calculated using the estimated fair value rather than the undiscounted future cash flows:

(Essay)

4.9/5  (31)

(31)

Showing 101 - 120 of 146

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)